The Ethereum (ETH) price finally broke the $2,000 barrier and traded for around $2,300 after serious past resistance. We hope this will bring us up to $3,000 and $4,000.

A sudden move began after the Federal Open Market Committee’s decision to stabilize interest rates on May 7th led to a full-scale risk-on digital assets.

The stage is set for a big rise as the top Altcoin prices clear critical levels and on-chain metrics flash bullish signals.

Eth Price breaks the key and breaks the $1,860 and $2,300 resistances

According to Ali Martinez, Ethereum prices have recently surpassed the $1,860 resistance. This is an important zone where 4.54 million wallets hold 5.58 million ETH. The top altcoins have finally broken off from the critical supply barrier that had stifled progress over the past few weeks, indicating a major shift in market sentiment.

With prices rebounding beyond this level and still strong now, Ethereum could gather in the long term with a potential goal of $3,000 and $4,000.

Source: Ali Martinez, X

Additionally, Crypto analyst Incomesharks highlighted that ETH prices cleared the second oblique resistance and confirmed a broader trend reversal. The chart showed that ETH was steadily rising after multiple purchase signals along the lower trendline.

The next major resistance zones are $3,000 and $4,000, so traders are looking at potential months of gatherings if current momentum applies.

Source: Incomesharks, x

Bullish divergence and on-chain data support ETH gatherings

In particular, Javon Marks noted that the big bullish divergence on the Ethereum price chart is a classic inversion pattern that marks a major price recovery in the future.

According to his analysis, ETH has a double base with momentum indicators such as the relative strength index (RSI), which begins to increase, indicating bullish divergence.

This technical arrangement was a sign of a new trend, usually starting with price targets that are much higher than current ETH prices.

Source: Javon Marks, x

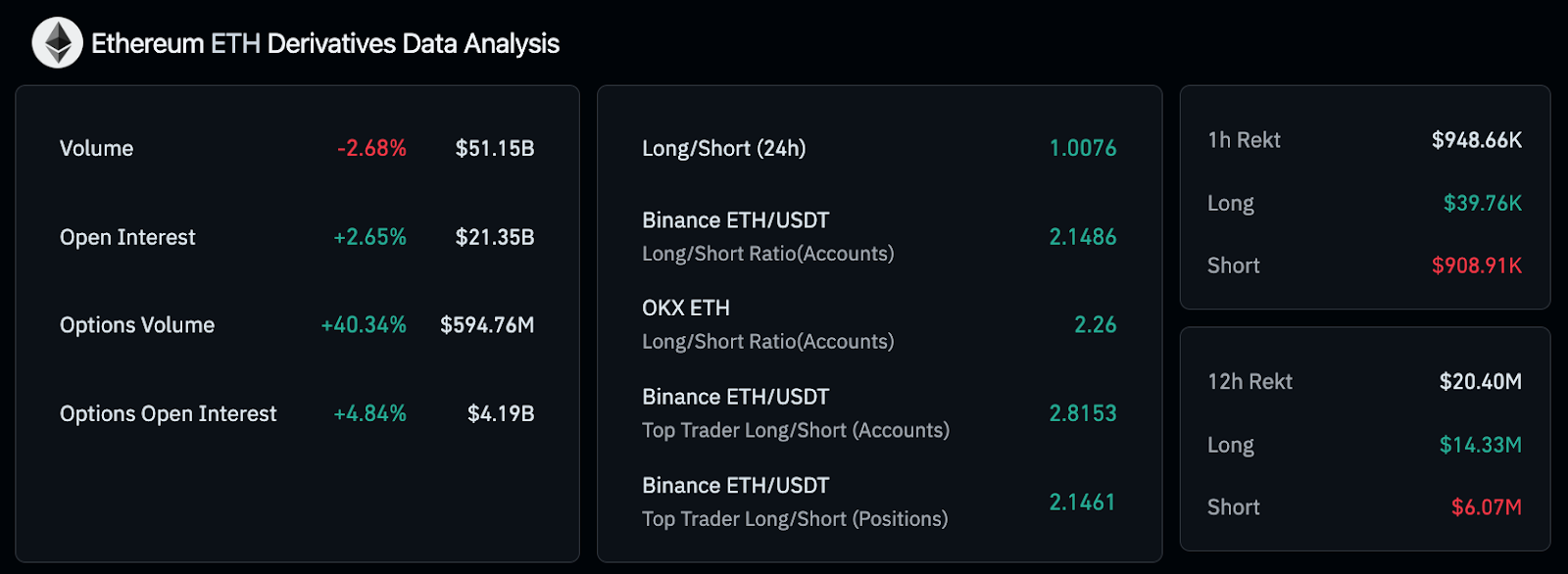

Meanwhile, on-chain data also supported this bullish outlook. According to recent figures, Ethereum’s public interest has increased 2.65% to around $213.5 billion over the past 24 hours, as new capital worth $400 million jumped into ETH futures. The increased open profit meant that traders were positioned for greater movements.

Derivatives market shows strong bullish sentiment

The derivatives market also reflects Ethereum’s strong bullish bias. Binance’s ETH/USDT Long/Short ratio is 2.1486, while OKX Traders are taking an even more aggressive stance at a 2.26 ratio. This means that more than twice as long traders are shorter and shows even stronger beliefs.

Source: Coinglass

For Binance’s top traders, the long/short position ratio has risen to 2.8153, indicating an increase in reliability for Ethereum’s upward slides. This is consistent with market sentiment as traders set it upside further. Longer exposure and increased open profits suggest that the market is anticipating a significant ETH price movement in the coming weeks.

Furthermore, liquidation data also supports this bullish trend. In the last 12 hours, ETH shorts have accounted for $14.33 million in long liquidation and $6.07 million in short ETH liquidation. This showed that Ethereum traders who were betting on a price recovery were squeezed out.

ETH prices are $4,000 as a notable important level

In particular, Ethereum prices are struggling to trade above $1900, as the next major resistance line is at $1950 and the next is at the $2000 level.

However, Ethereum (ETH) prices are expected to continue their recent momentum to avoid pullbacks to the $1,860 support zone.

At a near stage, if the Fed rate pauses as a catalyst, this may just be the beginning of Ethereum’s recovery. As technical metrics improve and market sentiment becomes bullish, Altcoin’s outlook strengthens, suggesting a potential breakout in the coming months.