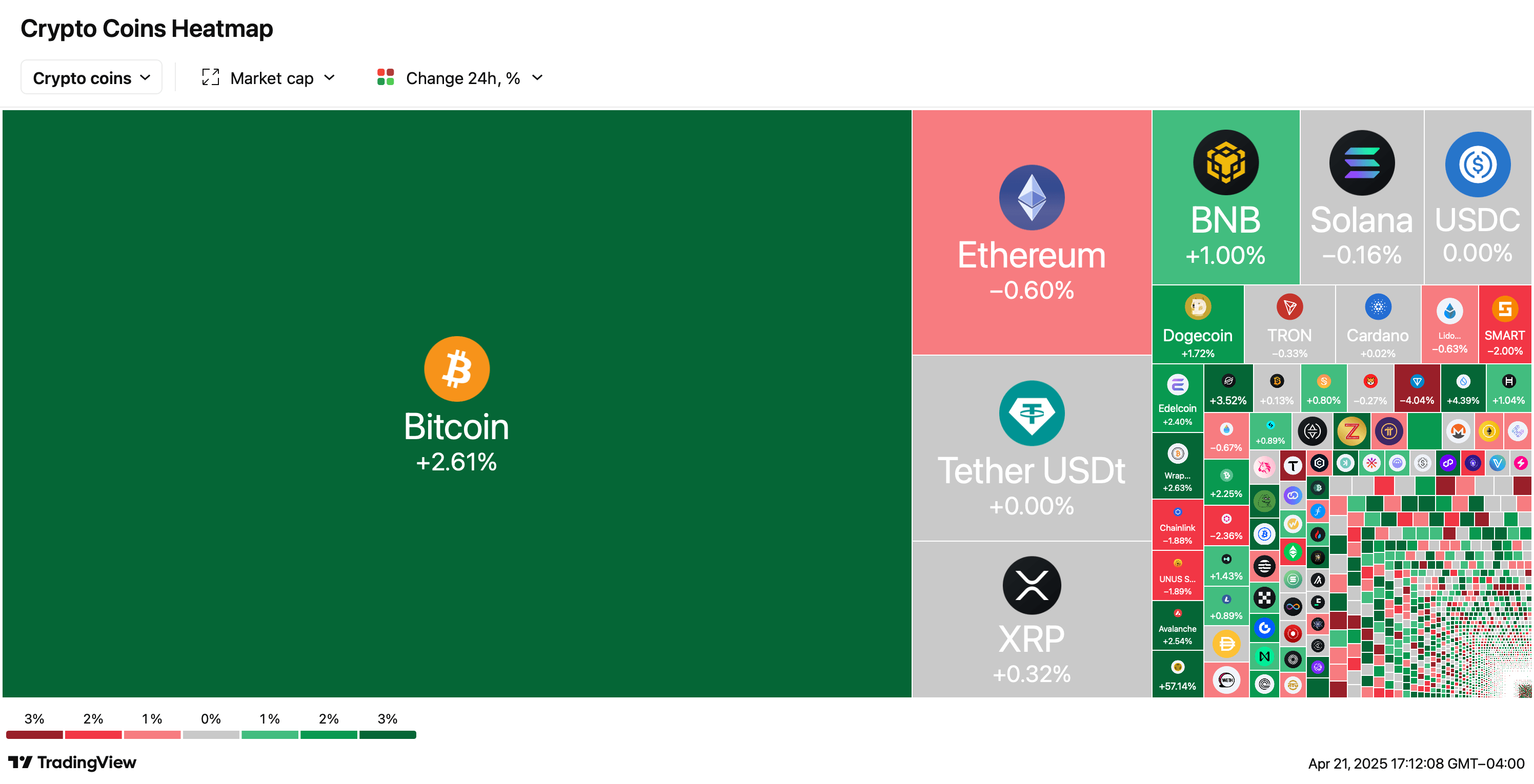

On Monday, Cryptocurrency Market experienced a notable rise as Bitcoin hit its intraday high of $88,527, reflecting renewed interest. Bitcoin had earned 2.61% by the evening, but some alternative digital assets outperformed, ensuring a greater increase. Among them, Convex Finance Token (CVX) stood out, rising 21.04% within 24 hours.

Trump’s policy triggers a $1.5T stock meltdown – crypto and gold emerge as shelter

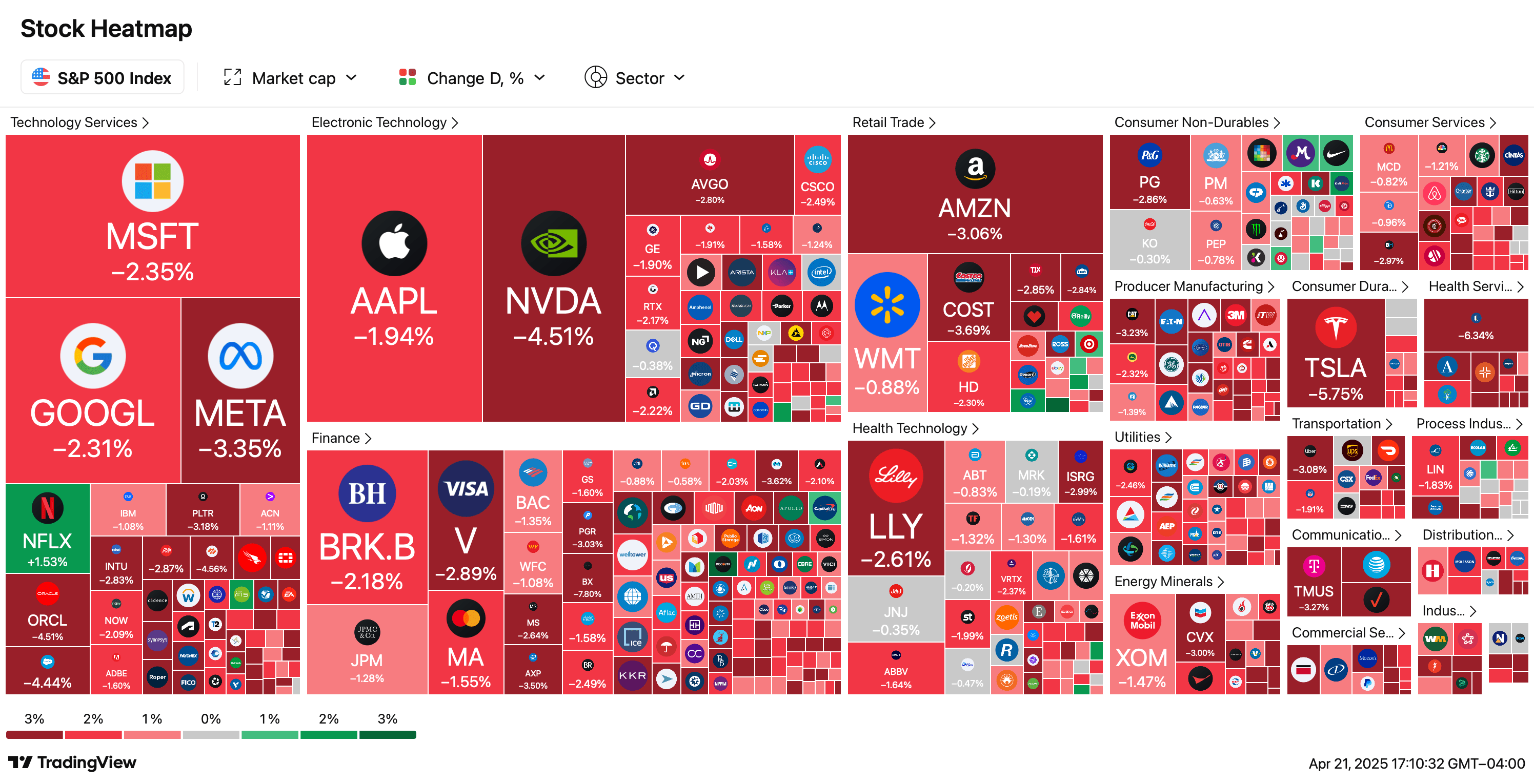

The crypto economy grew 1.77%, reaching $2.73 trillion as of 5pm on Monday, adding about $75 billion to the sector. Digital assets performed widely on April 21st as the Tradfi market plummeted. The Dow Jones collapsed 972 points, the S&P 500 fell by 125 points, lowering the high-tech heavy-nus dach composite 416 points amid a rapid erosion of investor trust.

Bitcoin (BTC) settled at $87,262 by 5pm before flirting at $88,527, boasting a significant 2.61% profit for the day. Convex Finance Coin (CVX) rose 21.04%, while Stacks (STX) rose 12.98% over the course of Monday’s trading session. Telcoin (Tel) went 11.57%, while Reserve (RSR) made a profit of 10.07%.

Fartcoin, Mana, CKB, KAS and POL also rose from a 4.53% increase in Pol to an 8.52% increase in Fartcoin. Elsewhere, many tokens stumbled on Monday, and despite recent announcements of burns, the Mantra OM continues to depreciate. OM finished the day as the steepest collapser with a 6.62% drop and Dexe reduced by 5.44%. Cheems slipped 4.12%, while Pyth and Theta fell 3.62% and 3.54% respectively.

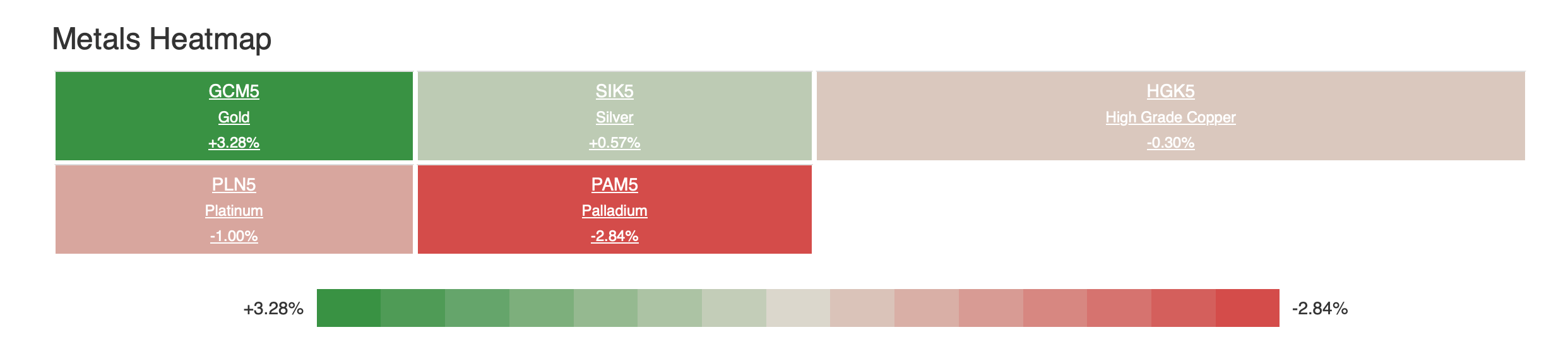

The gold market shined at its current $3,425/ounce on Monday with a profit of 3.28%, cementing a monthly 12% superior advance, with silver at today’s modest 0.57%, 2.67% below the ago level for the month.

The financial world is holding its breath as President Trump’s trade war rules the story, and today’s session alone has evaporated an astounding $1.5 trillion from US stocks.