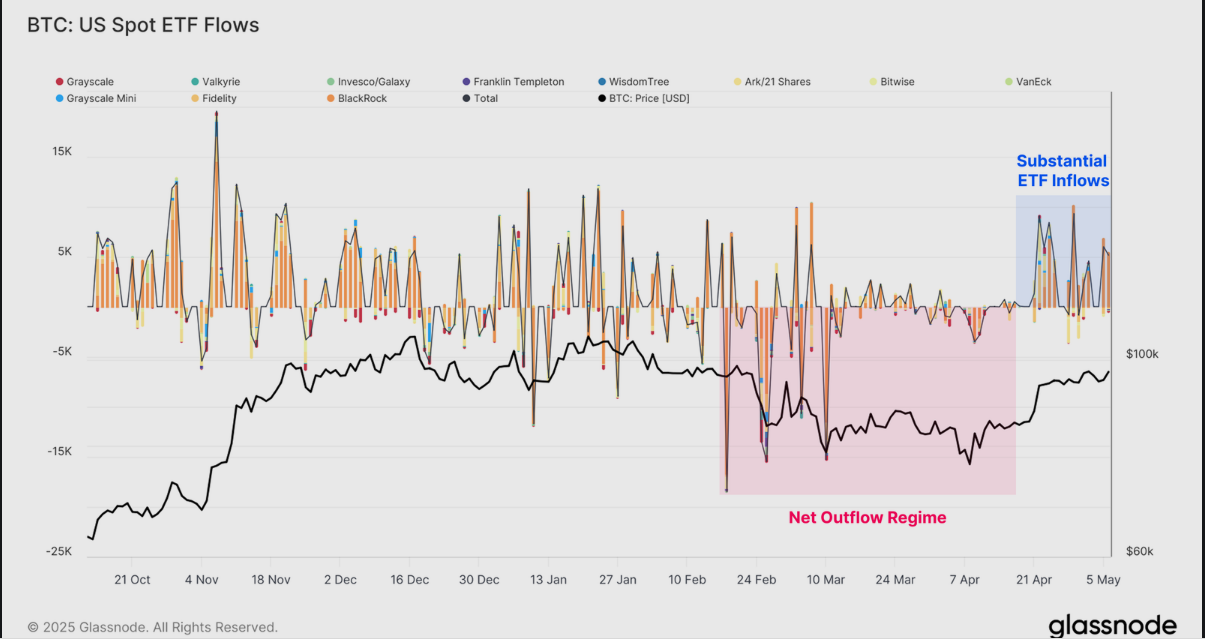

After months of bleeding, the US Bitcoin ETF pulled in $4.6 billion in two weeks. “Get the ground.”

The Spot Bitcoin ETF has shown a rapid shift in institutional sentiment, seeing a net influx of nearly $1.3 billion over just two days in the past week.

BlackRock’s IBIT alone led competitors like Fidelity’s FBTC to retard, while withdrawing $970 million in one session.

After enduring the largest sustained runoff streak on record in April, the ETF complex is back in growth mode.

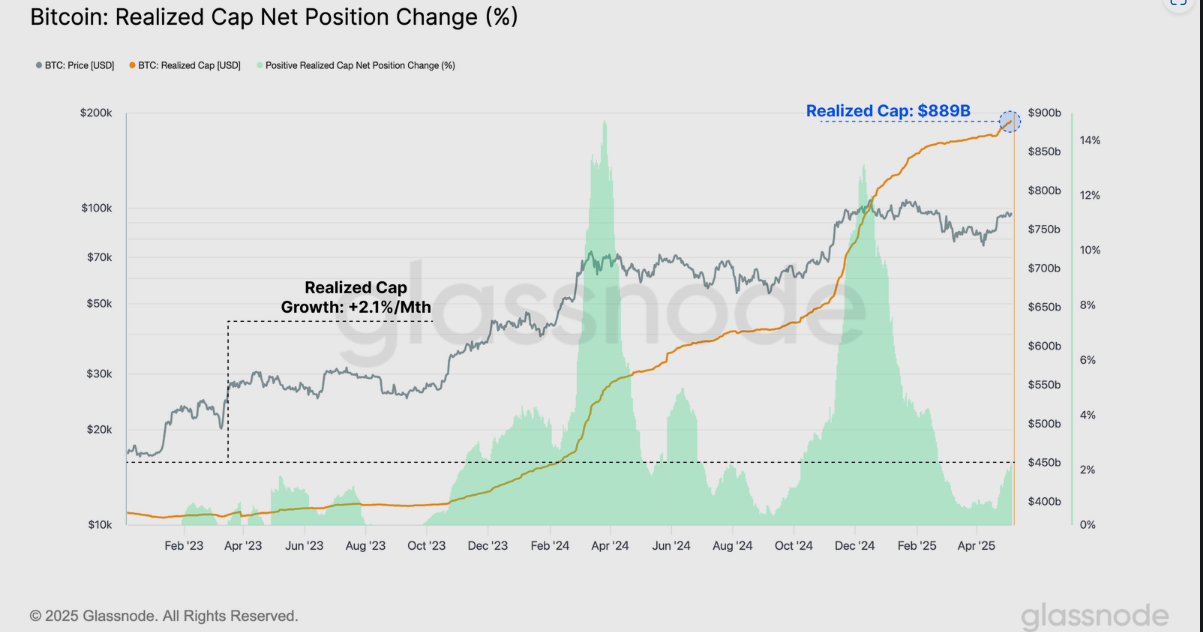

Bitcoin prices themselves surged from a low of $74,000 to $97,900 on April 27, 2025, pushing the market realisation cap to a record $889 billion, according to data from CoinmarketCap.

The rally has brought relief to millions of holders, but is this the bottom of the market or another twist set up, as prices have oddly quietly and well-stopped the expectations of critical thresholds and volatility?

“Ground Acquisition” to record Bitcoin ETF inflow and BTC

Bitcoin ETFs were in the rut. From January to March 2025, they lost 70,000 BTC in net spills. This is the longest sustained exit on record.

After that, everything changed. Between April 13th and April 27th, 2025, ETFS absorbed $4.6 billion, nearly wiping out previous losses.

US Spot BTC Flow | Source: GlassNode

The managed assets reached 1171 million btc and peaked at just 11,000 btc with shyness of 11,000. This surge was driven by Bitcoin climbs to $97,900, bringing institutional demand back into vengeance.

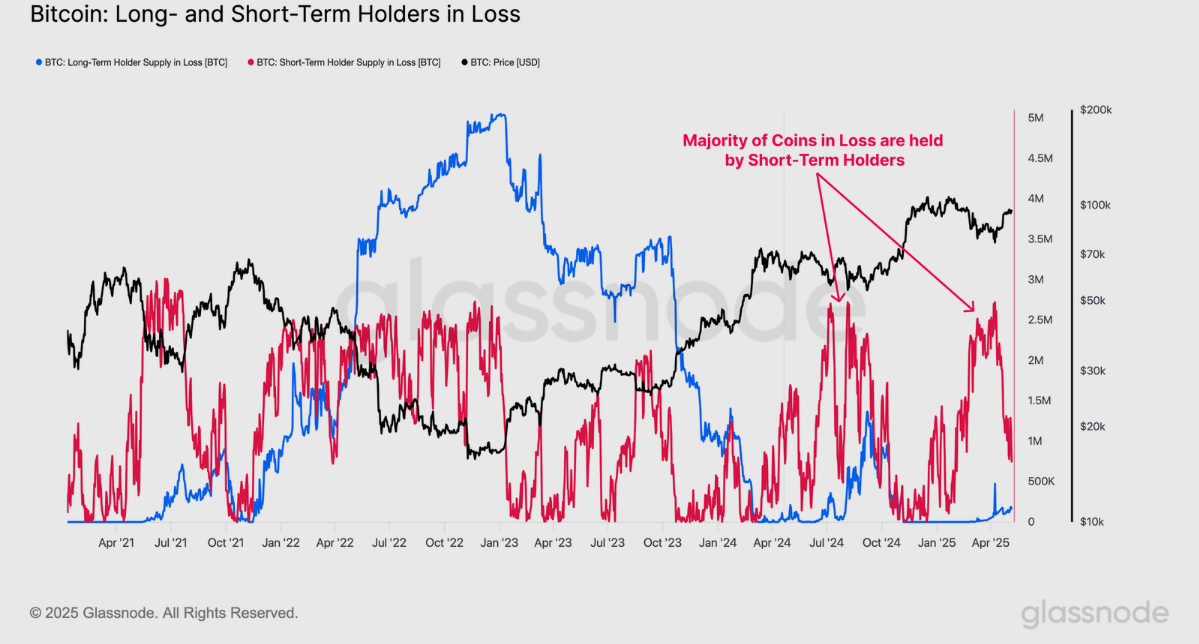

Bitcoin prices jump from $74,000 to $97,900. This was not just a chart blip, it was a lifeline. At the lows in April, more than 5 million BTC was underwater.

By April 27, 2025, according to the newsletter, there were still losses by April 27, 2025, with 3 million BTC earning profits. Short-term holders (STH) held 83% of the underwater coins, making a profit.

btc lth versus. sth of loss | Source: GlassNode

Daily capital inflows reach $1 billion, with profits controlling 98% of the transaction. The realized cap rose 2.1% a month to $889 million, reflecting the highest demand ever.

BTC has achieved cap net position | Source: GlassNode

Bitcoin is trading at $97,000, but it’s a tightrope walk. According to GlassNode’s analysis, the price cleared the 111-day moving average and the STH cost base. Both are close to $94,000.

However, the realized supply density metrics showed clusters of cost-based Coinbase dense coins accumulated between December 2024 and February 2025.

Options market adds plot. The implicit volatility of the week-and-month contract has collided with lows not seen since July 2024. The three- and six-month contracts have also been squeezed, with the March 2026 option being 50% premium, a historically low level.

Historically, expectations for such low volatility have preceded sharp price fluctuations. Traders may be underestimating turbulence.

Bottom or bounce?

Larry restructured the behaviour of investors. Total profits and losses reach $1 billion each day, with only 15% of trading days watching this cycle.

Losses account for just 1-2% of the transaction, indicating that most holders over $96,000 hold solidly. STH has become neutral and mitigated financial stress by unrealized losses that surged during the rewinds of the yen and carry trade in August 2024 and the slump in early 2025.

A drop below $94,000 could derail the rallies around the report. For now, Bitcoin’s $97,000 price and ETF rally point to a potential bottom, but that’s not a completed transaction.

Traders monitor whether ETF momentum applies and whether on-chain strength leads to price increases. With spot funds being preferred and underwater holders fewer, the market may have found floors at least until the next volatility surge.