Ethereum has experienced a strong upward rally over the past two weeks, pushing it from $1,500 to over $2,600. However, signs of fatigue are beginning to emerge. For now, the higher time frame remains bullish, but short-term attention is required.

Technical Analysis

Shayan Market

Daily Charts

The ETH reached the technical ceiling just under a $2,900 resistance that closely matches the 200-day moving average. This zone previously served as a major breakdown point in February and now serves as a supply area. RSI has recently entered over-acquisition territory, suggesting that momentum has declined as prices approach this resistance.

Rejections from here could lead to pullbacks towards a $2,200 support zone and a 100-day MA near $2,100. A confirmed breakout of over $2,900 will bullish bias and have a potential continuation heading towards a key $4,000 zone.

4-hour chart

When it drops over the four-hour time frame, Ethereum shows signs of weakening momentum. After the explosive movement exceeds $2,100, prices are consolidated within a narrow range near the area between $2,500 and $2,600.

Currently, RSI has seen a clear divergence of bearishness, with prices gaining highs and RSI gaining lower highs. This usually indicates a potential fix. If ETH loses support of $2,450, it would likely be a retracement to $2,200, and even $2,050, to $2,050. On the back, regaining $2,600 with a strong volume will disable the bear signal and allow you to open a path to drive in the $3,000 area.

Emotional analysis

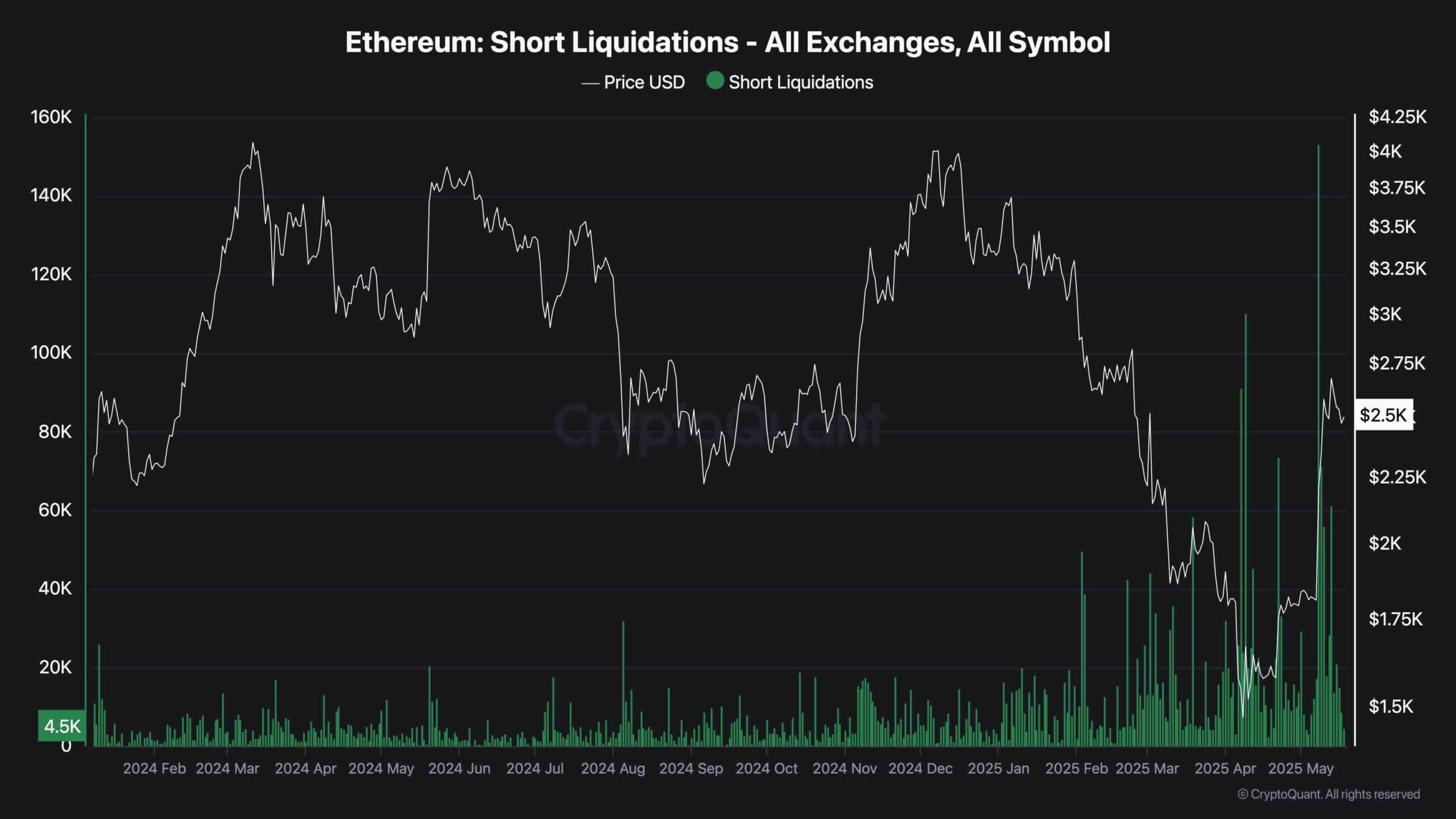

Recent rallys have sparked a sharp wave of short liquidation and promoted an aggressive price surge. As seen in the short liquidation chart, the largest liquidation occurred between $2,400 and $2,600, indicating that the majority of sellers were forced out of the market. This usually leads to short-term cooling as the rally’s “fuel” is exhausted.

The liquidation chart shows a clear increase in forced closures over the past week, coinciding with Ethereum’s breakout. These spikes often mark the top of the locals as removal of excessive short exposures removes momentum drivers. With liquidation tapering, prices can struggle to push higher without new demand entering the market. This context reinforces the idea that ETH can be integrated or modified before meaningful continuation.