Bitcoin (BTC) has just made a difficult move to ignore. After three failed attempts to break the stubborn downtrend – January, February and March all said “Nope” – the BTC officially cracked on April 15th, sending signals to the entire crypto market where the Bulls may be awake.

To date, BTC is trading at around $85,844, an increase of 1.48% on the day. But what’s the real story? Liquidation data.

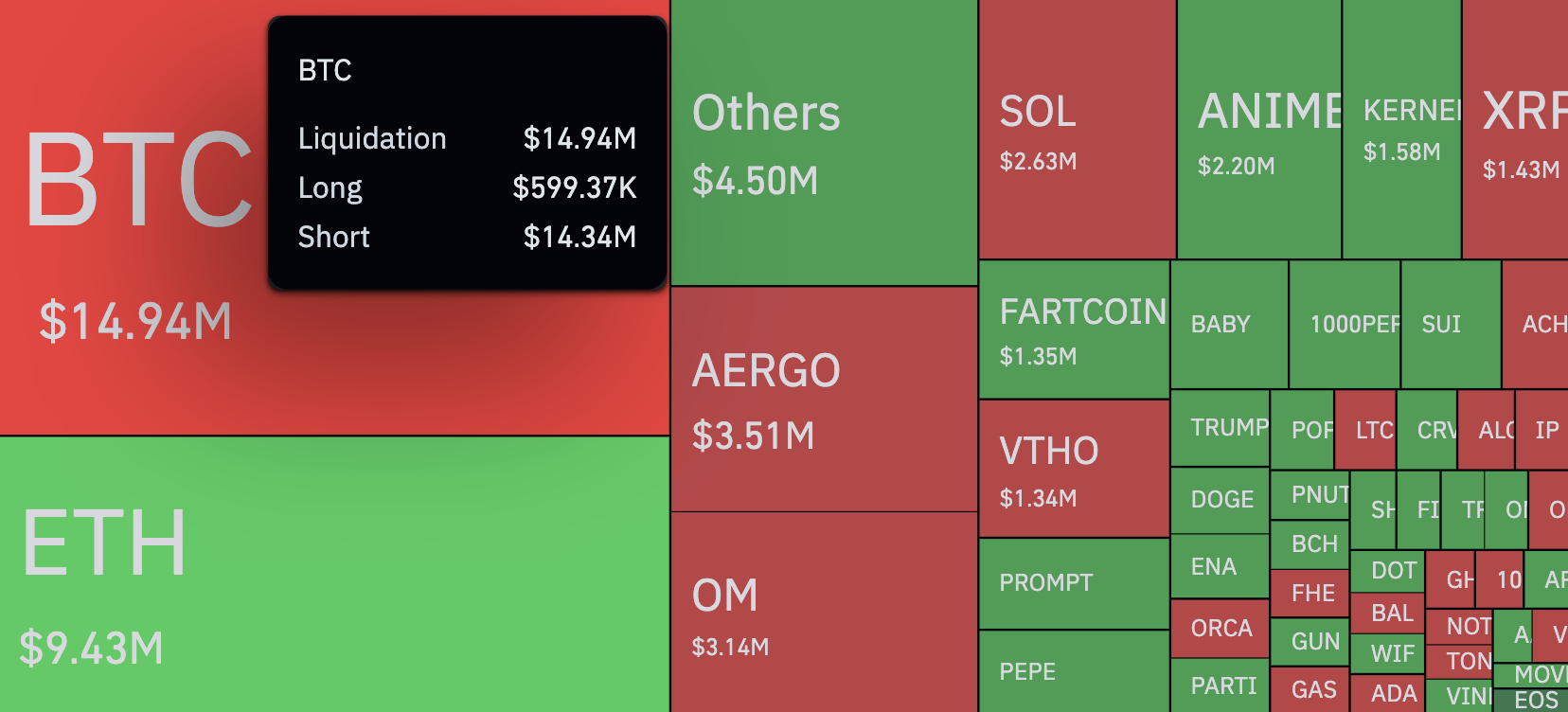

Over the past 12 hours, BTC’s $14.94 million has been settled, while Long was $599,000 and $14.34 million was in shorts. It’s an imbalance of 2,131% – a massive short squeeze that caught the bear off guard.

Zooming out into the wider market, a total position of $57.43 million was wiped out by the same 12-hour window, and the shorts were bruntled, winning a long of $33.61 million versus $2,382 million. Over the past 24 hours, the liquidation total reached $188.37 million, with nearly 92,000 traders winning “Rekt.” According to Coinglass, a $3.43 million liquidation was put on OKX’s BTC/USDT pair, with one deal particularly struggling.

What causes the surge? As mentioned earlier, BTC has been testing its descending trendlines since the beginning of this year. Today it broke out nicely.

Some traders say this is the beginning of a bullish reversal, especially as Bitcoin is above breakout levels. Others believe this could be a temporary throttle with limited follow-throughs.

At the end of the day, this move is exciting, but also risky. Short-term liquidation can cause major price fluctuations, but it does not guarantee long-term trend changes.