Ethereum price action It was quiet, but it has been calculated over the last few weeks. ETH, which has the $1,600 mark on the $1,600 mark, appears to form the base, but are you ready for a breakout or is it coming even more of a downside? Important technical indicators line up to tighten moving averages, Ethereum may be preparing for a critical move. Let’s break down what the chart says to us and what happens next.

Ethereum price forecast: What drives ETH’s current price action?

Currently, Ethereum prices are trading at around $1,595. It hasn’t been explosive lately, but it shows resilience. The broader crypto market is still recovering from a volatile start to April, with Ethereum prices no exception. However, ETH avoids further breakdowns and shows signs of stabilization, suggesting that the seller may be losing power.

One of the clearest signs comes from a daily chart where ETH prices have moved sideways over the past few sessions in close proximity. This type of compression often precedes larger movements. Traders are watching carefully, checking if the movement goes up or down.

Daily Chart Summary: A Quiet Battle between a Bull and a Bear

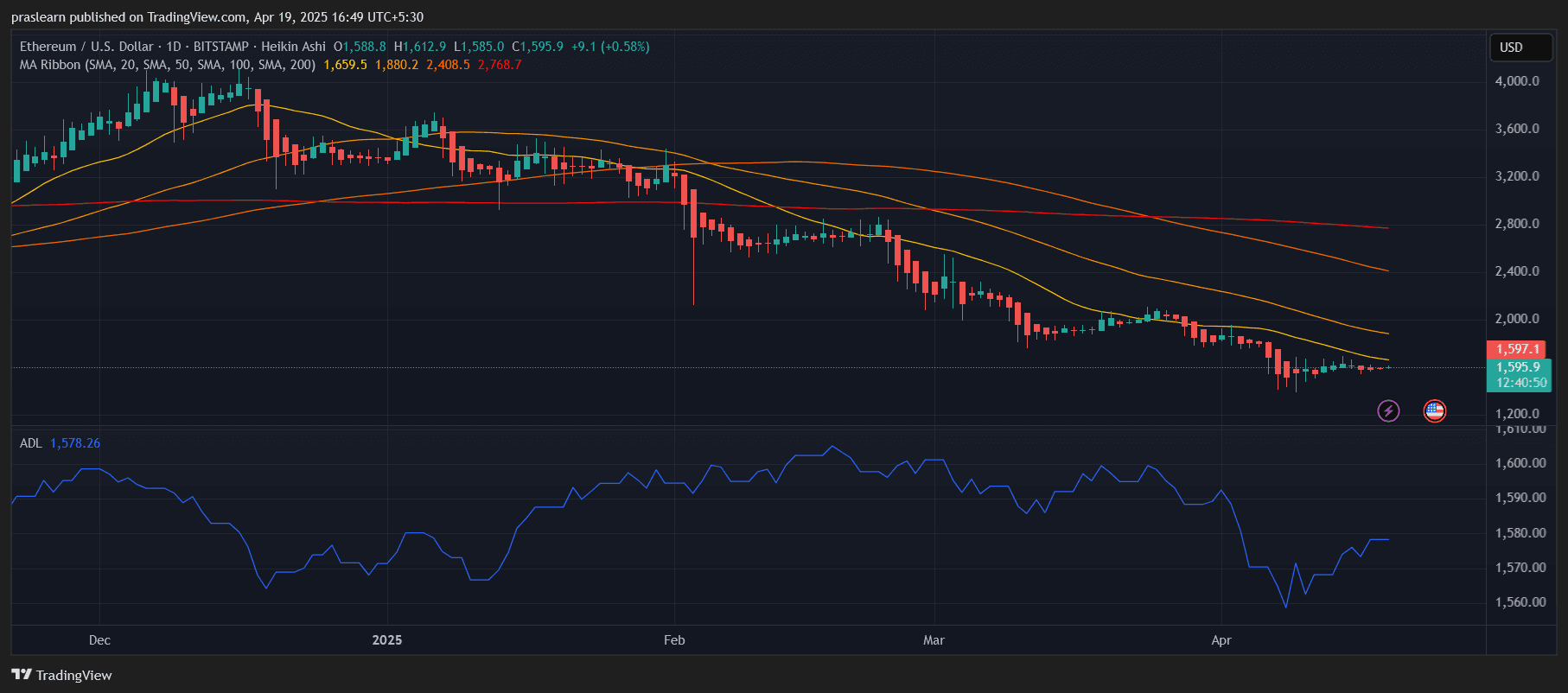

eth/usd daily charts – TradingView

Daily charts draw pictures of Ethereum that integrate after weeks of decline trends. The price is just below the main moving average cluster, including 50-day, 100-day and 200-day SMA, and is now acting as an overhead resistance. These far outweigh current prices and far outweigh the $1,880-$2,768 zone. As long as Ethereum trades below these, the long-term trend remains bearish, but momentum appears to be changing.

Interestingly, the accumulation/distribution line (ADL) is again facing upward, suggesting that larger players may be slowly accumulating ETH at current levels. This difference between price and ADL suggests that sales pressure will be weakened and that the breakout requires a proper catalyst. If your ETH breaks beyond the $1,650 range, it could accelerate towards $1,800 before testing the heavier resistance zone above.

Hourly chart analysis: Keep lines or lose steam?

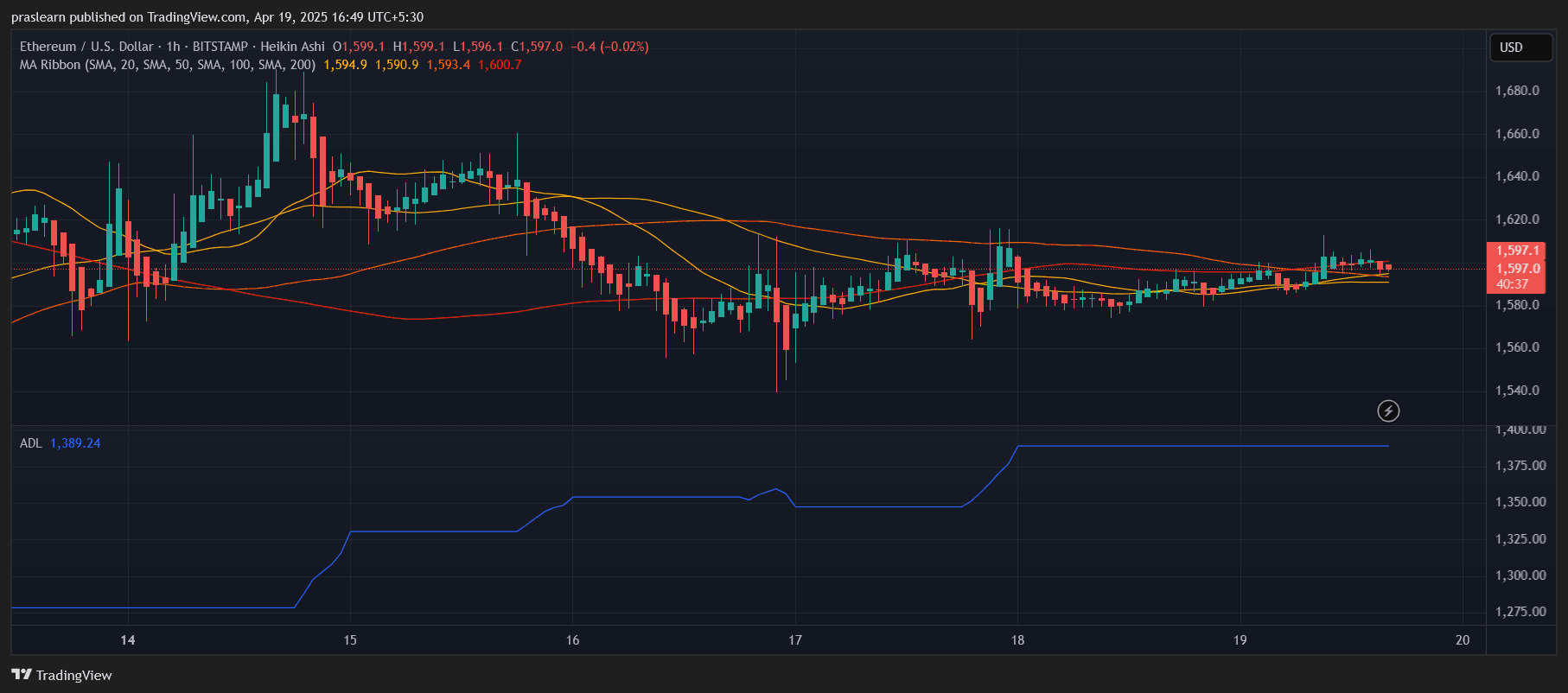

ETH/USD 1 hour chart – TradingView

Hourly charts provide more insight into short-term emotions. Ethereum has been trading between $1,585 and $1,600 over tight horizontal channels for the past few days. Despite the shorter daytime cores at both ends, the price respects these boundaries with minimal volatility. This calmness may be deceived.

Looking at the hourly MA ribbon, the ETH is sandwiched between 20, 50, and 100 hours of SMA, all within close range. These moving averages begin to flatten and indicate that the momentum is neutral. The hourly time frame ADL remains stable at nearly 1,389, reflecting the balance of trading activities. It’s not enough to cause trends, but enough to show that traders aren’t losing interest.

If buyers can surpass ETH prices in excess of the $1,605-$1,610 volume, this would be a strong signal that the Bulls are regaining control. Conversely, a drop below $1,580 suggests that the bear is still in charge.

Ethereum price forecast: Breakout brewing?

The tight range of Ethereum may be a sign that a breakout is approaching. In the short term, traders are looking at the $1,610 level as their first hurdle. A break above this could turn ETH towards $1,650, where it faces more severe resistance from a higher moving average. This momentum continues and once ETH exceeds $1,700, it will be possible to retest $1,880.

However, if Ethereum Price loses grip with $1,580 in support, the price could slip into $1,520, making $1,460 a deeper support zone. While the broader drop still holds weight, current integration and climbing ADL suggest an increased possibility of bullish reversal, especially when macro conditions are stable.

Final Thoughts: Wait or jump in?

Ethereum is at a technical intersection. It shows early signs of strength after a long decline, but no bullish breakout has been confirmed. Daily charts show potential accumulation stages, and hourly charts reflect strong support, but the market requires clear movements of over $1,610, leading to a critical shift in short-term momentum to favor bulls.

Investors and traders need to closely monitor this zone. A break at volume could start the rally towards $1,800. But patience is important – until ETH prices clear these levels, this remains a monitoring and reaction scenario, not a jumping moment now.