President Trump has once again called on Federal Reserve Chairman Jerome Powell to cut interest rates, but the crypto community doesn’t seem interested anymore. Rate cuts still seem unlikely, but there is a new bullish story in the market.

Between US-China trade contracts, new investors and technological advances, the fear of a recession appears to have clearly left the crypto market.

Trump continues to drive interest rate cuts

When Trump’s tariffs threatened to disrupt the global economy, the crypto industry fixed its hopes in one bullish story: reducing US interest rates.

The US president repeatedly disliked Jerome Powell and even threatened to fire him before relent, but Powell and his allies were solid. This hadn’t happened. Trump continues to ask, and continues to appeal to Powell today:

Throughout these lawsuits, the crypto industry repeatedly urged more interest rate cuts, claiming that “money printers” would cause economic collapse.

Trump recently asked Powell to cut interest rates, but the latest FOMC meeting reaffirms the status quo. How did Crypto respond to this? So far, it appears they have finally got a note.

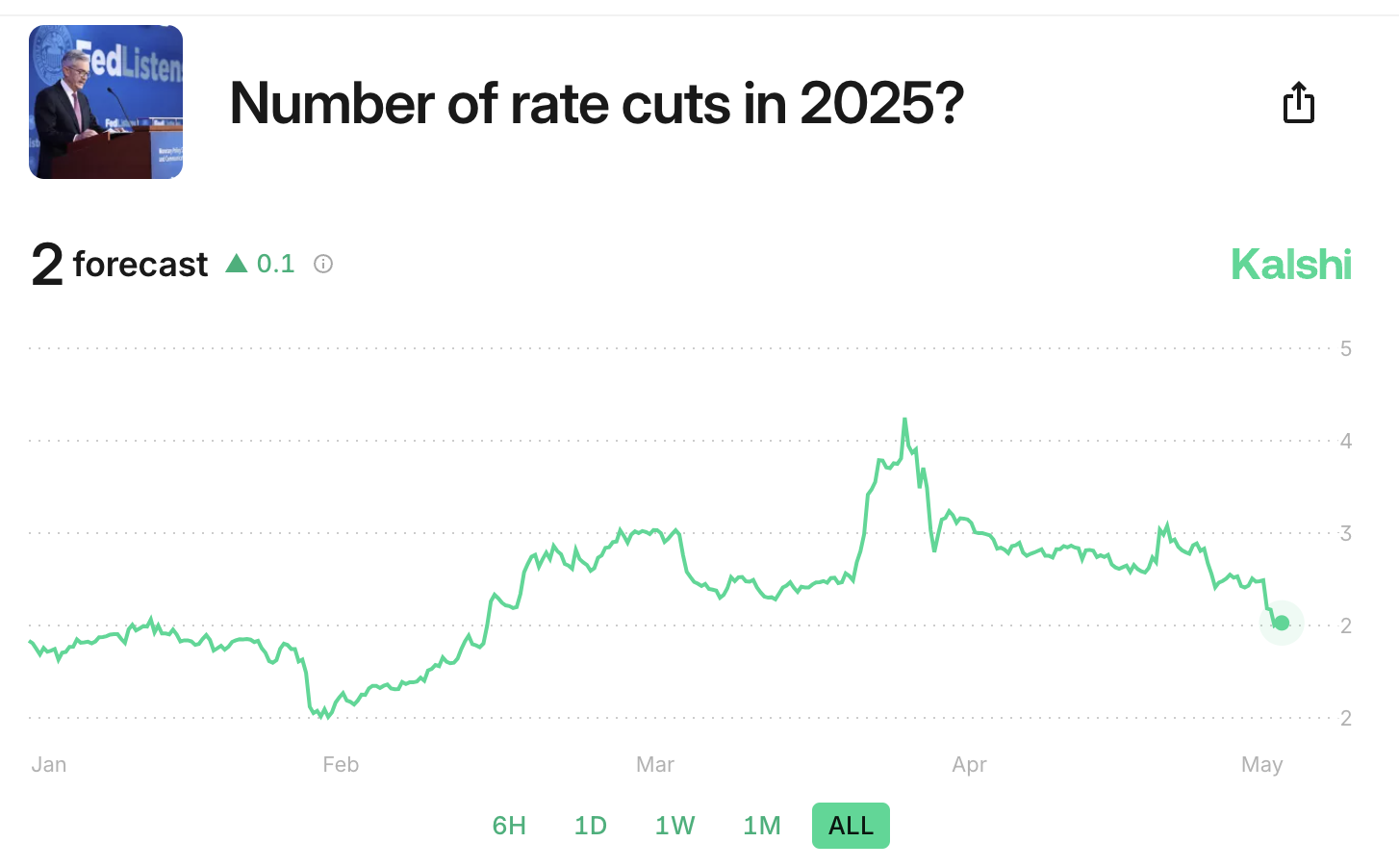

Crypto proposal markets like Kalshi have repeatedly posted optimistic odds of Trump’s rate reduction compared to Tradfi evaluators like CME Group. For example, when Trump made the request last, Calci predicted that three cuts would occur this year.

At the time, this meant that it was cut in half of the remaining FOMC meetings of the year. In March, I was hoping for 4 calci! Meanwhile, CME placed an odds of over 98% without cuts in May.

In fact, this scenario happened, and Karshi lowered that expectation. Currently, only two cuts are expected for the remaining years, in line with other companies’ forecasts.

What will interest rate reductions be in 2025? Source: Kalshi

What can Crypto conclude from now on? The community appears to have made it clear that Trump cannot force interest rate cuts. However, things are going well.

The US-China trade agreement has led to Bitcoin exceeding $105,000, with a large number of investors returning, and technology is advancing. Fear has mainly left investors’ calculations. Anyway, who needs to cut rates?

So, Trump’s proposed interest rate cuts was just one way to potentially drive crypto investment. If Powell voluntarily changed his mind today, it would be bullish, but for now, the crypto market is slowly moving away from these macroeconomic drivers.