Ethereum (ETH) has grown by more than 58% over the last 30 days, with nearly 40% of that surge occurring in the last 10 days. Despite this sharp gathering, some key indicators are beginning to flash carefully.

Bbtrend is negative, whale accumulation is reduced, and short-term EMA momentum is halting. These signals suggest that Ethereum needs updated purchase pressure to maintain the uptrend, or may be approaching a critical point where there is a risk of a potential reversal.

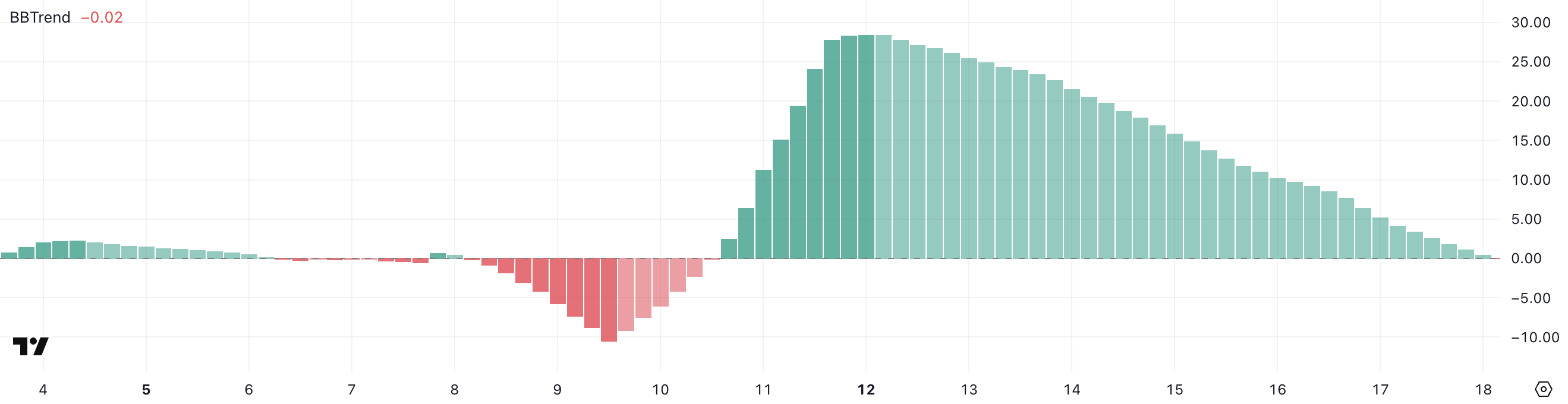

Ethereum bbtrend gets negative after a month’s surge

Ethereum’s Bbtrend has immersed in the negativity but is now sitting at -0.02 after maintaining a positive trend for about seven consecutive days.

This shift marks the end of the bull phase following a strong peak of 28.39 on May 12th.

The sub-zero movement comes after Ethereum surged 58.5% over the past month, raising questions about whether assets are entering a consolidation period or facing early signs of pullback.

ETH BBTREND. Source: TradingView.

The trend in BBTREND, or BOLLINGER BAND, measures price momentum versus volatility by assessing how much price movement deviates from the average within the Bollinger band.

Positive BBTREND values generally show bullish momentum, while negative values suggest that the market may lose strength or enter the bearish stage.

A slightly below zero in ETH’s BBTREND could indicate a decline in purchasing pressure after a recent rally. If this trend continues downward, Ethereum prices could stall or boost as traders move towards a more cautious stance.

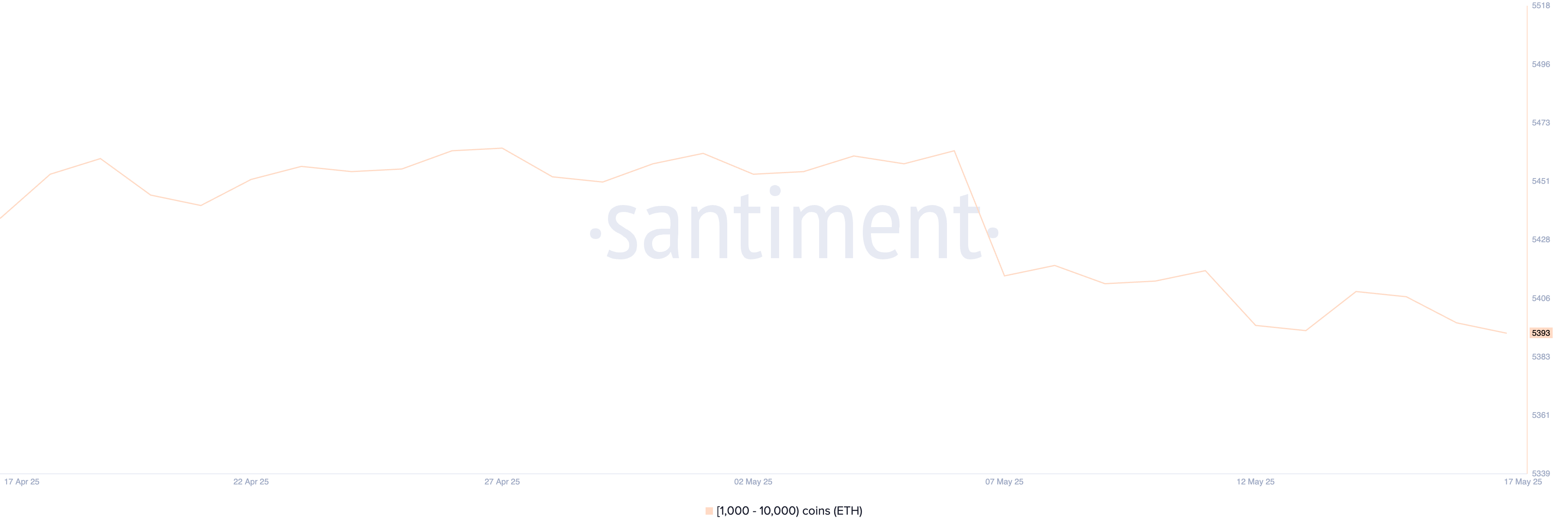

Ethereum whale count falls below key level for the first time since April 9th

Ethereum whales’ activity shows signs of decline after several weeks of stability. ETH (address classified as Ethereum whales) between 1,000 and 10,000 has exceeded 5,440 since mid-April, reaching 5,463 on May 8th.

However, over the past 10 days, this number has gradually declined despite slight fluctuations.

As of now, it is 5,393, the first time it has been soaked below 5,400 since April 9th, a level of psychological and historical support that is important for large owners.

Ethereum whale. Source: Santiment.

Tracking Ethereum whales is important as these addresses often function as market campaigners due to the size of their holdings. Increased whale populations usually show accumulation reflecting confidence and long-term positioning.

Conversely, a decline may suggest distribution, profit, or attention between key players.

The recent decline could mean a decrease in convictions from large investors following strong ETH gatherings, potentially leading to an increase in volatility or a period of cooling down on price momentum.

That’s coming Wh at onceSome analysts point out that ETH could overtake BTC, while others have questioned whether ETH is still a good investment in 2025.

ETH will struggle nearly $2,700 – Will the Bulls be able to regain $3,000?

Ethereum’s EMA (exponential moving average) line remains bullish, with short-term EMAs sitting on top of the long-term.

However, the momentum appears to be slowing down as the short-term lines are flattened and the gap between them is narrowing. This pattern often indicates a potential change in trends, especially when buyers fail to regain control.

The overall structure remains positive, but the loss of upward momentum causes short-term uncertainty.

ETH price analysis. Source: TradingView.

ETH prices have struggled to beat major resistance levels in the past few days at $2,741 and $2,646.

If the purchase pressure is not updated, the assets may not be able to regain the psychological $3,000 mark. This is a level that has not been mentioned since February 1st.

As sales pressure rises, Ethereum can revisit support for $2,408. Failure there can cause further losses, with $2,272 and $2,112 serving as the next important support zone.