Ethereum prices fell 56% this year from the November high.

Ethereum (ETH) performance has deteriorated compared to other top cryptocurrencies such as Bitcoin (BTC) and Solana (SOL). In fact, Ethereum falls to a record low against Sol, hovering at its 2020 low against BTC.

This performance has led some investors and analysts to question whether Ethereum is dead. In a YouTube video on Thursday, Cardano (ADA) founder Charles Hoskinson predicted that Ethereum would not exist for the next 15 years.

He pointed to the growth of Layer 2 networks such as Base, Optimism, Kinkai and Polygon, which continue to gain market share. These chains primarily retrieved users from Ethereum. This is a chain known for its slow speeds and high transaction costs.

You might like it too: Analysts can turn to stocks as Bitcoin is approaching the top of the range.

However, a closer look at top network data reveals that Ethereum is far from heading towards its final mise. Its distributed exchange protocol has processed more than $57 billion in volumes over the last 30 days, making it the second largest chain after Solana, and that protocol processed $61.3 billion over the same period.

Ethereum is also the largest chain in terms of locked total values. TVL is $107 billion and has a market share of 57%. The $124 billion Stablecoin market capitalization accounts for 51% of the market share. This is the largest chain in the inappropriate token industry.

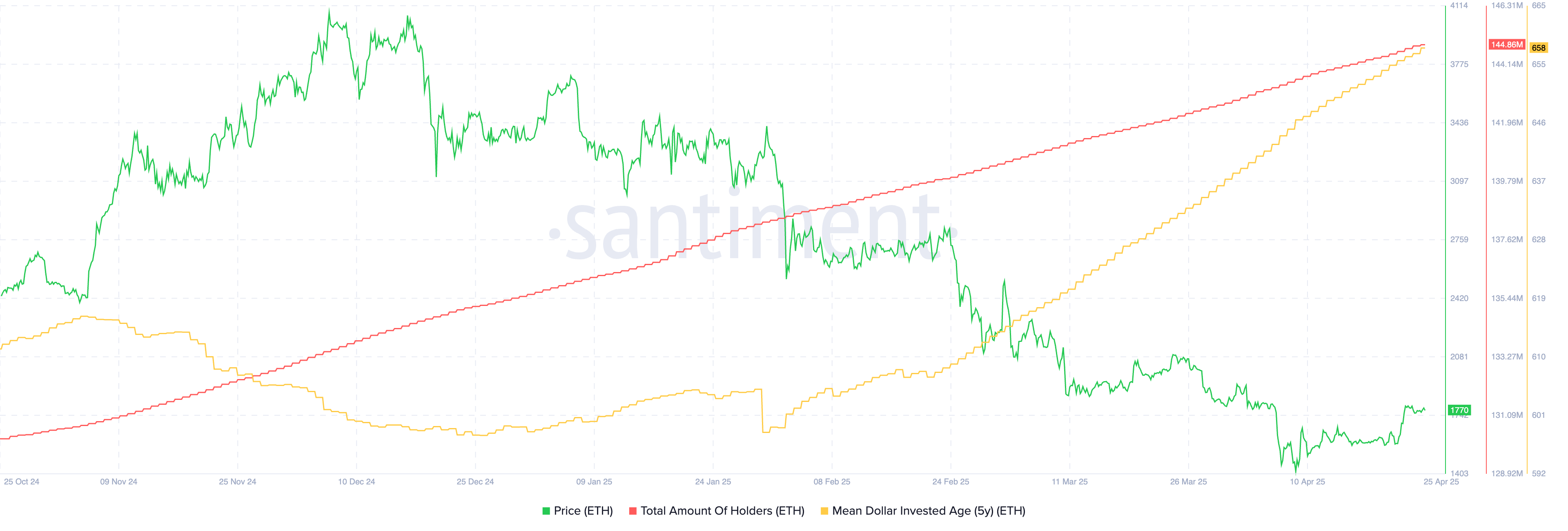

Furthermore, Santiment data shows that the number of Ethereum holders continues to increase. Currently, there are over 144.8 million holders, up from 130 million in October last year. Additionally, the average investment age over the five years has increased to 658, indicating that older holders are not selling.

ETH Holder and MDIA | Source: Santiment

Ethereum Technical Analysis: $2150 is a key price to watch

ETH Price Chart | Source: crypto.news

The daily chart shows the ETH price bouncing off after being held to the bottom of $1,383 earlier this month. It rebounded to $1,787, the highest level since April 6th.

The coin has moved above the upper limit of the falling channel, which has been formed since November last year. It also jumped above the 25-day moving average, forming a small bullish flag pattern.

A great oscillator is about to move above the zero line. Finally, in November it surpassed that level and triggered a 40% jump.

So the important Ethereum price level to watch is $2,150, the lowest point for last August and September. A break above that level could show more profits, potentially $3,000. Not exceeding that level is dangerous as it presents a break-and-retest pattern.

You might like it too: Pengu Price breaks out with 40% surge and $0.015 before Eyes $0.015 ETF approval