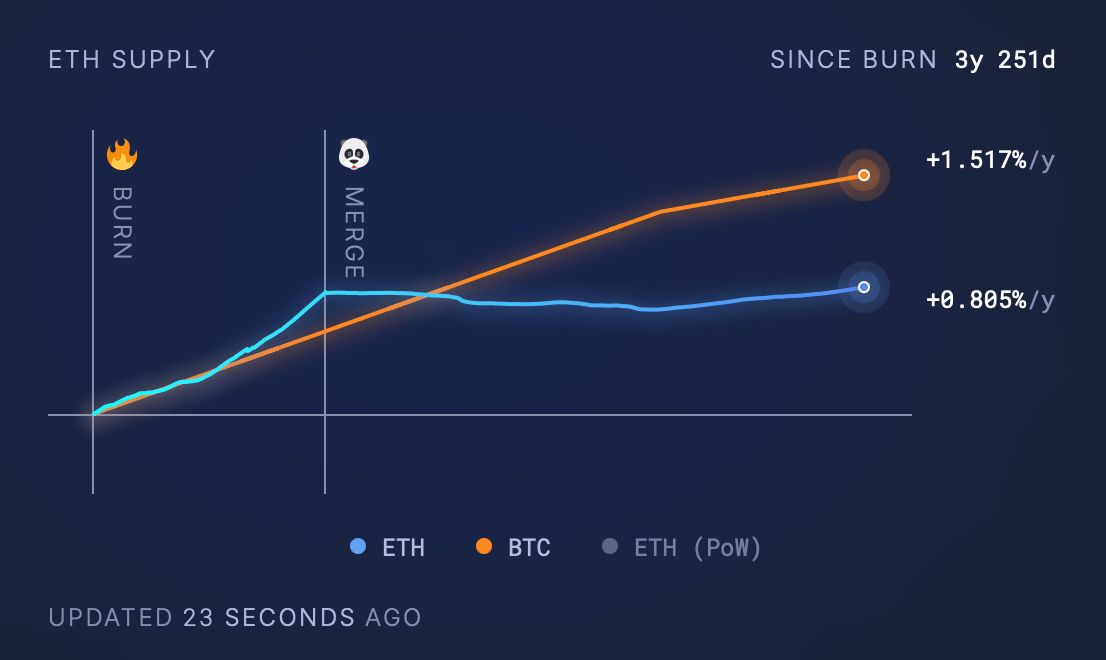

Three years after Ethereum’s London Hard Fork aimed at restraining supply growth, the network remains inflationary, opposing the promise of early deflation.

The etheric deflation promise continues to be fulfilled

As of April 13, 2025, Ethereum’s net ETH supply has increased by 0.805% per year since the London Hard Fork in August 2021, adding 3,477,830.85 ETH to the circulation. Despite burning 4,581,986.52 ETH via the EIP1559 fee burning mechanism (the cornerstone of the upgrade), burn rates have not been able to consistently offset the new issue.

Since August 2021, $7.3 billion worth of Ethereum (ETH) has been on fire.

Bitcoin recorded a high annual inflation rate of 1.517% over the same three years and eight months, but the fixed supply cap contrasts with the ETH capless model. The London Hard Fork, implemented in August 2021, introduced ETH Burns as counterbalance block rewards. However, upgrades like Dencun in 2024 reduced transaction fees and reduced burn rates.

Reducing network activity further results in issuance exceeding burns as fee revenues are even more limited. The current supply of Ethereum’s 120.69m ETH reflects an annual increase of 0.51%, contradicting expectations of sustained deflation. According to metrics collected by ultrasound.money. ETH transfers have led all activity since the introduction of the Ethereum burn mechanism, a total of 374,298.59 ether has been burned.

The Impossible Token (NFT) market continues as the second largest contributor responsible for the combustion of 230,051.12 ether, driven primarily by NFT transactions. Uniswap V2, which operates through Router 2, is closely ranked with 226,501.32 ether burned. Tether (USDT) transactions on the Ethereum Network also played a key role, resulting in a combustion of 208,769.94 ether.

The universal router for UnisWap accounts for an additional 153,525.44 ether, while UniSwap V3 via Router 2 burned 124,596.09 ether. Metamask’s swapp router contributes 89,489.95 ether to the total burns, while another Uniswap Universal Router instance closes the leaderboard by burning 84,388.61 ether. Asset prices have immersed 10.5% this week in $1,601, consistent with wider market trends.

Although periods of deflation have occurred during peak network usage at certain times over the past few years, consistent rarity remains elusive. Advocates argue that future upgrades or demand spikes could lean ETH towards deflation, but current data highlights the challenge of balancing burns, issuance and network efficiency. For now, Ethereum’s monetary policy as “ultra sound money” remains an ongoing work.