Crypto ETF publishers are jumping at every opportunity and want to take advantage of SEC, which is more encryption-friendly.

This year, the Securities and Exchange Commission will be filled with ETF applications. On Monday, April 21, Bloomberg analyst Eric Balknas noted that 72 crypto exchange sales funds are currently awaiting approval.

Currently there are 72 crypto-related ETFs sitting waiting for approval for the SEC to list or list options. From XRP, Litecoin, Solana to Penguins, Doge and 2x Melania to everything in between, everything. It will be a wild year. Amazing roundup from @jseyff pic.twitter.com/ihtqqxeh35

– Eric Balchunas (@ericbalchunas) April 21, 2025

The list includes leveraged funds that bet on altcoins, NFT tokens, memokines, and Melania Trump tokens. The Melania 2X Fund is one of the leveraged Mecoin and altcoin funds by Turtle Capital registered in the Cayman Islands. With the number of these submissions, Bulknut predicted the “wild year” of the code.

“We currently have 72 crypto-related ETFs waiting for approval for the SEC to list or list options. From XRP, Litecoin, Solana, Penguins, Doge, 2x Melania, everything in between, it’s going to be a wild year.”

XRP leads in ETF filing

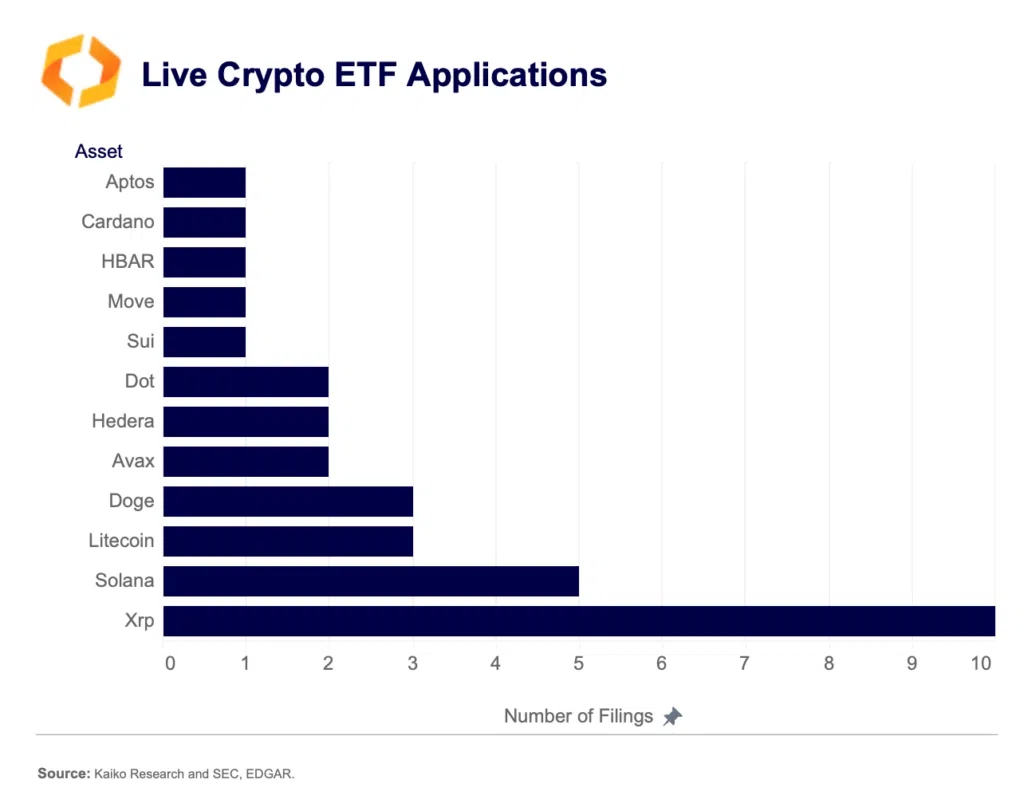

The list of ETF filings is diverse to say the least, but there are clear leaders in this area. In particular, Altcoins such as XRP (XRP), Solana (Sol), and Litecoin (LTC) are leading in terms of the number of individual submissions. Specifically, by April 15th, there were 10 individual filings in XRP, and 5 in Solana. As some of the biggest altcoins on the market, they are attracting institutional attention.

Altcoins by number of ETF filings | Source: Kaiko

At the same time, Litecoin and Dogecoin (Doge) were tied to third place, with three future publishers. Both of these tokens benefit from decentralization, but Doge has attracted mainstream attention thanks to its relationship with Elon Musk.

ETFs are becoming an important narrative for crypto adoption as they provide an easier way for both retail and institutional investors to be exposed to digital assets. Instead of holding assets directly, the fund must hold underlying assets, while also complying with strict regulatory requirements surrounding its custody.

read more: Q&A with figment: Inside the new TSX Solana StakingETF (SOLQ)