- Over $380 million in Ethereum has flowed from exchanges over the past week.

- The large ETH holders reversed the long-term downward trend in wallet concentration and increased positions.

- On-chain data suggests a growing confidence among investors despite modest trading volumes and ongoing market attention.

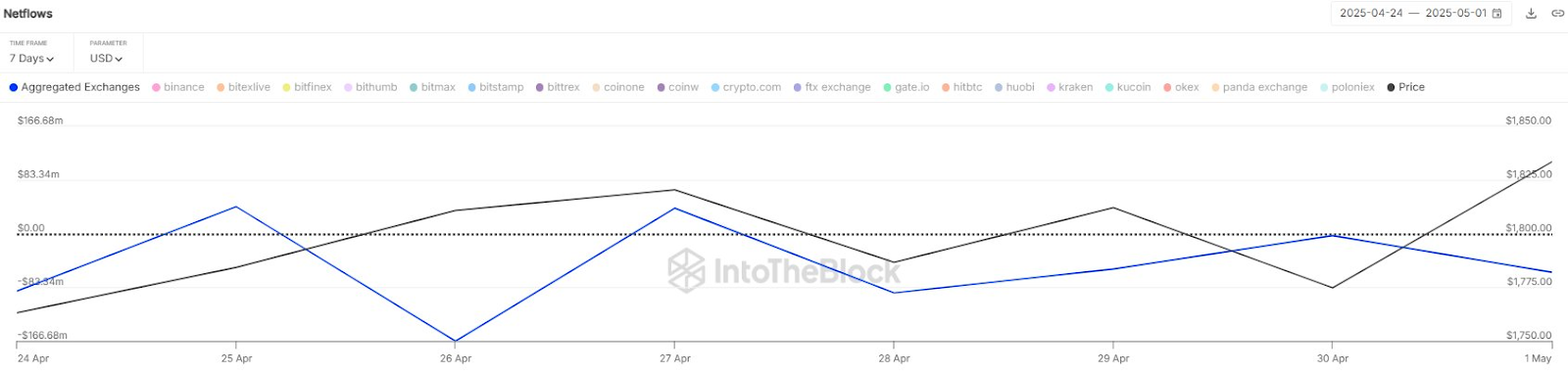

Ethereum (ETH) continues to flow from centralized exchanges at a considerable speed. In the past seven days alone, net outflows have exceeded $380 million, according to blockchain analytics firm IntotheBlock.

This reduction in Exchange-Held ETH reflects an independently-reliant increase in investor accumulation and could point to tightening the supply narrative that historically precedes price rise.

ETH accumulation lasts despite price volatility

According to the data, net flow from Ethereum’s exchange was consistently negative between April 24th and May 1st, with a particularly large outflow recorded on April 26th. This action suggests that investors used a short-term price dip to buy ETH and withdraw their own rulings.

Despite weekly price fluctuations, ETH ended the period with a positive note and climbed over $1,840. Analysts interpret sustained exchange outflows as a sign of bullishness, as lower supply on exchanges reduces the risk of selling pressure and could create breakout conditions if demand increases.

On-chain data shows whale accumulation and stable activity

This trend in spills supports the broader narrative that Ethereum can set up for a massive rebound after falling significantly below Bitcoin. Recent data from Cryptoquant shows that the distribution of Ethereum supply by wallet size indicates that the largest holders continue to maintain their position or accumulate.

Cryptoquant analyst Darkost highlighted that since August 2024, wallets holding more than 100,000 ETH have increased by around 3%. He sees this as a sign of “smart money” positioning. He noted that the proportion of ETH held by large wallets has gradually decreased since 2020, but that trend appears to be reversing now.

Bullest on-chain data pointing to potential Ethereum rally

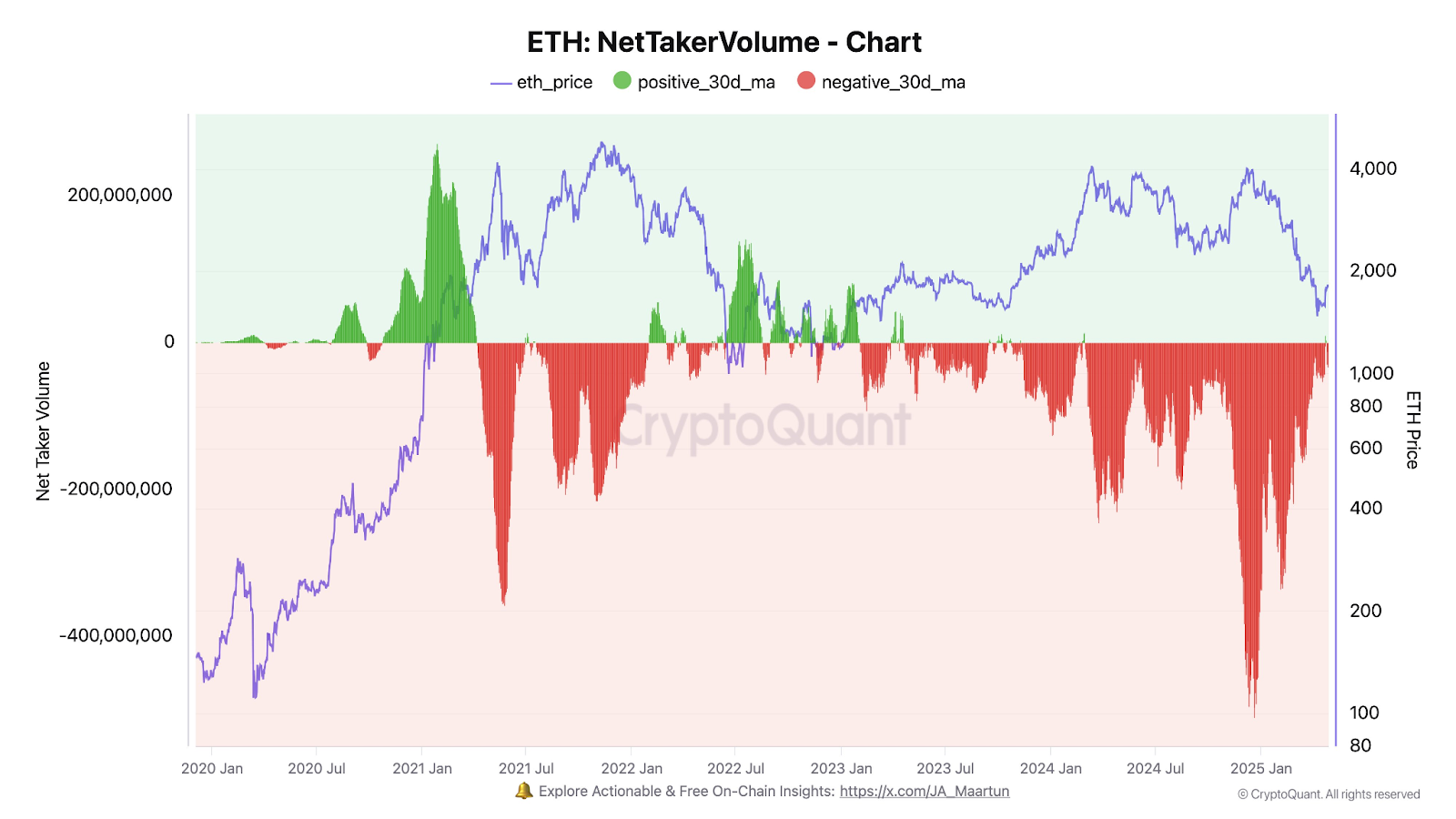

Darkost also noted that despite the price drop in ETH, the number of active addresses remains stable. He observed considerable sales pressure in the derivatives market, which could be eased. In particular, net taker volumes tested positive on April 23rd and 24th, and if the trend continues, it could mark the beginning of the bottom process.

Darkost emphasized that these metrics are contrary to the “Ethereum is dead” story. Essentially, ETH points to aggressive data in the chain despite currently trading at over 62% of all-time 2021.

How to approach ETH

Darkost concluded that although there are several encouraged long-term signals, on-chain data still reflects a prolonged sense of pessimism around ETH. He also said open interest has declined significantly, trading volume remains curtailed, both highlighting cautious market sentiment.

In his view, the most careful approach at the moment is to wait for a clear invalidation of bearish trends, or to engage in a dollar-cost average (DCA) strategy at best.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.