Over the past few weeks, the cryptocurrency market has been overwhelmed by the high levels of uncertainty and volatility caused by the ever-changing global macroeconomics. In this volatile market state, Bitcoin prices danced between $74,000 and $83,000 in a few days.

BTC prices sank to $74,000 earlier this week as Crypto Investors panic after Donald Trump announced new trade tariffs. On Thursday, April 10th, the finest cryptocurrencies regained the $83,000 level after President Trump suspends trade tariffs in all countries except China.

Is Bitcoin a “mature asset” now?

Bitcoin prices are highly responsive to almost every news of global trade, indicating a very unstable state of the cryptocurrency market. However, on-chain analytics experts explain that the current Bitcoin market volatility pales in comparison to past episodes.

In a new post on social media platform X, Julio Moreno, head of research at Cryptoquant, revealed that the Bitcoin price volatility for the ongoing world trade drama is “a lot lower” than other past events, including the Covid-19 crash, Terra-Luna Collapse, FTX fally and the Silicon Valley Bank (SVB) Banklank.

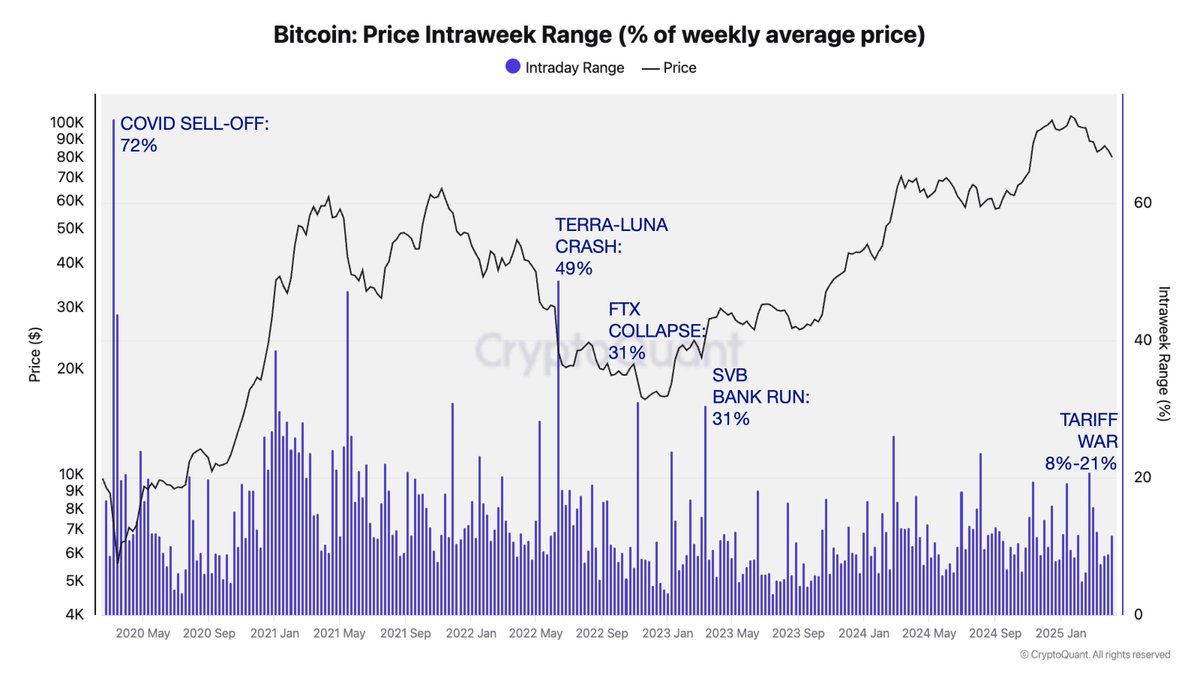

The relevant metric here is the price extension range metric that estimates the change in the percentage of Bitcoin’s average weekly price. According to data from Cryptoquant, the Bitcoin Price Intraweek range rose to an all-time high of 72% during the Covid-19 market slump in April 2020.

Source: @jjcmoreno on X

The chart above shows that BTC internal range metrics surged to 49% after the Terra Luna ecosystem collision in May 2022. Meanwhile, after the collapse of the Sam-Bankman Fried LED FTX Exchange in late 2022 and the SVB Bank operation in early 2023, the indicator reached 31%.

Due to the escalation of trade tensions between the US and China, Bitcoin’s price intraweek range metric is between 8% and 21%. This decline in volatility suggests that the best cryptocurrencies have matured as assets due to deeper liquidity and improved market structure.

As institutional players begin to see the world’s biggest cryptocurrency as a risky asset and as hedges against macroeconomic uncertainty, relatively stable price actions can connect to long-term holder growth bases and stable corporate adoptions.

Bitcoin price at a glance

At the time of writing, BTC priced around $83,700, reflecting a 5% increase over the past 24 hours.

The price of BTC returns to above $83,000 on the daily timeframe | Source: BTCUSDT chart on TradingView

ISTOCK featured images, TradingView chart

Editing process Bitconists focus on delivering thorough research, accurate and unbiased content. We support strict sourcing standards, and each page receives a hard-working review by a team of top technology experts and veteran editors. This process ensures the integrity, relevance and value of your readers’ content.