The Bitcoin (BTC) market was extremely bullish last week, with prices jumping over 10%. In this positive development, there is prominent investor activity, which refers to indomitable demand that can support sustained price increases.

BTC Supply Shake Up: Long-term Holders Increase, New Buyers Step Over 92K

In a recent X post, the popular Crypto Pundit Axel Adler Jr. shared some interesting on-chain insights into the Bitcoin market.

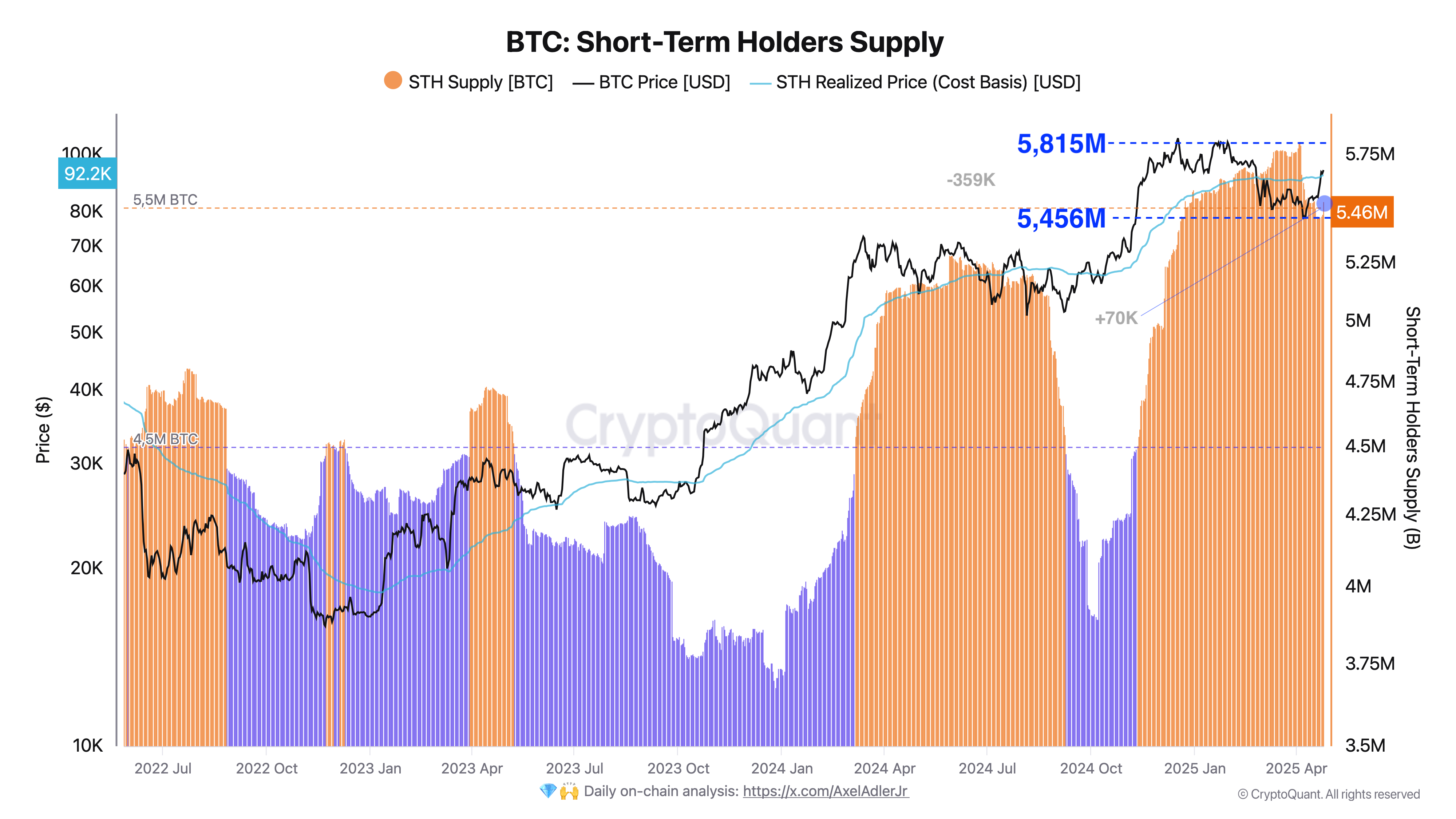

Using Cryptoquant data, Adler reports that short-term holder market supply fell by 359,000 BTC, valued at $33.84 billion over 16 days between April 4 and 21. Interestingly, this decline was due to coin maturation rather than sales pressure, which resulted in a transition to the long-term holder category.

This is a positive market signal that indicates that holders are confident in Bitcoin’s long-term outlook. By choosing to oppose sales, owners are strengthening the underlying market demand and providing a solid foundation for future price increases.

In another interesting development, Axel Adler JR said the supply of short-term BTC holders has increased by 70,000 BTC, amounting to $65.9 billion in the last two days after Bitcoin’s latest price rally.

Analysts explain that the increase is attributable to profit gains from long-term holders through redistribution. As prices rise. Importantly, short-term holders effectively absorb this new supply, indicating strong demand in the Bitcoin market.

This demand is heavily reflected in Bitcoin’s ability to exceed $92,200, a cost basis for short-term holders, representing the average acquisition price of the holdings. This shows robust market confidence as new buyers are actively stepping into the market and expanding their STH cohort.

Overall, the combination of significant coin maturation, healthy redistribution, and Bitcoin’s resilience above the cost base of short-term holders highlights structurally strong market demand. BTC appears to be suitable for sustained upward momentum in the medium to medium term, as it demonstrates that long-term holders can effectively absorb supply by trust and new demand.

Bitcoin price overview

At the time of writing, Bitcoin was trading at $94,408, reflecting a 0.78% decline on the last day. However, daily asset trading volume has declined by 55.53%, suggesting participation in a declining market.

Nevertheless, it appears that BTC is set up to maintain price increases. This has moved major resistance levels at $91,000, supported by other bullish developments, including a revival of ETF inflows totaling around $3.06 billion over the past week.

The next resistance is $96,000, and moving through the past could further raise prices to around $100,000. However, a price rejection could allow you to return to around $92,000, which could effectively create range-bound movements.

Economic Times featured images, TradingView charts

Editing process Bitconists focus on delivering thorough research, accurate and unbiased content. We support strict sourcing standards, and each page receives a hard-working review by a team of top technology experts and veteran editors. This process ensures the integrity, relevance and value of your readers’ content.