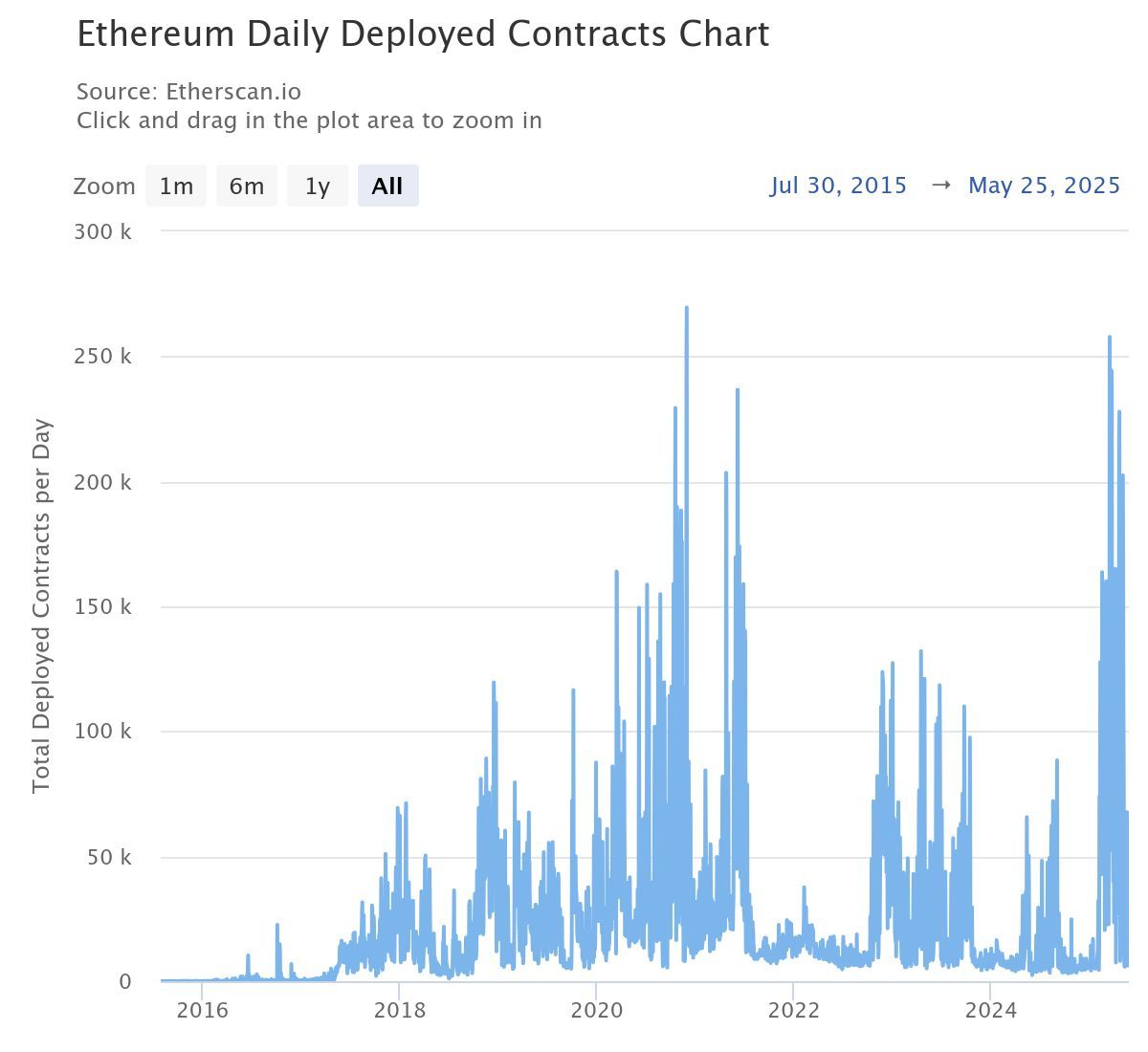

In 2025, Ethereum (ETH) experienced a significant surge in smart contract deployment activities. The number of contracts unfolding every day has reached levels not seen since 2021.

This marks a powerful revival of the Ethereum ecosystem, one of the world’s leading blockchain platforms. It also strengthens bullish forecasts for ETH prices and raises questions. Will Ethereum be able to retrieve the highest ever since 2021?

What drives Ethereum to $10,000?

According to Etherscan data, the number of smart contracts deployed daily on Ethereum has been rising sharply since the beginning of the year. The chart shows that in the first quarter of 2025, ETH reached its highest level of daily development since 2021, the highest ever ever, with ETH above $4,800.

This surge in the first quarter was largely anticipating an upgrade for Pectra. Furthermore, the number of smart contracts is increasing, reflecting the rise in Ethereum utilities, which increases demand for ETH.

Ethereum Daily Deploymed Contracts. Source: Etherscan

However, ETH prices do not fully reflect this positive trend. It fell from $3,700 to $1,400 before recovering at the time of writing.

Despite prices lagging behind the growth of smart contracts, Crypto Investor Ted remains optimistic. He believes ETH could soon surpass the 2021 high.

“Ethereum’s daily contract development has hit a level not seen since the Bull Run in 2021. Builder activity is rising and a clear signal that on-chain momentum has returned. Prices continue to the basics.

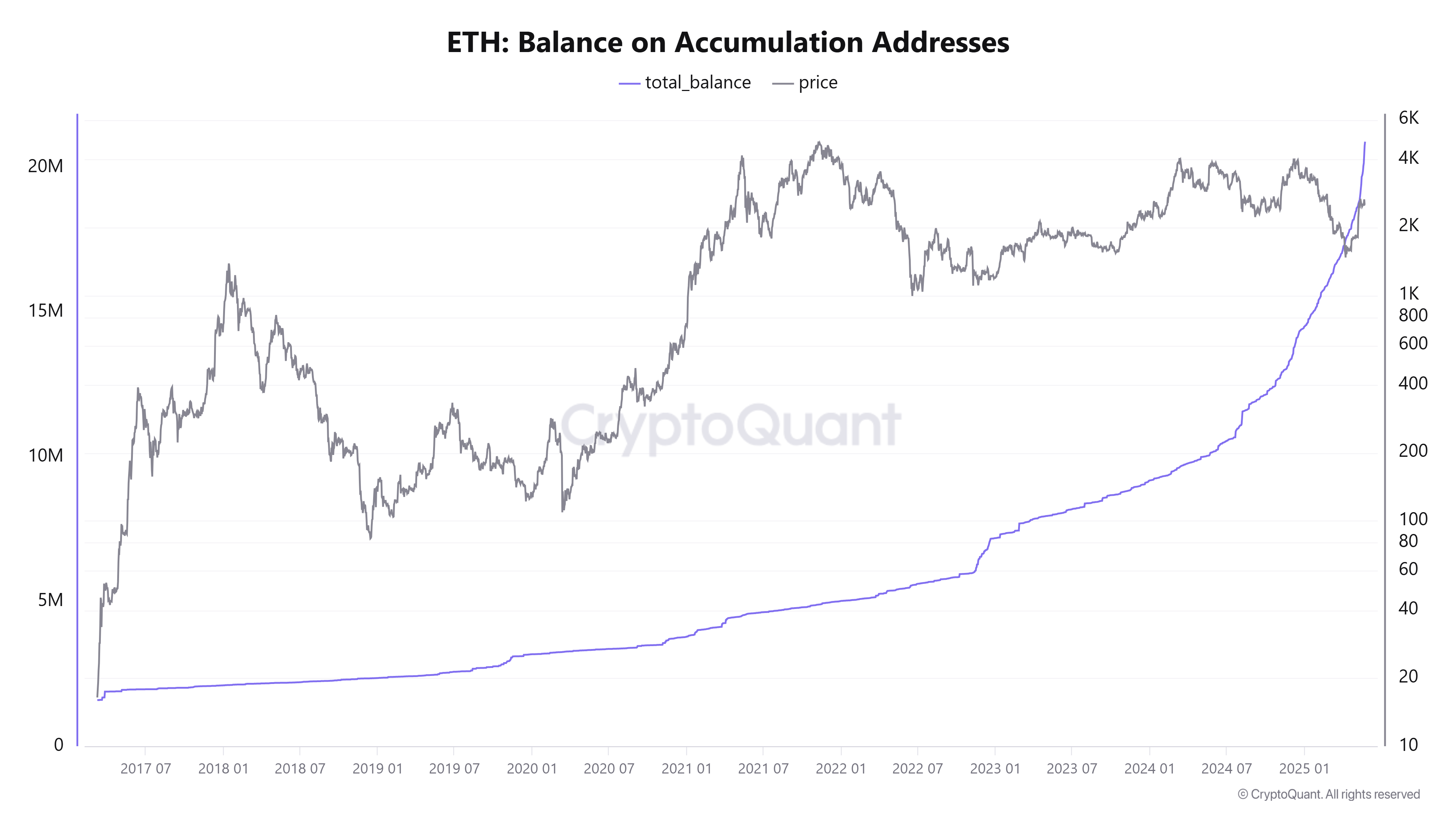

At the same time, Cryptoquant’s data is even more optimistic. The amount of ETH flowing into the storage wallet has hit a record high. These wallets usually belong to large investors, also known as “whales.” The increased influx suggests strong long-term trust in the potential of ETH.

As a result, the ETH balance in the accumulation wallet reached a new high, namely 21 million ETH, or 17.5% of the circulation supply. In 2025, the upward trend on this chart highlights strong ETH demand.

ETH balance of accumulated addresses. Source: Cyptoquant.

The record highs of smart contract deployment and ETH accumulation reinforce the view that Ethereum appeals to developers and investors despite the volatile crypto market.

Past price performance suggests a short-term return of $4,000

Analysts also make bullish price forecasts based on ETH chart patterns.

Analyst Cas Abbe used a two-week Gaussian channel indicator to assess Ethereum price trends. By comparing past price behaviors, Abbe predicts that ETH could reach $4,000 in the third quarter of 2025.

Ethereum prices and 2 weeks of Gauss channel. Source: CasAbbé

“ETH is trying to regain its 2W Gaussian channel. ETH has only recovered this channel twice since 2020. Both have gathered together strongly. In 2020, ETH rose from $300 to $4,000. In 2024 it rose from $2,400 to $4,100.

Another important factor is the performance of ETH compared to Bitcoin (BTC) in 2025. Coinglass data shows that ETH above BTC in Q2 shows. Currently, ETH’s Q2 return is +40%, while BTC’s return is +33%.

Historical Coinglass data also reveals that ETH exceeds BTC in normal Q2. ETH’s average second quarter returns are 64.22% compared to BTC’s 27.30%.

However, recent chain analysis from Beincrypto highlights the growing attention of investors. Many investors are facing profits after ETH has rebounded more than 80% since the beginning of last month. This sales pressure could be across the road to higher price levels for ETH.