As the cryptocurrency market deepens into 2026, volatility across digital assets is increasing. This environment has brought renewed attention to tokens with the potential for significant long-term returns.

The biggest cryptocurrencies are already commanding huge valuations, but investors’ attention is shifting elsewhere.

The field is interested in established but expanding networks, particularly those experiencing accelerated adoption, increased institutional involvement, and strengthening structural demands.

When these factors come together, these assets have the potential to reap significant gains in the next market cycle.

Solana (sol)

Solana (sol) has become one of the most active blockchain ecosystems, with network usage surging and transaction volumes reaching multi-month highs, demonstrating growing demand from both users and developers.

This momentum is fueled by the rapid growth of real-world asset tokenization on the network, with tokenized assets valued at over $1 billion, bringing traditional financial use cases on-chain and anchoring activities aligned with real economic demand.

Institutional involvement further strengthens Solana’s prospects as major asset managers and crypto companies roll out Solana-related funds, with more than $1 billion in assets tied to the network.

These trends, along with infrastructure improvements and expanding cross-chain interoperability, position Solana as an emerging core payments layer rather than a high-beta altcoin, with significant upside potential ahead.

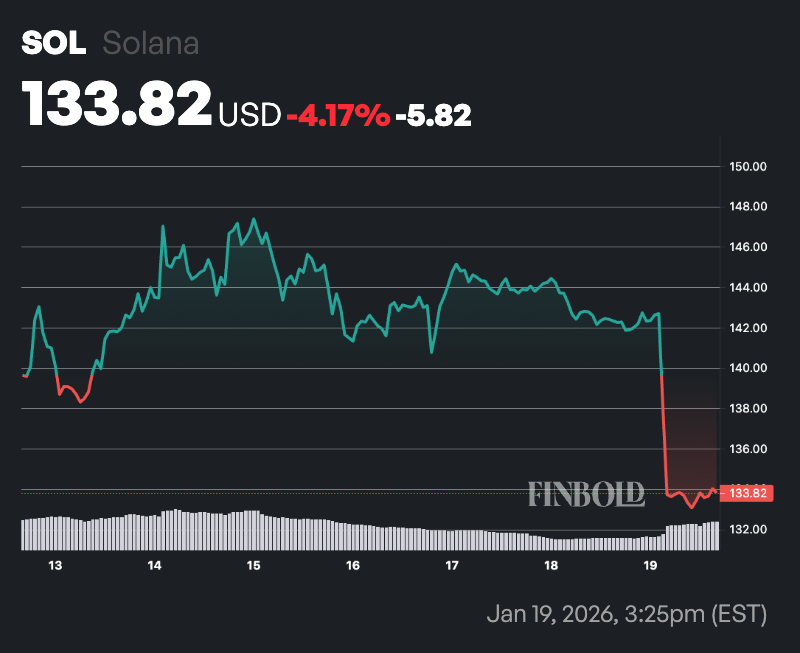

By press time, sol is trading at $133, down nearly 6% in the past 24 hours. On a weekly basis, assets fell about 4%.

chain link (link)

chain link (link) is increasingly viewed as a long-term growth asset due to its important role in the blockchain ecosystem. In terms of price, link It has fallen over 7% in the past 24 hours and is trading at $12 at the time of writing.

As the leading decentralized oracle network, Chainlink provides secure, real-world data to smart contracts, powers much of decentralized finance, and has become essential to the tokenization of real-world assets.

As more institutions consider blockchain-based financial products, the demand for reliable and tamper-resistant data feeds continues to grow, strengthening Chainlink’s core relevance.

On-chain trends suggest that this growing importance is reflected in market positioning. While activity among large holders has increased, a pattern that has historically preceded increases in price performance, tighter supply relationships could amplify future movements if demand accelerates.

At the same time, institutional adoption of Chainlink’s infrastructure for compliance, payments, and cross-chain connectivity is growing, reinforcing its role as a critical bridge between traditional finance and blockchain networks.

Featured image via Shutterstock