Ethereum took yet another hit this week, sliding into a fresh low of around $1,380, a level not seen since March 2023. Ongoing downward trends have made investors more concerned. Market conditions remain harsh due to sustained macroeconomic tensions, increasing global instability, and uncertainty caused by US trade and fiscal policy.

Feelings across the crypto space continue to deteriorate, and Ethereum’s price action reflects that anxiety. After months of struggling to hold key support levels, the under $1,500 breakdown added to the fear that deeper fixes could be unfolding.

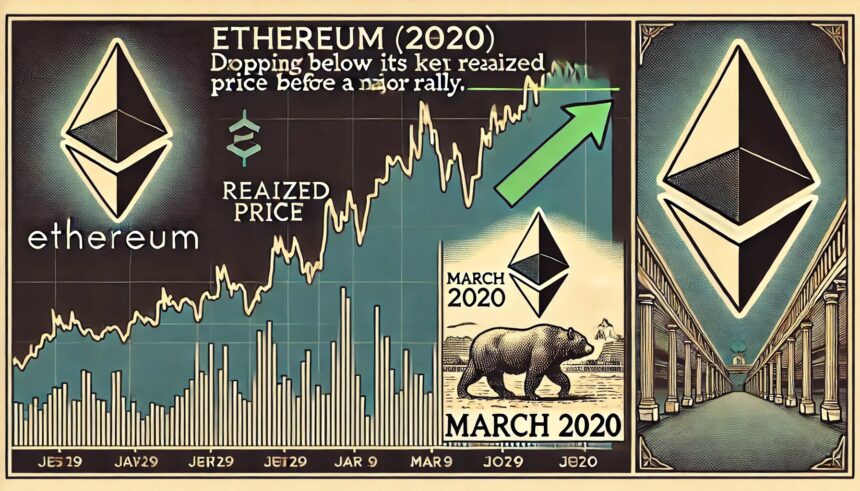

But in the darkness, there may be a silver lining. According to Cryptorank data, Ethereum is currently below realized price. This is a rare occurrence historically related to the bottom of the market and the strong recovery phase.

Although the outlook for the near future remains uncertain, such rare on-chain signals may indicate that Ethereum is in a critical accumulation zone. The next few days and weeks will be important in determining whether this is just another leg or when the start of a long-term reversal.

As fear takes over the market, Ethereum sinks below realised prices

Ethereum has lost more than 33% of its value since late March, causing deep concern among investors and analysts. Prices reduced ETH to a level not seen for more than two years, causing panic and despair among holders who expected 2025 to be the altcoin breakout year. Instead, Ethereum has become a symbol of market vulnerability as the broader macroeconomic landscape continues to deteriorate.

The fears of a trade war, inflationary pressures and a potential global recession are shaking financial markets at their heart. In this climate, high-risk assets like Ethereum are one of the first things to suffer. As Capital left speculative assets in favour of safer shelters, ETH’s selling only accelerated, and investors’ trust was hit seriously.

However, there may be some slight hope in the data. Crypto analyst Top Analyst Carl Runefelt recently pointed out in X that Ethereum is below $2,000 realisation price.

Runefelt emphasized that the last time ETH fell below its realised price crashed from $283 to $109 in March 2020, but would recover strongly in the next few months. Although the current environment is full of uncertainty, such on-chain metrics suggest that ETH may be entering the accumulation stage again.

Still, confidence remains fragile and price action must be stable before the actual bullish narrative returns. The next move in Ethereum is important in determining whether this level marks the true bottom or another stop along the way.

ETH is struggling for less than $1,500, but there is no clear support.

Ethereum is now below the $1,500 level after suffering a brutal 50% decline since late February. As ETH shows no signs of recovery, the offensive sale erased several months’ profits and put investors in a state of uncertainty. Market sentiment is overwhelmingly bearish and rarely shows that it has reached the bottom.

At this stage, Ethereum does not have a well-defined support zone. Bulls have lost control, price action continues to decline with increasing fear as demand is weak. To begin a meaningful reversal, ETH must first regain the $1,850 level. This previously served as a vital support and now existed as a major resistance.

Until that happens, upward attempts can be met with strong sales pressure. Things become even more volatile if Ethereum loses its $1,380 level. Falling under this area could open the door to a deeper correction towards the $1,100 to $1,200 range.

With macroeconomic tensions still high and volatility expected to last, traders and investors will watch carefully to see if Ethereum will stabilize.

Dall-E special images, TradingView chart

Editing process Bitconists focus on delivering thorough research, accurate and unbiased content. We support strict sourcing standards, and each page receives a hard-working review by a team of top technology experts and veteran editors. This process ensures the integrity, relevance and value of your readers’ content.