Ether has priced above $4,000 for the day’s biggest short position wipeout across all crypto assets on Friday, with some analysts saying the day could be set to a short aperture.

The rally led to Eric Trump, the son of US President Donald Trump, who took a jab with a bearish trader.

$4.1K has become the key to “short aperture,” says traders

“I’m going to put a smile on my face to see my ETH shorts smoke today. Stop betting on BTC and ETH – you’ll run away,” Trump told X-Post Friday.

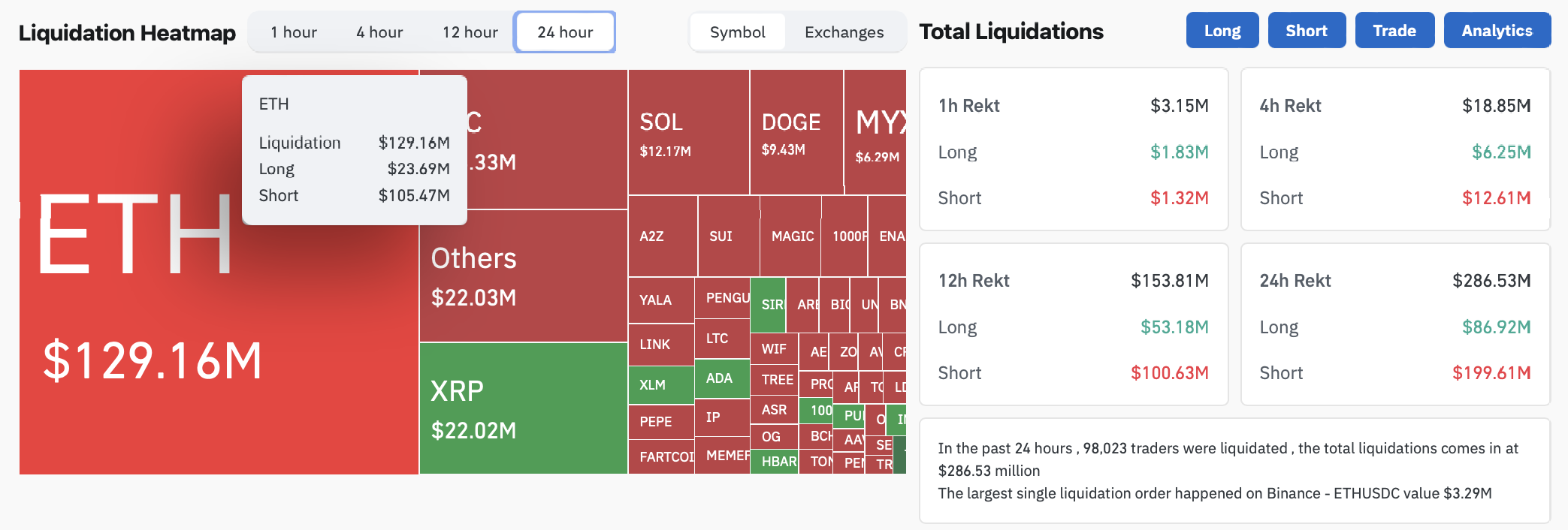

About $105 million ether (ETH) short positions were liquidated on Friday, as ether accounted for around 53% of the total $1,961 million of liquidated shorts from the entire crypto market, according to Coinglass.

The total ether liquidation over the past 24 hours has reached $129.16 million. sauce: Coinglass

According to Nansen, the price of ether reached $4,060 per day, up 4.6% over the last 24 hours, and was raised to $4,015 at publication.

Crypto Trader Ash Crypto said the actual test would be at a price level of $4,100.

“If ETH breaks $4,100, it could trigger a short aperture that sends ETH to $4,400-4,500 in just a few hours,” says Ash Crypto.

Etheric optimism is rising in the crypto industry

“In my opinion this was not so bullish,” Crypto Trader Ted said, pointing to growing institutional interest in the demand for Ether ETFs.

Over the past four trading days, Spot Ether ETFs have seen an inflow of approximately $537 million, according to Farside data.

Recently, there have been several major price forecasts for ether. After the Crypto Trader mustache broke over $4,000, he said, “I know it sounds wild, but I think ETH will be over $10,000.”

Meanwhile, FundStrat co-founder Tom Lee said Thursday that Ether has a “Bitcoin 2017 moment” and could reach $16,000.