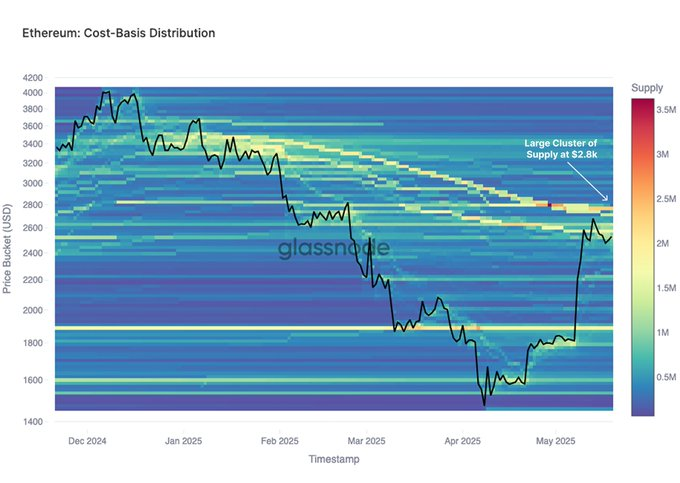

Ethereum’s recent upward climb has become a serious obstacle this week around the $2,800 mark. Fresh on-chain data from GlassNode suggests that the spot is a major supply zone, a major supply zone where many investors who bought before the recession in March and April are now approaching breaking evenly or seeing profits. This means that these traders can sell their activities as they resolve risks or simply cash out.

There is a prominent cluster at an investor cost-based level of about $2,800 for $ETH. As prices approach this zone, it can increase the pressure on the seller side, as many previous underwater holders may appear to take risks near the break-even point. pic.twitter.com/ukn2s7cojo

– GlassNode (@GlassNode) May 24, 2025

Looking back from December 2024 to May 2025, Ethereum (ETH) fell from over $3,800 to nearly $1,600. The recovery ride since then has managed to undo ETH in its crucial $2,800 neighborhood. According to GlassNode’s heat map, the latest cost-based distribution shows a lot of wallet activities. The maximum concentration in this heatmap clearly flags this $2,800 region as a dense supply zone, indicating a potential price cap unless there is a strong wave buying punches through resistance.

GlassNode: Benefits Turning to the $2,800 Zone, packed with ETH Long-Term Holders

During the first quarter of 2025 market slump, on-chain data shows that Ethereum wallet activity has shifted significantly to a lower price range. Supply density has been strengthened between $1,600 and $2,000. This is the extent to which served as a solid ground for Ethereum’s rebound in May. This accumulation period may have placed a temporary floor under prices, but that $2,800 level is approaching a large cap where ETH has not yet been decisively broken.

If Ethereum can actually push this $2,800 mark away with a critical, sustained volume, then it can invert the previous resistance level to the new support. Otherwise, continuing to bump into this heavy supply band could lead to new profit acquisitions or rounds of defensive sales from neural holders.

Related: Ethereum (ETH) indicates “golden cross”. Analysts will see a price target of $3,000

Cryptoquant: Ethereum Active deals with rising lag prices

Adding another layer to the photo means that Ethereum’s recent price rise does not match the proportional jump of daily active address activity. Cryptoquant data shows that, as of May 2025, ETH is back to around $2,500, while the number of active addresses is hovering to nearly 340,800. That figure is slightly up from the 300,000 sub-level seen at the beginning of the year, but far below the addressing activity spikes observed in late 2023 and early 2024.

Source: Cryptoquant

Historical trends often show that a significant increase in active addresses is closely related to general price gatherings or signal local tops. The current divergence here is highly appreciated, but it suggests that existing participants could be the main engine behind Ethereum’s latest price transfer rather than a fresh wave of new user adoption.

Recent ETH Price Dip highlights the ceiling strength of $2,800 resistance

As this report summarizes, Ethereum prices fell 3.46%, trading at $2,567.78. This is a decrease of over $100 from the previous day’s height. On top of this, according to CoinMarketCap, trading volume actually rose 8.77% to $228.1 billion, while market capitalization fell to $309.9 billion. This volume jump along the price decline often reflects an increase in liquidity as sell orders hit the market, which can lead to a halt order.

The inability for Ethereum to exceed $2,600 in this recent move highlights how important the $2,800 resistance area is. Without a clean, decisive breakout on top of that heavy supply zone, traders should expect a presumably short-term price tick to stick.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.