Bvnk has secured support from Visa Ventures and marked the latest move from payment giants to integrate Stablecoin technology into their global network.

The Stablecoin Payments Infrastructure Provider Bvnk secured strategic investments from Visa, pushing traditional payment giants into blockchain-based settlement technology. The investments made through Visa Ventures were announced on Tuesday by BVNK CEO Jesse Hemson-Struthers.

Financial terms have not been revealed, but the move follows BVNK’s $50 million Series B round in December 2024, led by Haun Ventures and includes support from Coinbase Ventures, Scribble Ventures, DRW Venture Capital, Avenir and Tiger Global.

Hemson-Struthers describes the partnership as “more than capital,” calling it a “strong verification of its vision of upgrading global payments with Stablecoin technology.”

Crypto.News contacted both BVNK and Visa multiple times, but neither of them responded by the time of publication.

You might like it too: Meta may be focusing on Instagram creator Stablecoin payments

In the announcement, Rubail Birwadker, head of Visa’s growth products and partnerships, said Stablecoins is “quickly becoming part of the global payment flow, and Visa will invest in new technologies and builders like BVNK and remain at the next frontline of commercial suitable for clients and partners.”

BVNK claims to process $12 billion in annual Stablecoin payments, and says it has built the platform from scratch to support automated, massive transactions. The company positions services as an alternative to the traditional correspondent banking system.

“At BVNK, we recognized early on that stubcoins would emerge as instant global payment rails and as viable alternatives to traditional correspondent banking systems. So we’ll build infrastructure to automate and coordinate stubcoin payments on a large scale, making these new rails accessible to all sizes.”

Hemson – Stratter

Stability tracking

Visa investment comes when the Stablecoin sector shows signs of wider institutional interest. In late April, Visa partnered with Stripe Acquired Bridge Startup to allow Fintechs to issue Visa cards drawn directly from the Stablecoin balance.

The new products initially launched in six Latin American countries will allow users to fund Stablecoins cards and convert them to local Fiats at the time of sale. Merchants are paid in local currency and are not exposed to crypto volatility.

Bridge CEO Zach Abrams described the collaboration as “a massive unlock for developers,” adding that everyone can “use Stablecoins on tap.” Jack Forestell, Visa’s Chief Product and Strategy Officer, emphasized that the company aims to “securely integrate Stablecoins into its global network,” offering more financial options to consumers and developers.

BVNK appears to be part of this broader strategic direction. In its announcement, the company noted that Stablecoin Rails will help redefine the way businesses operate in digital economies, particularly in areas where access to efficient cross-border banks is restricted.

The company also opened offices in San Francisco and New York earlier this year, expanding into the US market. That US business is led by former Blocfee executive Amit Cheera and former Cross River executive Keith Vanderleast.

“A Trillion Dollar Opportunity”

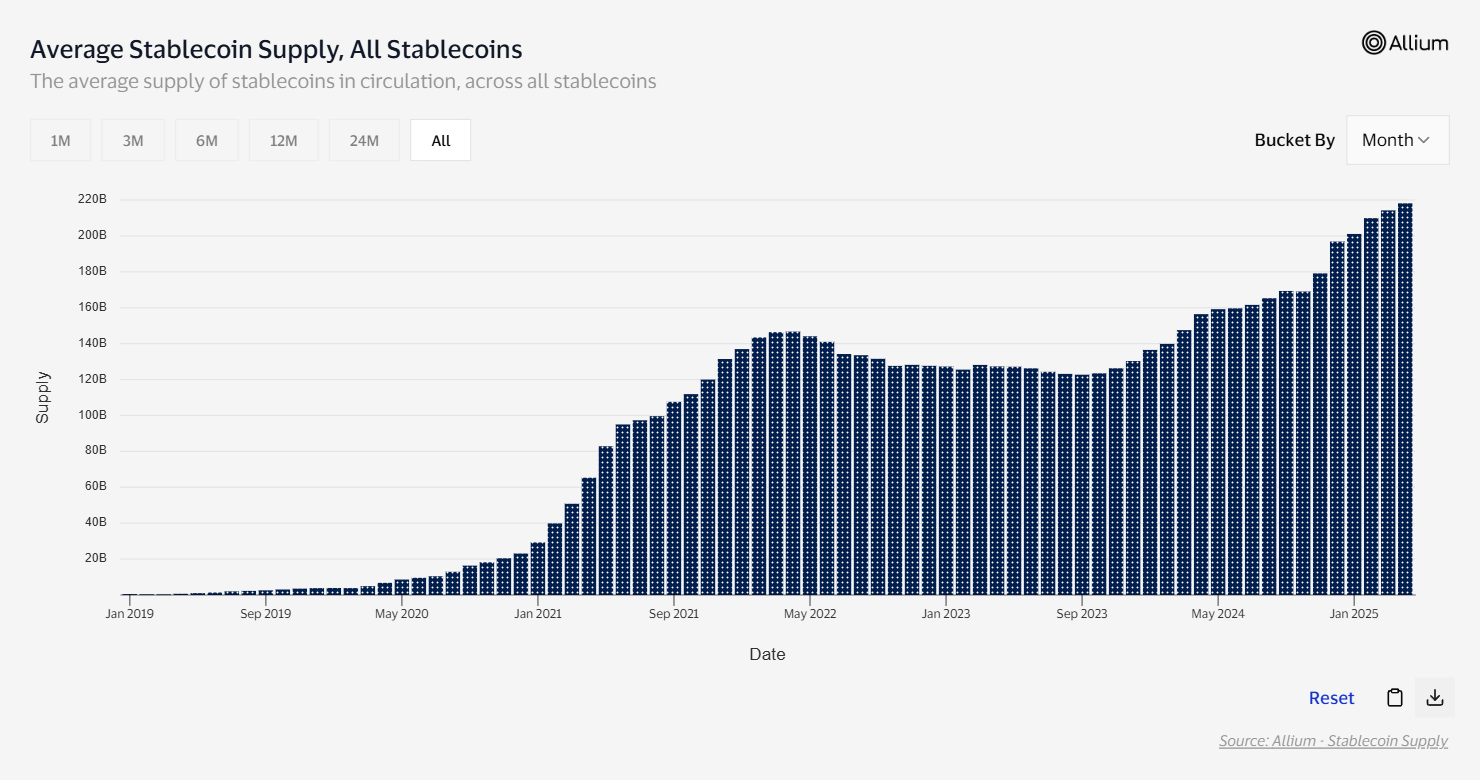

Stablecoin payments have skyrocketed in recent quarters. Visa’s Onchain Analytics platform reports a global stubcoin volume of $33.4 trillion over 5.5 billion transactions, indicating increased traction beyond trading use cases.

Average stable supply | Source: Visa

City Wells also said that Stubcoin “could strengthen control of the US dollar.”

https://twitter.com/hosseeb/status/1874288532686295058

Haseeb Qureshi, managing partner at Dragonfly Capital, previously predicted that 2025 could mark a turning point for Stablecoins, and has shifted speculative crypto transactions to actual payments and settlements, saying it could be a key tool for small businesses.

“The use of STABLECOIN will explode, especially among SMBs. Not only trading and speculation, but actual companies will begin using on-chain dollars for immediate settlement.”

dry

He also added that efficiency and accessibility can outperform traditional systems, especially as regulations clarity improves.

Another well-known Crypto Venture company, Pantera Capital, calls Stablecoins a “trillion dollar opportunity,” noting that it accounts for more than 50% of blockchain transaction activity compared to just 3% in 2020.

For BVNK, visa trading is also a milestone in its reputation. Hemson-Struthers framed it as a return to the first principle in payment innovation.

“We are particularly excited about the meaning of partnering with Visa, the original payment innovator,” he said, adding that Visa expertise in building a global payment network, combined with BVNK’s Stablecoin infrastructure, creates “strong possibilities.”

read more: Stablecoins accounted for almost 50% of South Korea’s first quarter cryptocurrency leaks, officials say