On-chain data shows that Ethereum Exchange Netflow has remained negative for the past week.

Ethereum Exchange Netflow suggests a trend towards withdrawal

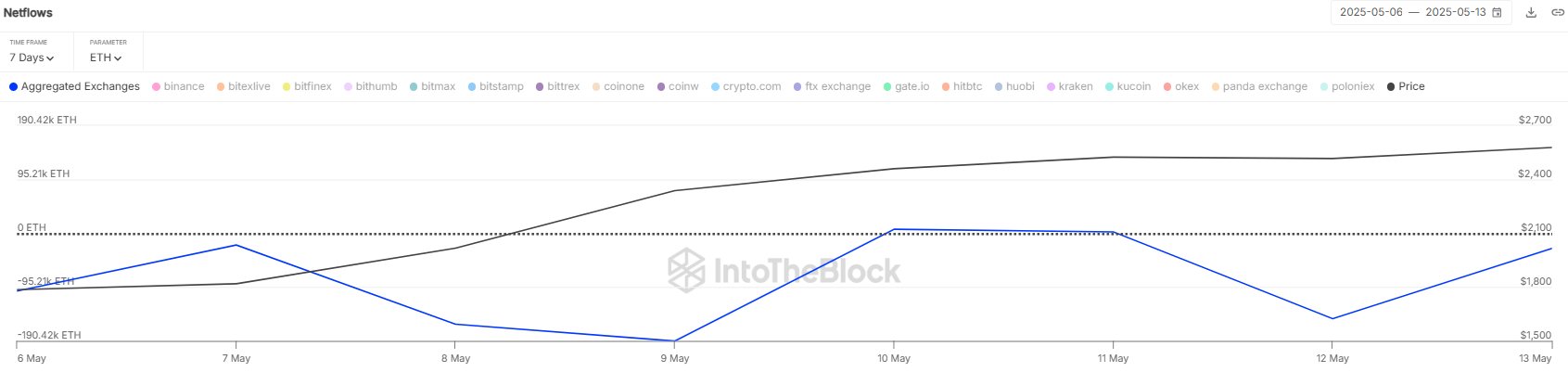

In a new post on X, Institutional Defi Solutions Provider Sentora (formerly Intotheblock) talked about the latest trends in Exchange Netflow on Ethereum. “Exchange Netflow” here refers to an on-chain metric that tracks the net amount of cryptocurrency that moves into the wallet associated with a centralized platform.

If the value of this metric is positive, it means that investors are depositing net tokens on these platforms. This type of trend can have a bearish effect on ETH prices, as one of the main reasons owners move to exchanges is for sales-related purposes.

On the other hand, an indicator below zero suggests that outflow is above inflow. In general, this kind of trend proves bullish for assets as investors keep coins away from managing exchanges for a long time.

Now, here is the chart shared by the analytics company.

The value of the metric appears to have been negative in recent days | Source: Sentora on X

As shown in the graph above, Ethereum Exchange Netflow was mostly negative within this window. This means that the holder is pulling supply from centralized exchanges.

In total, investors have retracted $1.2 billion worth of this outflow. “This sustained trend of net spill, which has been intensifying since early May, has continued to accumulate and lowered the pressure on sellers,” Sentora said.

ETH has seen this bullish development recently, but cryptocurrencies may not offer that good entry opportunity now, as analytics firm Santiment explains in its insights post.

The data for the 30-day and 365-day MVRV Ratios of ETH | Source: Santiment

The indicator shared by analytics companies is “Market Value to Realized Value (MVRV) ratio,” which essentially provides a measure of the decline in profits for Bitcoin investors.

The chart contains two versions of the indicators for Santiment: 30 days and 365 days. The former speaks about the profitability of investors who have purchased within the last 30 days and the profitability of buyers over the past year.

As can be seen in the graph, Ethereum’s 30-day MVRV ratio is currently worth a notable positive, meaning that recent buyers are making great profits. More specifically, the metric is located at 32.5%. This is well above the 15% risk zone of Altcoins, which analytics companies recommend as hygiene rules.

“It may not mean that prices are about to fall, but it suggests that the rally will likely be slower or stopped until the 30-day MVRV returns to something more reasonable,” explains Santiment.

ETH Price

At the time of writing, Ethereum has traded about $2,600, over 43% last week.

The trend in the ETH price over the last five days | Source: ETHUSDT on TradingView

Dall-E, santiment.net, featured images from intotheblock.com, charts from tradingview.com

Editing process Bitconists focus on delivering thorough research, accurate and unbiased content. We support strict sourcing standards, and each page receives a hard-working review by a team of top technology experts and veteran editors. This process ensures the integrity, relevance and value of your readers’ content.