Digital asset investment products recorded their first weekly outflow in four weeks, with $952 million in outflows last week.

The negative flows in crypto funds came as delays in the US Clarity Act reignited regulatory uncertainty and weighed on institutional sentiment.

US regulatory delays renew institutional vigilance as $952 million leaks from crypto funds

The outflow was driven by a combination of legal impasse and renewed concerns about selling pressure from large holders, according to weekly crypto fund flow data.

“We believe this reflects a negative market reaction to the delay in passage of the US Clarity Act, which has prolonged regulatory uncertainty for this asset class, along with concerns about continued selling by whale investors,” wrote James Butterfill, head of research at CoinShares.

With momentum weakening, analysts now say it is increasingly unlikely that digital asset ETP inflows in 2025 will exceed last year’s. Total assets under management are currently $46.7 billion, compared to $48.7 billion at the end of 2024.

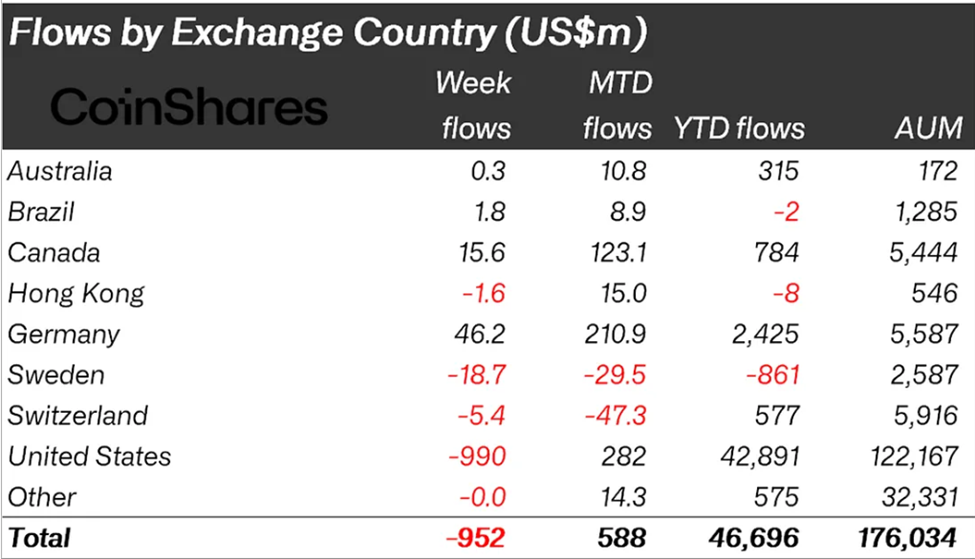

Negative sentiment was overwhelmingly concentrated in the United States, which accounted for $990 million of total crypto outflows. In contrast, investors in other regions appeared to be more constructive.

- Canada records inflow of $46.2 million

- Germany raised $15.6 million, partially offsetting U.S. losses, but not enough to reverse the overall trend.

Cryptocurrency fund flows by region last week. Source: CoinShares Report

This difference highlights how regulatory uncertainty is having a more severe impact on U.S.-based institutional products than on products listed in other countries.

The Transparency Act aims to establish a clearer federal framework for digital assets, but its slow progress has perpetuated ambiguity over oversight, registration requirements, and the division of power among U.S. regulators.

For institutions operating under strict compliance obligations, that uncertainty directly translates into reduced exposure.

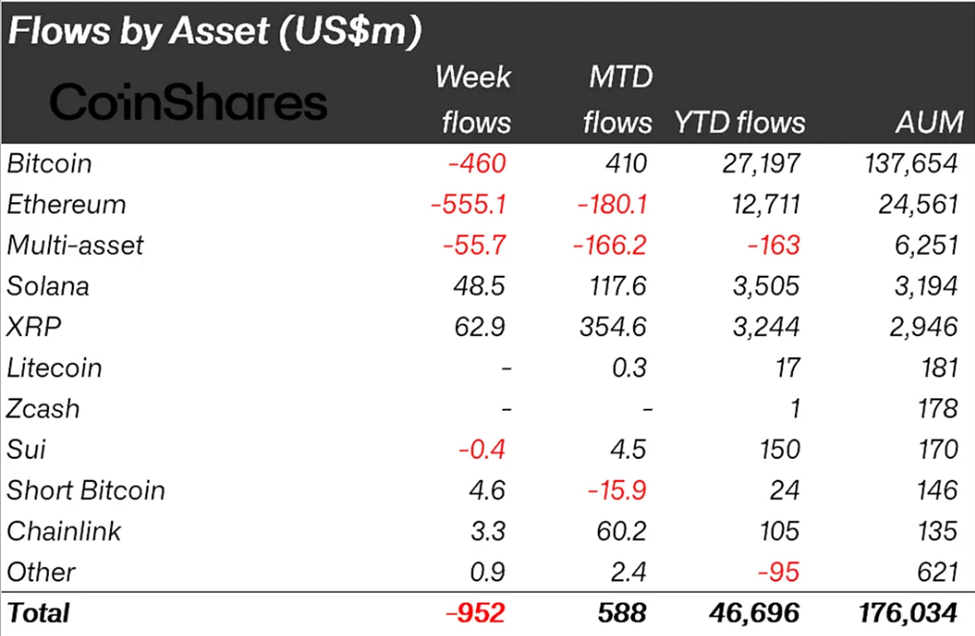

Ethereum most exposed to regulatory risk as data shows selective altcoin support

Ethereum led the week with $555 million in outflows, reflecting increased sensitivity to the consequences of US crypto laws. Market participants widely believe that Ethereum stands to gain or lose the most from clearer definitions of what constitutes digital products and securities.

Despite sharp weekly outflows, Ethereum’s long-term inflows remain strong. Year-to-date, total inflows totaled $12.7 billion, significantly exceeding the $5.3 billion recorded for all of 2024.

This contrast suggests that while institutional interest in Ethereum remains, trust is fragile without near-term regulatory clarity.

Bitcoin was followed by an outflow of $460 million. Although it continues to attract the largest share of all institutional investors, year-to-date inflows are $27.2 billion, well below the $41.6 billion expected in 2024.

The data suggests that Bitcoin’s role as a regulatory safe haven is being tested amid widespread uncertainty across U.S. markets.

Crypto fund flows by asset last week. Source: CoinShares

Not all assets were involved in the sale. Solana recorded $48.5 million in inflows, while XRP collected $62.9 million. This indicates selective investor support rather than a widespread exit from digital assets.

These inflows indicate increasing differentiation within the market. Capital will shift towards assets that are perceived to have a clearer regulatory position or a stronger network-specific narrative.

Until U.S. lawmakers provide clearer direction through legislation such as the Transparency Act, the flow of funds is likely to remain unstable.

The post Ethereum took a bigger hit than Bitcoin when $952 million was withdrawn from crypto funds – The reason why appeared first on BeInCrypto.