Ethereum prices are undoubtedly better in recent weeks than in the first quarter of this year. However, “King of Altcoins” appears to be trapped in a loop. This involves repeated pushbacks at certain price levels.

After riding the bullish momentum of the week, Ethereum prices faced substantial downward pressures of over $2,700, then crashed around the start of the week. Below are the fundamental factors behind the struggle for ETH over $2,700.

What happens when the price of an ETH exceeds $2,700?

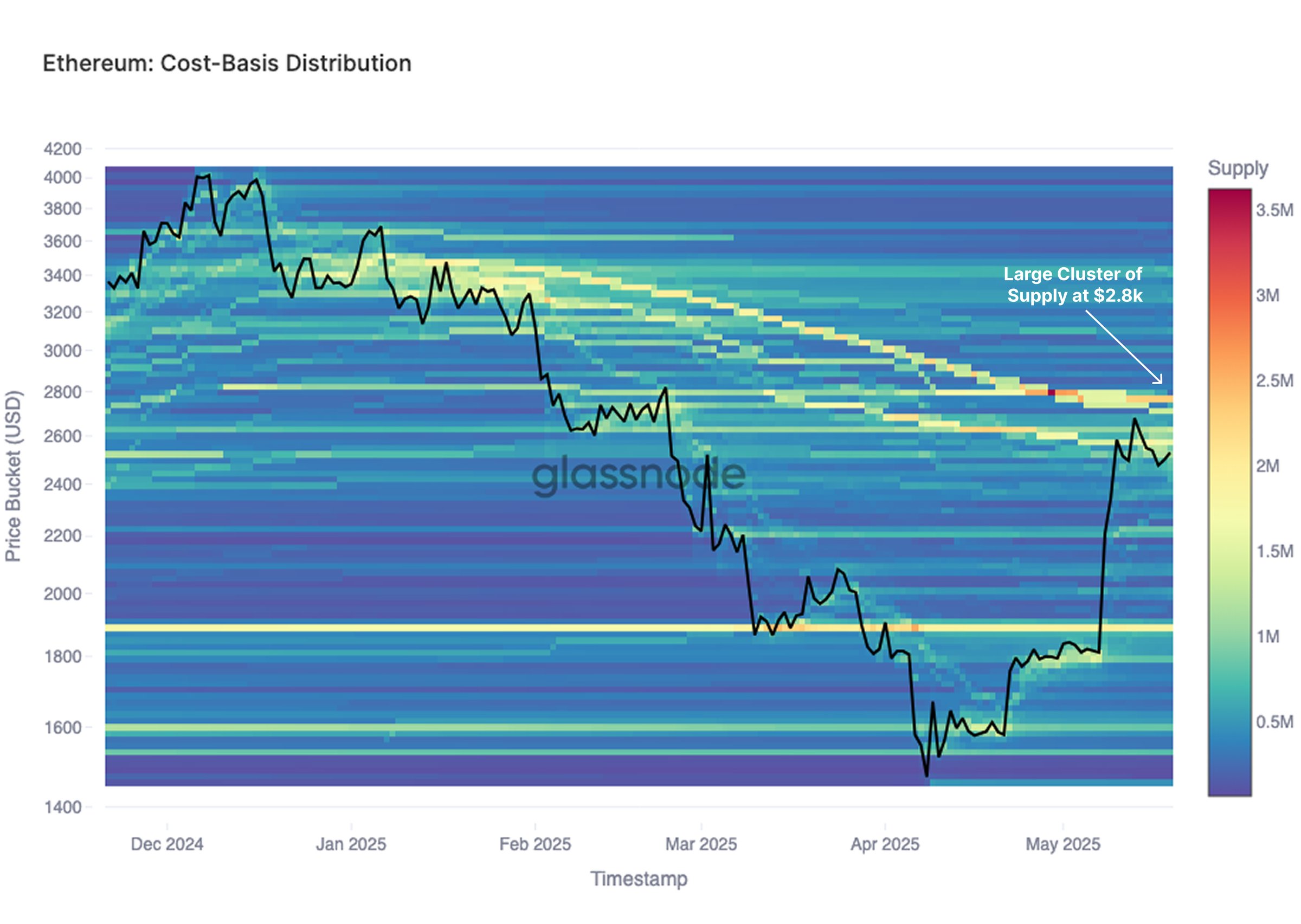

In a May 24th post on X, blockchain analytics firm GlassNode shared fresh on-chain insights into Ethereum price movement over the past few days. According to Crypto Platform, the next most important level of ETH prices is around $2,800.

The rationale behind this on-chain observation is the cost basis distribution of ETH supply. The relevant metric here is the cost-based distribution (CBD). This reflects the general ethical supply held by an average cost-based address within a certain price range.

Source: @glassnode on X

As shown in the chart above, CBD metrics use heatmaps at fixed price range levels (vertical axis) for a given period (on the horizontal axis). This metric provides insight into investor cost-based trend shifts over a specific period.

GlassNode noted that there is a significant cluster of investor cost-based distributions around the $2,800 Ethereum price level. Essentially, this means that some investors have acquired coins around this price area.

Going further, GlassNode explained that Ethereum prices could witness significant seller pressure as they approach around $2,800 on the CBD cluster. This phenomenon is based on several previous trends in underwater investors, making it appear as if they offload their assets near the break-even point.

This on-chain revelation explains why Ethereum has faced a denial of over $2,700 over the past few weeks. For the second largest cryptocurrency to surpass this supply barrier, ETH demand around CBD clusters must exceed sales pressure.

Ethereum prices are at a glance

At the time of this writing, the Ethereum token was valued at around $2,0, reflecting a decrease of less than 1% over the past 24 hours.

The price of ETH on the daily timeframe | Source: ETHUSDT chart on TradingView

ISTOCK featured images, TradingView chart

Editing process Bitconists focus on delivering thorough research, accurate and unbiased content. We support strict sourcing standards, and each page receives a hard-working review by a team of top technology experts and veteran editors. This process ensures the integrity, relevance and value of your readers’ content.