Bitcoin (BTC) has returned to near the $110,000 mark, up about 4.5% over the past seven days. The price has exceeded $105,000 in the last four days, reinforcing bullish sentiment in the market.

This stable performance comes amidst the pause of whale accumulation and powerful technical indicators such as bullish EMA alignment and limb cloud support. When BTC tests key resistance levels, traders will monitor closely to see if momentum carries or if the pullback is on the horizon.

BTC whales pause accumulation

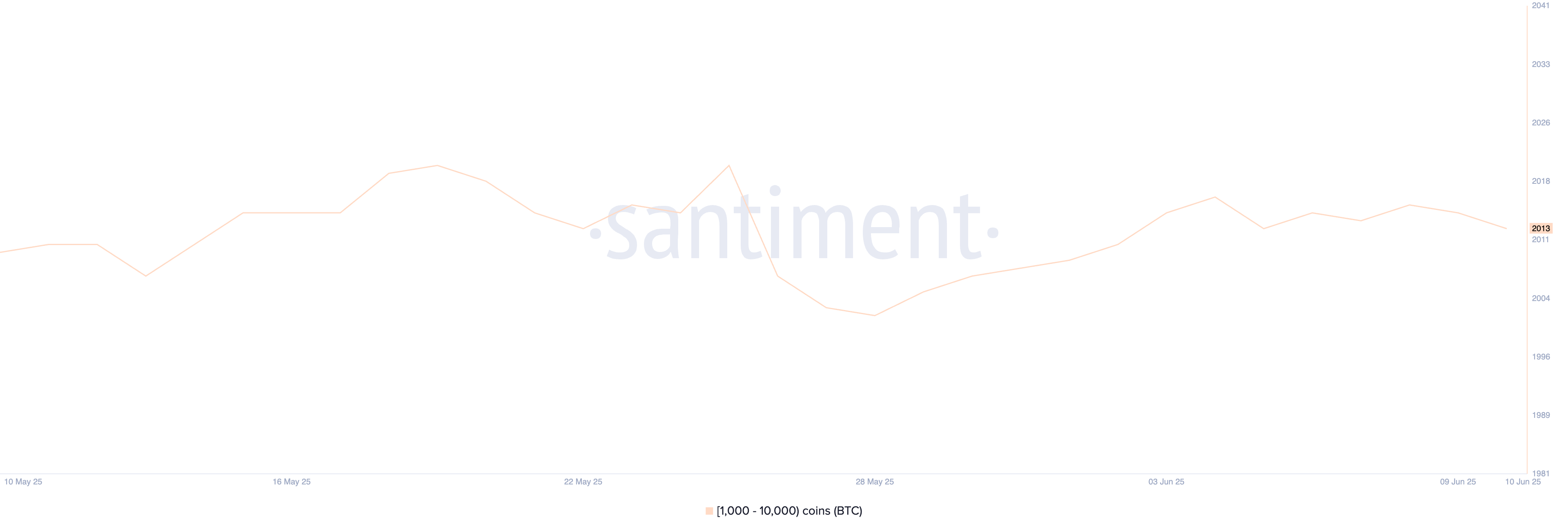

Between May 28th and June 4th, the number of Bitcoin Zilla wallets (1,000-10,000 BTC) increased from 2,002 to 2,017.

This short increase suggested renewed interest from large owners, often considered smart money. However, since then, the number of whales has been stable, hovering between 2,013 and 2,016 over the past week, with the current count sitting at 2,013.

This continuous lack of growth indicates a pause of positive accumulation, at least for now.

Bitcoin jelly. Source: Santiment.

Tracking the Bitcoin Zilla is important as its movement often precedes a major price shift. These large holders can influence market sentiment, create liquidity waves, and communicate institutional trust or attention.

Current plateaus in whale activity may reflect a waiting approach in uncertain macro or technical conditions.

While recent rises have suggested accumulation, subsequent stagnation suggests that whales may be hesitant to deploy more capital at current price levels.

Bitcoin stays above the clouds, but momentum slows down

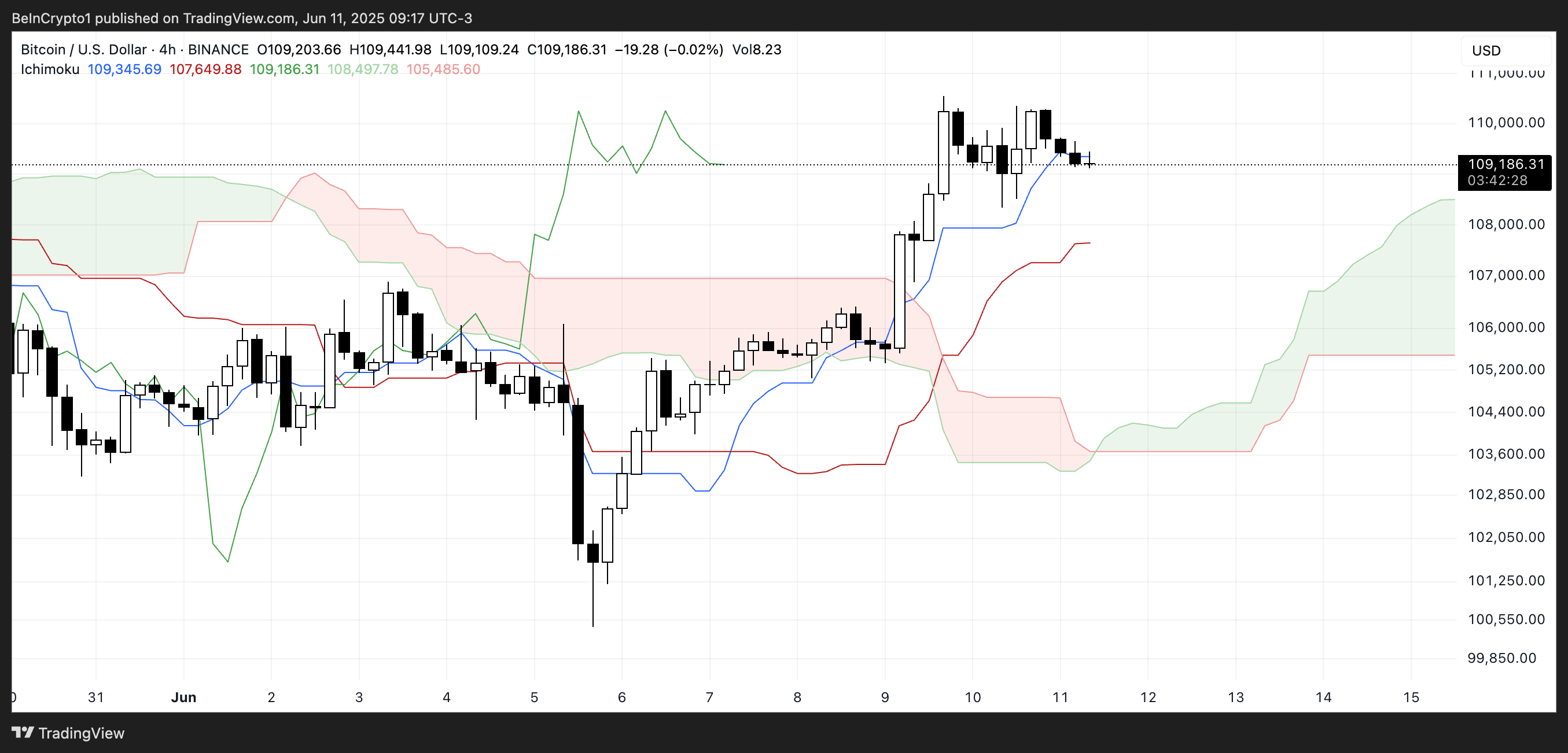

Bitcoin’s Ichimoku Cloud Chart shows price action above the green cloud, reflecting a bullish market structure.

The main span A (top of the cloud) is facing upwards, while the green color of the cloud ahead shows strong momentum. The cloud acts as a potential support zone.

A recent breakout from Red Cloud confirms that buyers have control over the post-merger.

btc icchimoku cloud. Source: TradingView.

The blue line (Tenkansen) remains above the red line (Kijunsen) and is another bullish signal that indicates that the short-term momentum is stronger than the medium-term trend.

However, both lines are slightly flattened, suggesting potential pauses or minor integration.

The green delay span (chikouspan) is placed above the price and clouds to enhance bullish bias. Still, convergence with current price measures suggests that drops under Tenkan-Sen should be paying attention.

BTC faces key support tests

Bitcoin’s EMA structure remains firmly bullish, with short-term EMA consistently and there is a healthy gap between them.

This alignment confirms strong upward momentum and suggests that the continuation of the trend remains intact unless it is destroyed.

As BTC prices approach the next level of resistance, breakouts above this level could pave the way for further profits and establish new short-term highs.

BTC price analysis. Source: TradingView.

However, there are still negative risks. If support fails near the $108,000 zone, BTC enters the fix phase and aims to gradually decrease the level of support.

A break below the $106,700 region opens the door to deeper retracements, with the $103,000 and $100,400 zones becoming potential targets with stronger downtrends.