This is a segment of the drop newsletter. Subscribe to read the full edition.

The summary features and endorses the Ethereum L2 blockchain, which claims to be “leading the next generation of consumer cryptography,” features and endorses crypto mining games that have been accused of being a Ponzi scheme.

The summary added “The Big Badge” as a visual badge reward for users involved with BigCoin. Big Coin is an app that allows players to wager big tokens and “mining” tokens from virtual “facilities.”

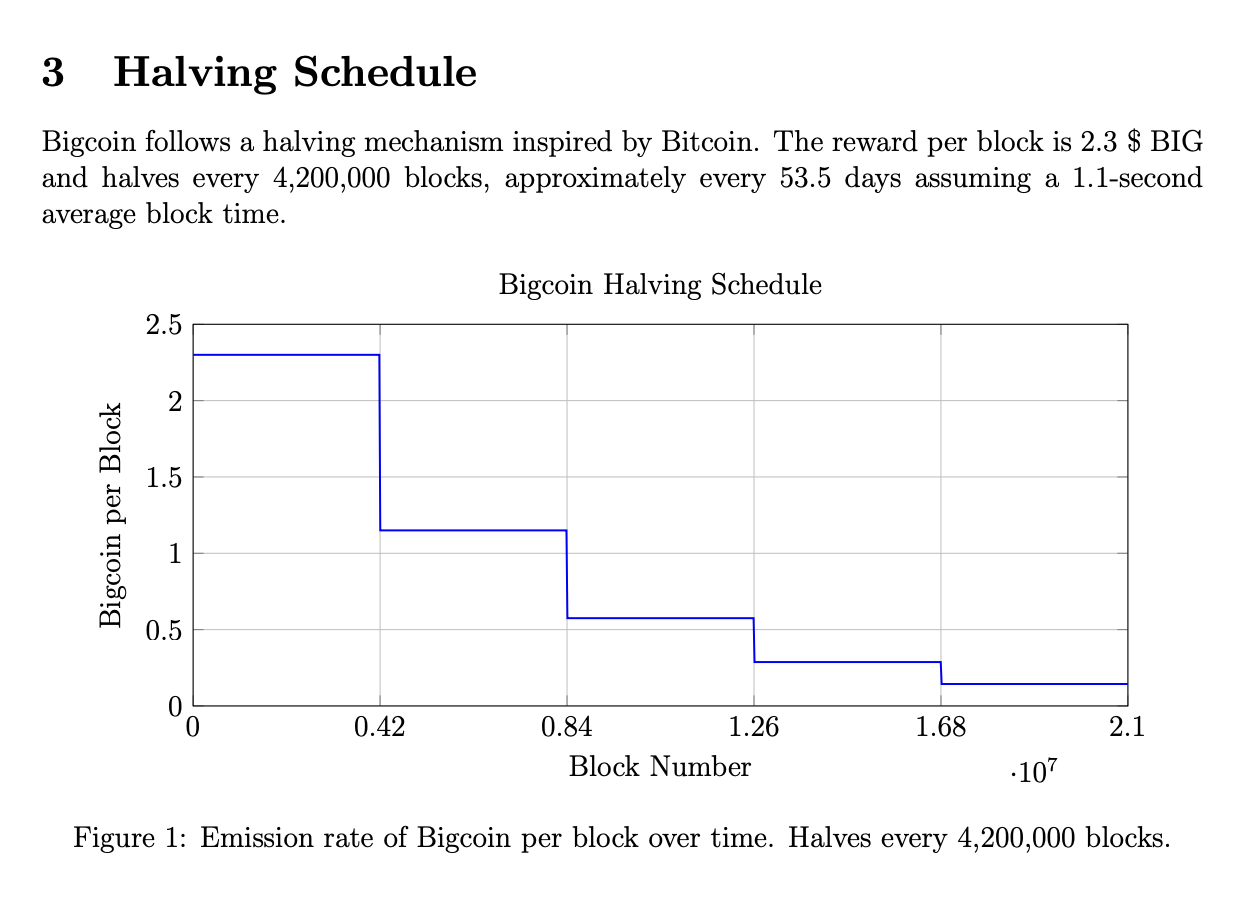

“Bigcoin aims to become the most recognized coin on the planet by combining Bitcoin’s proven efficacy dynamics with viral community-driven incentives,” reads the Token whitepaper. Satoshi Bigmoto, a pseudonym X user, “Satoshi Bigmoto,” also known as “Bigtoshi,” is listed as the creator of Bigcoin and the author of the white paper. Their account was created in February, just a few months ago.

However, to “miner” the hashrate and increase the hashrate, players must use the big themselves to purchase “miners” for pixelated “facilities” (both facility size and number of miners increase the hashrate). Players will also need to spend a lot of time “upgrade” these virtual mining rooms.

Abstract marketing lead Fin Totten has confirmed that Big Coins are not actually using the player’s physical computer to minify tokens, and that the tokens are not actually mined. Instead, what’s happening is a simulation driven by the smart contract of tokens.

One X user declared over the weekend that “Bigcoin took the timeline by storm and made a lot of money for those who went early,” adding, “Congratulations to everyone who went early.”

Others argue that all cryptography is a Ponzi scheme, but Bigcoin is less useful and less legitimate than Bitcoin, the inspiration adopted by Wall Street in the form of Bitcoin ETFs.

Cornell Law School defines the Ponzi scheme as follows: “The type of investment fraud in which investors promise an artificially high rate of return with little or no risk. The original investors and perpetrators of the fraud are repaid by funds from later investors, but there is little or no actual business activity that generates revenue.

However, in addition to enriching the miners who “enter early” with a layer of gamification above, it is currently unknown what the big coin’s points are.