More than $84 million in crypto tokens will be unlocked in several major projects between May 19th and 25th. This upcoming surge in insiders marks a pivotal moment for investors.

Data from Tokenomist shows that Pyth Network ($Pyth) alone accounts for more than 90% of the total unlock value next week, with more than $78 million tokens expected to be released. These important insider unlocks often reflect changes in investor strategies or align with the basic growth plan. As a result, market participants are closely watching these developments for potential trading opportunities and attention signals.

The breakdown of next week’s key tokens will be cancelled

This week’s highlight is Pyth Network ($Pyth), which unlocks 12.76% of distribution supply. This is an astounding $78.21 million, significantly outpacing the other tokens.

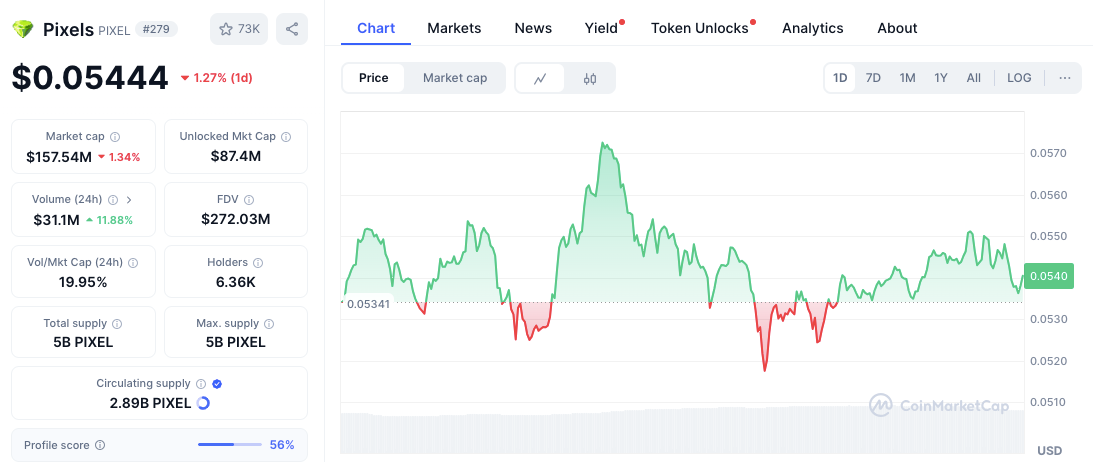

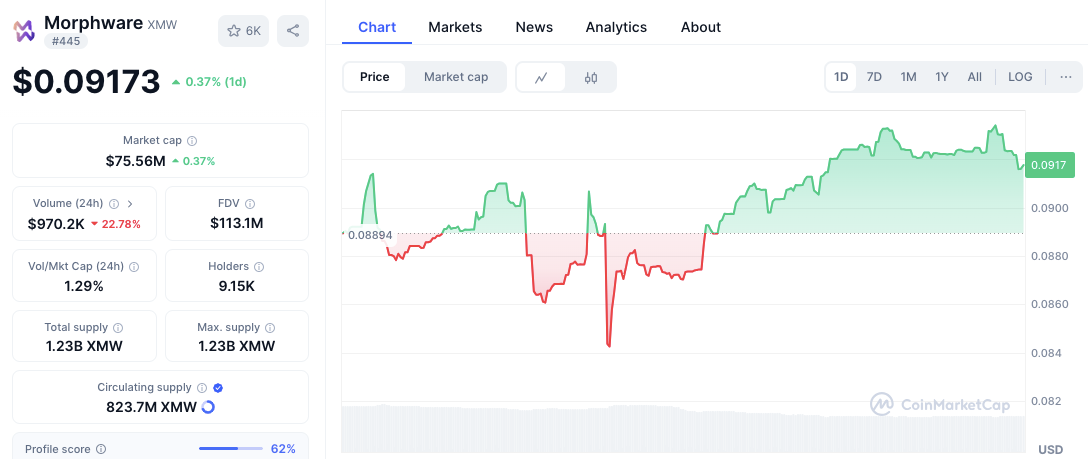

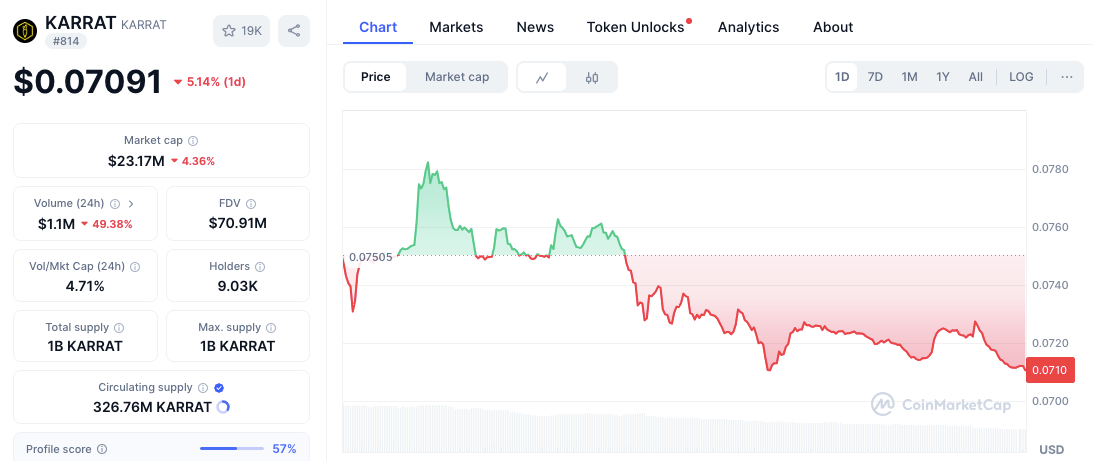

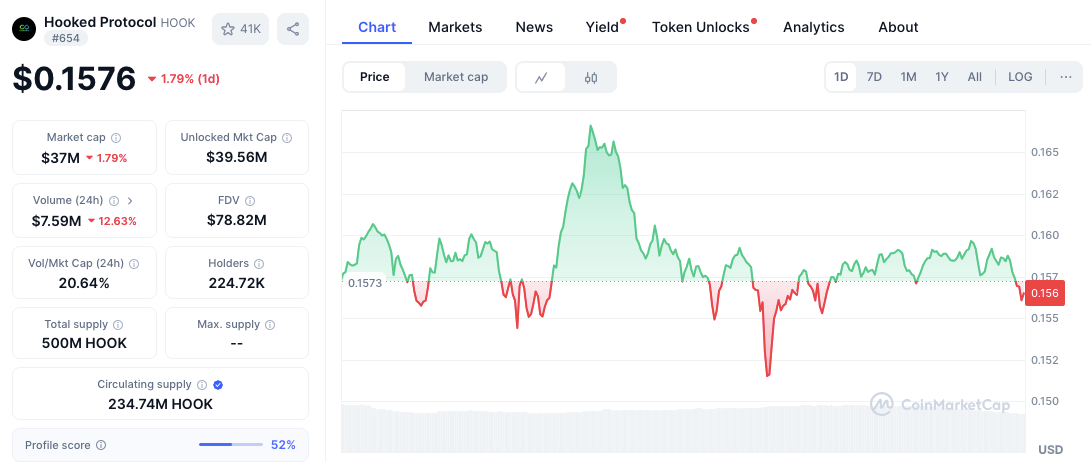

Following Pyth is Pixels ($Pixel), which unlocks $1.98 million (4.77%), while Morphware ($XMW) is $1.14 million (1.58%). Meanwhile, Karrat and Hooked Protocol ($hook) contribute at $903.51K (3.84%) and 661.59K (1.70%), respectively.

🟣Weekly Insider Unlock: 19 – May 25, 25

🔥84.0m +🔥

Insider Unlocks Highlights

.

(Cir. Supply%) pic.twitter.com/tmaqubxu4l– Tokenomist (Prev. Tokenunlocks) (@tokenomist_ai) May 16, 2025

These unlocks are not just the numbers that could restructure the dynamics of supply demand. Some owners may choose to settle, while others may hold the bank to long-term value. Therefore, price responses often depend on broader market sentiment and the volume of trading around the unlock window.

Technical Trends: What to Expect Next

$Pyth is trading within a narrow band of $0.160 to $0.172, with resistance of $0.1722 and solid support of $0.1605.

Daily trends show small bearish movements, while sustained quantities show strong market interest. A breakout that exceeds resistance can rekindle bullish movements.

Source: CoinMarketCap

Meanwhile, Pixel has experienced range-bound volatility and struggles to infringe on its daily high of $0.0572. Support is around $0.0521, suggesting a downside risk if the volume surges downwards.

Source: CoinMarketCap

However, XMW showed mild bullishness at a higher low, rising from $0.0860, suggesting a possible continuation if it clears $0.0925.

Source: CoinMarketCap

Meanwhile, Karrat has undergone a recession, dropping by 5% in erosion volumes. If it falls below $0.0705, additional losses could continue.

Source: CoinMarketCap

Hook failed to breakout at midday and lowered key resistance at $0.1605, but can exceed $0.1550 when demand is returned.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.