Galaxy Digital has withdrawn a large amount of Ethereum through an OTC transaction and forwarded it to addresses reportedly linked to whales and facilities.

This is because Ethereum (ETH)’s price consolidated at $2,626.51, reflecting a mere 0.64% increase over the last 24 hours.

According to LookonChain, Galaxy Digital’s commercial (OTC) wallet has withdrawn 89,000 ETH from the exchange. The withdrawal worth around $234 million has attracted market attention. However, the transfer did not stop.

Apparently the whale/facility purchased $108,278 ($283 million) through the OTC.

The Galaxy Digital OTC wallet has withdrawn $89,000 ETH ($233.5M) from the exchange for the past 12 hours, then transferred $108,278 ETH (283mm) to Whale/Facility Wallet 0x0B26.

Wallet 0x0b26 currently holds …pic.twitter.com/bgqilh2xlh

– lookonchain (@lookonchain) June 4, 2025

Galaxy Digital has since facilitated an additional OTC transaction of 108,278 ETH worth around $283 million. This transaction occurred in multiple batches of 44,000, 50,000, and 14,278 ETH, and was then moved to another address.

Go to whale address

Following the OTC transaction, these Ethereum possessions have been transferred to a new address: 0x0B26. this address It currently holds a total of 139,476 ETH, worth around $365 million. According to Lookonchain, the address can be owned by whales and facilities.

This transfer illustrates a substantial accumulation of Ethereum, especially given the substantial value of the assets involved. Typically, whales and agencies add large quantities of Ethereum, which usually indicates a potential long-term holding strategy. This can increase rarity and increase asset prices due to lower sales pressures.

Over the past few weeks, Galaxy Digital OTC addresses have been forwarding large amounts of Ethereum (ETH) to exchanges such as Coinbase and Binance through multiple transactions. In particular, these transfers occurred during April at several stages throughout April, including transactions such as 4.4K ETH ($7.86 million), 5K ETH ($893 million), and 5.5K ETH ($9.83 million) to the Coinbase Exchange. These happened around April 28th.

ETH prices fell in early April, followed by a stagnation of around $1,800 when these transactions took place. However, as transactions began to move to individual addresses, ETH prices began to gain momentum and eventually spiked above $2,500 by mid-May. Nevertheless, this may be a coincidence.

Significant leaks from exchanges

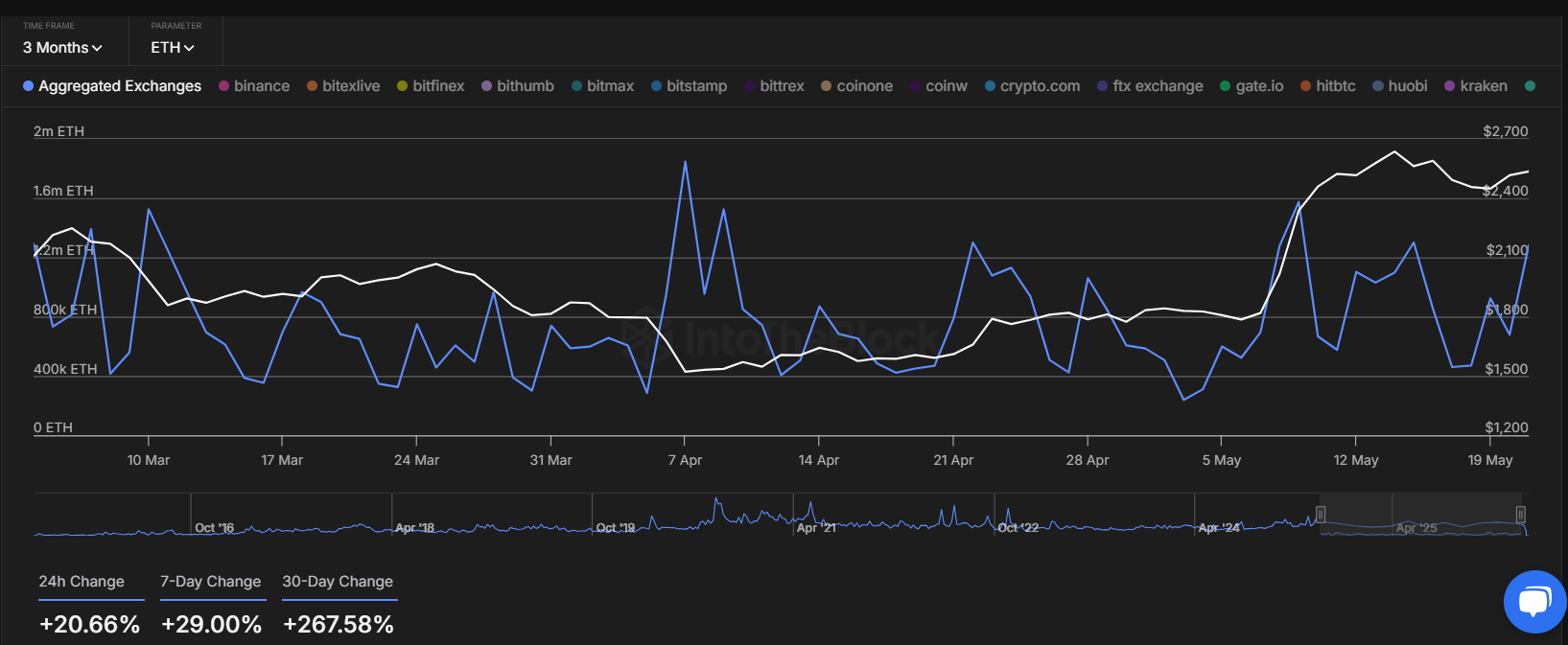

Intotheblock data further confirms that the exchange has experienced a significant outflow of Ethereum.

Ethereum Exchange leak

The flow of funds from the exchange has increased significantly, with 20.66% of the 24-hour change, 29.00% for the 7-day change, and 267.58% for the 30-day change. This rise in the outflow suggests a major change as investors appear to be moving their assets off the centralized platform.

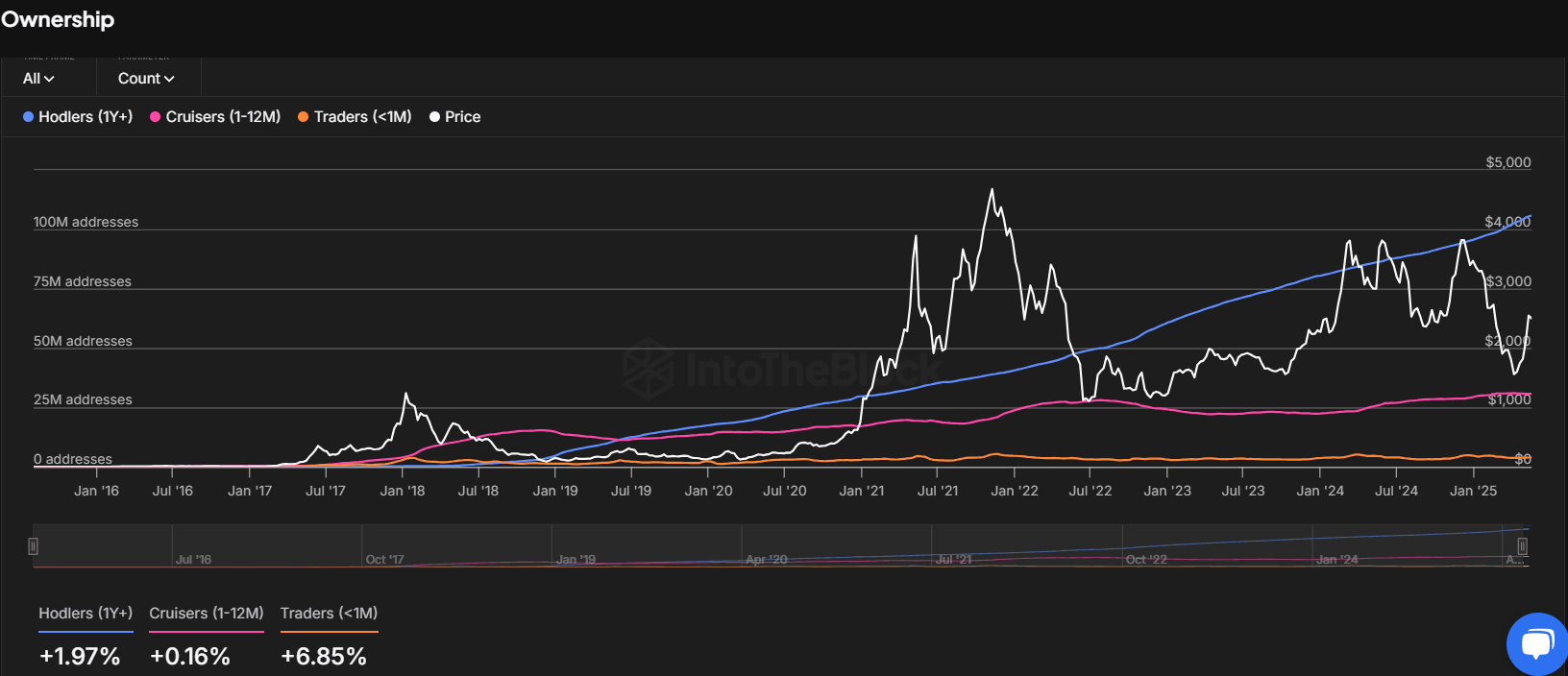

Changes in Ethereum ownership across the wallet

The data also shows a significant change in Ethereum ownership among different types of investors. Percentage of Ethereum Addresses that have held ETH for more than a year have increased by 1.97%.

Ethereum address at each time of the event

Meanwhile, medium-term investors who held ETH between one month and one year saw a slight increase of 0.16%. In contrast, short-term speculators who held ETH in less than one month experienced a more significant 6.85%. These moves reflect a wider change in investor behavior, especially as they focus on long-term holdings.

Large institutions are also accumulating ETH

In addition to these wallet trends, prominent institutions have shifted their focus from Bitcoin to Ethereum. For example, Black Rock is gradually Liquidation That Bitcoin supports Ethereum.

This shift has been observed over the past few days, with BlackRock moving 5,362 BTC, worth $561 million, earning 27,241 ETH simultaneously, valued at $69.25 million.