The Sigil Fund is betting on Stablecoins, and Circle says it is the only investment in the market that will allow it to happen.

According to the Sigil Fund, Stablecoins are becoming mainstream, according to the Sigil Fund. On Tuesday, June 10th, Sigil Fund shared details of its investment in USDC Stablecoin Issuer. The financial company told investors it has already achieved a four-fold return on its $5 billion independent public investment investment.

“Sigil Core invested in the circle in July 2024, well before its public debut. On IPO day alone, this position provided a +9% profit for the fund’s NAV.

Circle IPOs have been a huge success, highlighting traditional investors’ appetite for the crypto business. The company began trading on June 4th at a share price of $31. By June 10, it had traded at $115.25 and recorded a 271% price increase within a week.

You might like it too: Circle’s star IPO fuel pro-shale and bitwise ETF filing tied to CRCL stocks

Why Sigil invested in circles

The Sigil Fund explained that investment in Circle is driven by a belief in the strategic importance of Stablecoins. According to the fund, stubcoin is the “crypto silent backbone” and is traditional finance (TRADFI) and distributed finances. Additionally, Sigil said that even major tech companies are investigating the possibility of issuing their own stubcoins.

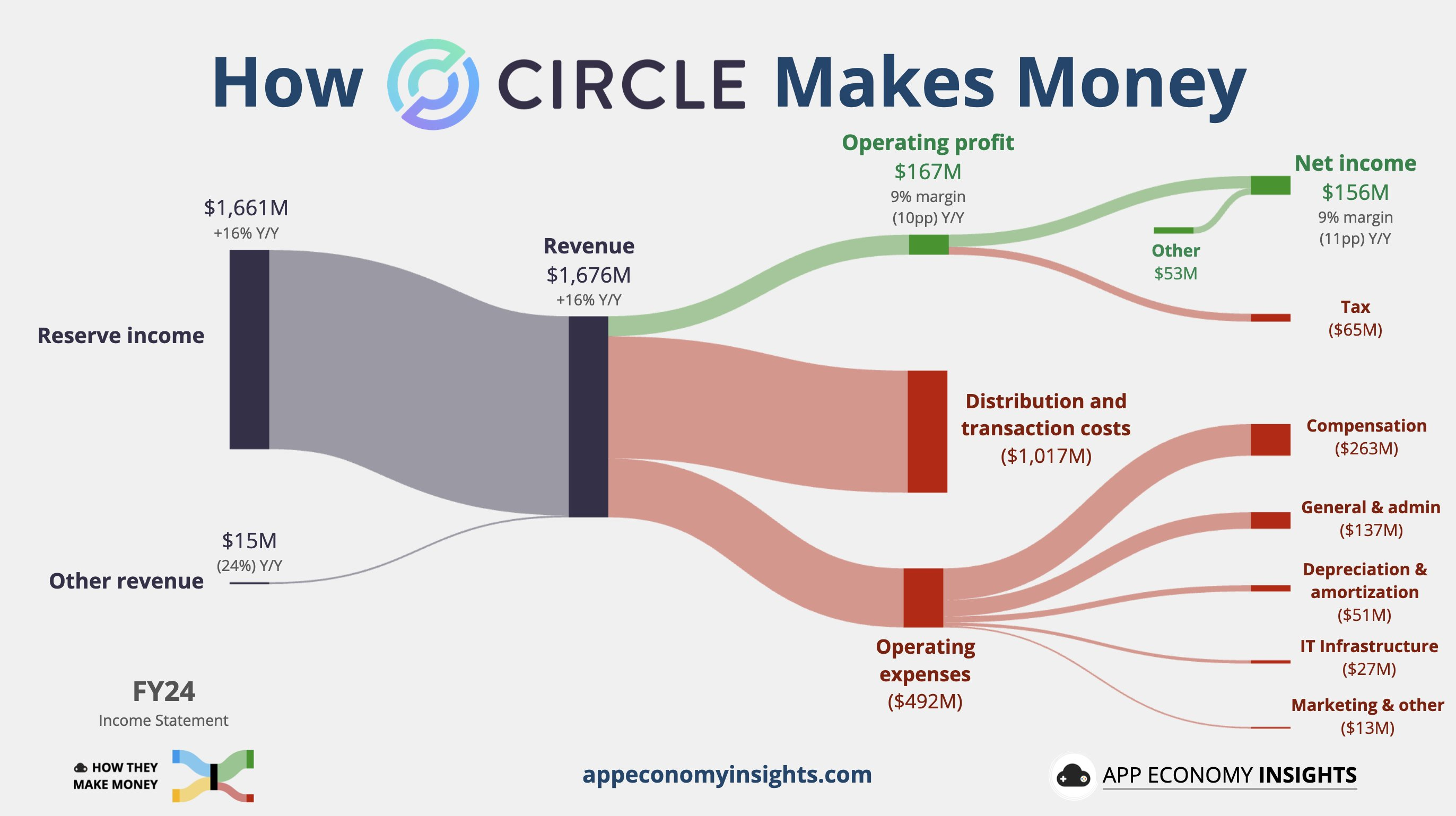

Chart explaining circle revenue, costs and profits | Source: x

Circle earns revenue primarily from reserves that support one-to-one retained property. These reserves are held primarily in short-term financial and repo agreements, both of which generate yields. As a result, the more problems with stubcoin circles, the greater the potential total revenue.

You might like it too: The Circle stock price could crash soon. Here’s why

Currently, Circle holds a reserve of $33 billion. This includes a $11 billion short-term Treasury Department and a $16 billion repo agreement. This structure generates a company’s net revenue of $1.46 billion. As USDC’s market capitalization increases, Circle’s revenue and profits will also increase.

According to the Sigil Fund, Circle remains the only “clean investable” option on the stock market due to its exposure to Stablecoins. For example, Tether, the largest Stablecoin publisher, is a private company. In other words, there are no tether stocks available for public investment.

read more: The weight of a duphold is calculated at an IPO or sale value of $1.5 billion or more