Following a notable surge, Ethereum began to lose momentum as it approached a critical zone of resistance of around $1.8,000. Nevertheless, the emergence of bearish divergence suggests potential short-term corrective integration before the next bullish continuation.

Technical Analysis

Daily Charts

Following a recent significant price rise, launched by strong purchase pressure at a critical $1.5,000 support level, ETH has reached a critical zone of resistance of nearly $1.8,000. This upward displacement creates a fair value gap, emphasizing the presence of smart money on the buyer side. However, the $1.8k region is consistent with previous order blocks, which are likely to be full of supply, making it a formidable barrier.

As a result, Ethereum is expected to enter a temporary integration phase, with minor modifications likely to follow before the next major move. If the buyer violates this resistance, the next target will be a critical level of $2.2,000.

4-hour chart

In the lower time frame, the shift in ETH bull market structure was confirmed after a breakout that surpassed the descending channel for several months, resulting in a strong surge towards the 1.8K resistance zone. This level coincides with previous important swinglows and reinforces their importance. However, momentum stopped when this critical threshold was reached, and prices entered a low volatile integration phase.

At the same time, a bearish divergence between prices and RSI indicators appears, suggesting the possibility of short-term corrective actions. As a result, an expanded integration or minor pullback is expected prior to bullish breakout attempts.

On-Chain Analysis

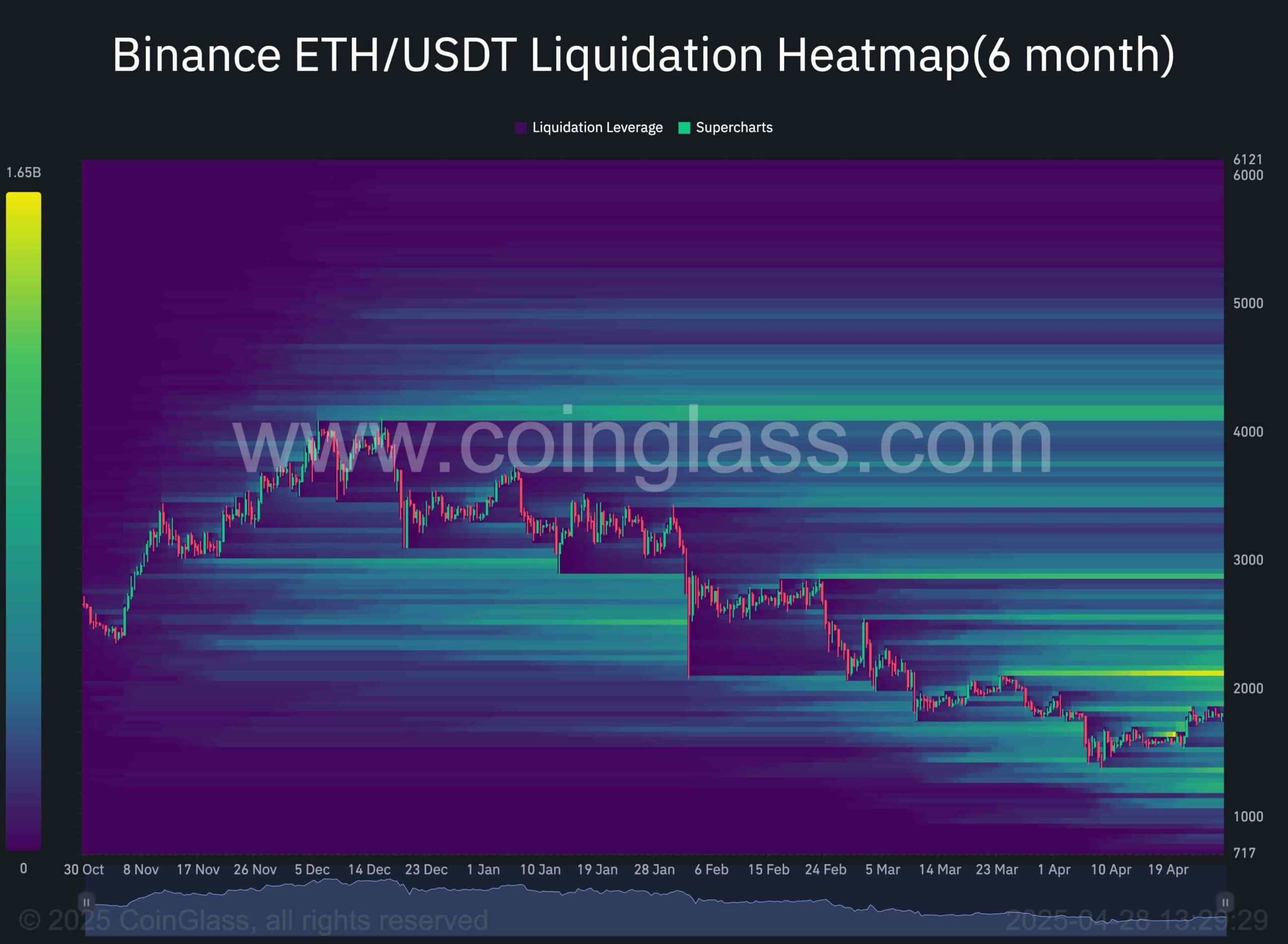

The Binance Clearing Heatmap continues to provide valuable insight into Ethereum’s current market structure and potential future price movements. Fluidity zones clustered around key psychological levels often tend to act as magnets and attract prices as market participants try to cause stop losses and liquidation.

Following recent significant downtrends, a significant concentration of liquidation levels formed just above the previous swing of Ethereum around the key $2K mark. Historically, during periods of recovery or bullish sentiment, the market is attracted to such liquidity pockets. Institutional players and smart money participants are trying to misuse sellers trapped by causing forced liquidation.

Currently, Ethereum’s price action shows growth in strength that has successfully rebounded from a major support area of $1.5,000, rebounding key technology levels. If assets continue to have upward momentum and enter a $2,000 liquidity cluster, a cascade of short liquidation could be unlocked. This injects additional volatility, amplifies the purchase pressure, and rapidly pushes Ethereum towards the next critical zone of resistance, close to $2.5,000.