Ethereum (ETH) prices may be set for further gatherings, suggesting on-chain data and market activity could potentially rise by $3.40.

In particular, this can happen immediately if you are above the main support level. Based on this outlook, analysts and market observers are closely watching the recent whale movement.

ETF inflow and cost basis distribution are also observed for clues as to where prices go next.

The cost-based distribution shows an intensity of around $2,750

According to recently released data by GlassNode, Ethereum occurred over $2,700. This occurred when the 200-week moving average served as a key level of support.

For each update, the cost-based distribution shows 1.3 million ETHs held between $2.7000 and $2.740 and between 800,000 ETHs at $2.760.

Image Source: GlassNode for x

This level has been tested since March 2025, when $1,890 was considered a key price range.

It is essential to add that the chart also highlights that Ethereum (ETH) has experienced 53% green days in the last 30 days and volatility measured at 2.29%.

These signals are moderate, but show that the market is leaning towards stable profits rather than sharp swings.

Resistance was close to $2,832, but analysts believe that if it exceeds $2,750, the price could be triggered at $3,500.

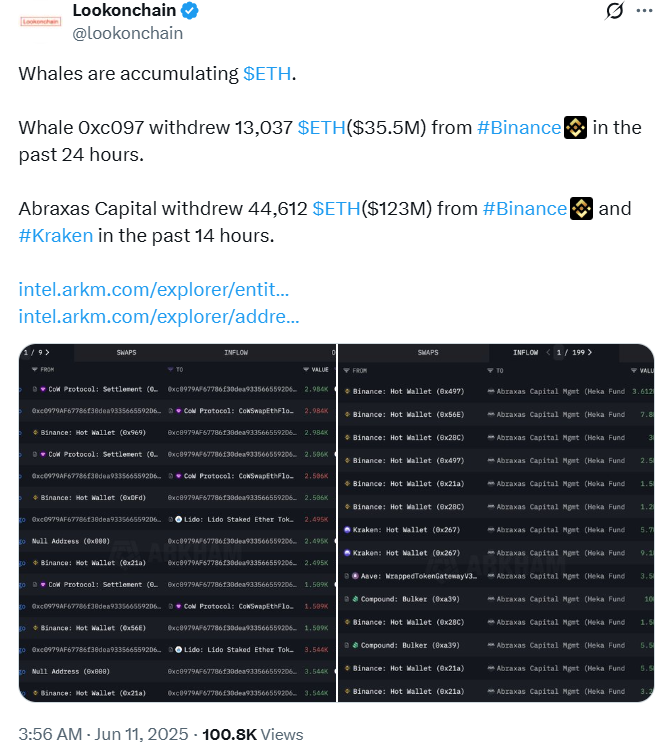

Furthermore, the whale movement adds weight to this outlook. LookonChain, for example, reports that in the last 24 hours, one wallet has withdrawn all funds worth around $35.5 million from Binance.

Image source: lookonchain for x

In a more aggressive move, Abraxas Capital collected 44,612 ETH, bringing it to about $123 million from Binance and Kraken over 14 hours.

This accumulation level suggests that large investors believe Ethereum (ETH) has a strong potential in the current price range.

Ethereum (ETH) ETF Market Log 14 Days Inflow

It is important to add that fresh momentum in the Ethereum ETF market is also boosting confidence.

According to Farside Investors, the Ethereum ETF had a 14-day influx streak.

Current data showed a net inflow of $125 million as of June 10th.

This streak drives Eta and Fidelity festivals primarily in BlackRock, accounting for more than 80% of net inflows since July 2024.

Grayscale ETH and Bitwise ETH recorded $9.7 million and $8.4 million on June 10th, respectively.

These inflows tighten supply. In particular, 70 million ETHs have already betted, following the live Pectra upgrade rollout at the beginning of the quarter.

Some market participants also believe that SEC’s recent approval of ETF options trading is contributing to the situation.

This approval has boosted investors’ confidence, especially among institutions, making Ethereum (ETH) one of the most powerful assets in terms of profits on the funds.

The outlook remains bullish, but support must be retained

According to current bullish outlook, the question is: Where can I find Ethereum prices?

Ethereum (ETH) prices are trading above the 200-day index moving average, appearing to form a bullish flag pattern.

At the time of this writing, market data shows that ETH prices were trading at $2,770.06, an increase of 2.28% over 24 hours. If the price goes above $2,870, the push to $3,500 could soon follow.

However, traders need to closely monitor key levels as Ethereum could potentially retest under $2,600 as they failed to maintain support of $2,750.

Benefits include sustained support, ongoing ETF interest and large accumulation, all could fuel the rally to $3,400 by mid-2025.

With strong support, lower sales pressures and institutional influx, Ethereum is well suited to swing this huge price.