After weeks of choppy price action, Ethereum is focusing on brewing volatility across the crypto market. ETH has been at a significant level recently, but the growing differences between price movements and open interest in futures have frowned upon.

As macro uncertainty eases and Altcoin’s story slowly returns to the spotlight, ETH is set for potential directional movements, but it remains to be seen whether it is an advantage or a drawback.

Technical Analysis

Shayan Market

Daily Charts

Ethereum continues to consolidate just below the $2,800 resistance zone after recovering its 200-day moving average yesterday. Prices are hovered within a narrow range, with the main resistance region sandwiched between the demand zones of around $2,800 and $2,500.

It also creates tight ascending channel patterns of less than $2,800. This is usually the inversion pattern if it breaks on the downside. However, a bullish breakout from this pattern could negate the inversion and add fuel to the potential rally.

The RSI chart also remains stable at the 60th level, indicating that there is still room for upward movement before assets enter the territory where they were acquired. However, without a compelling break of over $2,800, the move could be categorized as a range rather than a continuation of the trend.

If $2,500 collapses and the channels are split into negative aspects, deeper pullbacks to the $2,100-$2,200 disparity zone are increasingly possible, especially as resting fluidity is recovered.

4-hour chart

Zooming in on the 4H time frame reveals the price action of ETH within the ascending channel. This pattern formed after a nearly vertical impulse movement from the $1,800 area, leaving behind a prominent imbalance that was still unfulfilled. There is also a fair value gap formed around the $2,600 level, but it now serves as short-term support.

This area is key to the buyer’s defense if they want to preserve the current market structure. So far, assets have attacked the channel’s higher trendlines multiple times, but each retest has been reducing bullish momentum.

Furthermore, although RSI prints low highs, the prices are stable, suggesting that potential bearish divergence is being formed. If confirmed, this could return to the lower limit of the channel and even potential failures, sending ETH to a $2,350 liquidity pool and even deeper into an imbalance zone of about $2,000. For bullish breakouts, ETH must clear $2,800 in strength and continuity. Ideally, the meeting should be fueled by the volume and the flow of liquidation.

Emotional analysis

Shayan Market

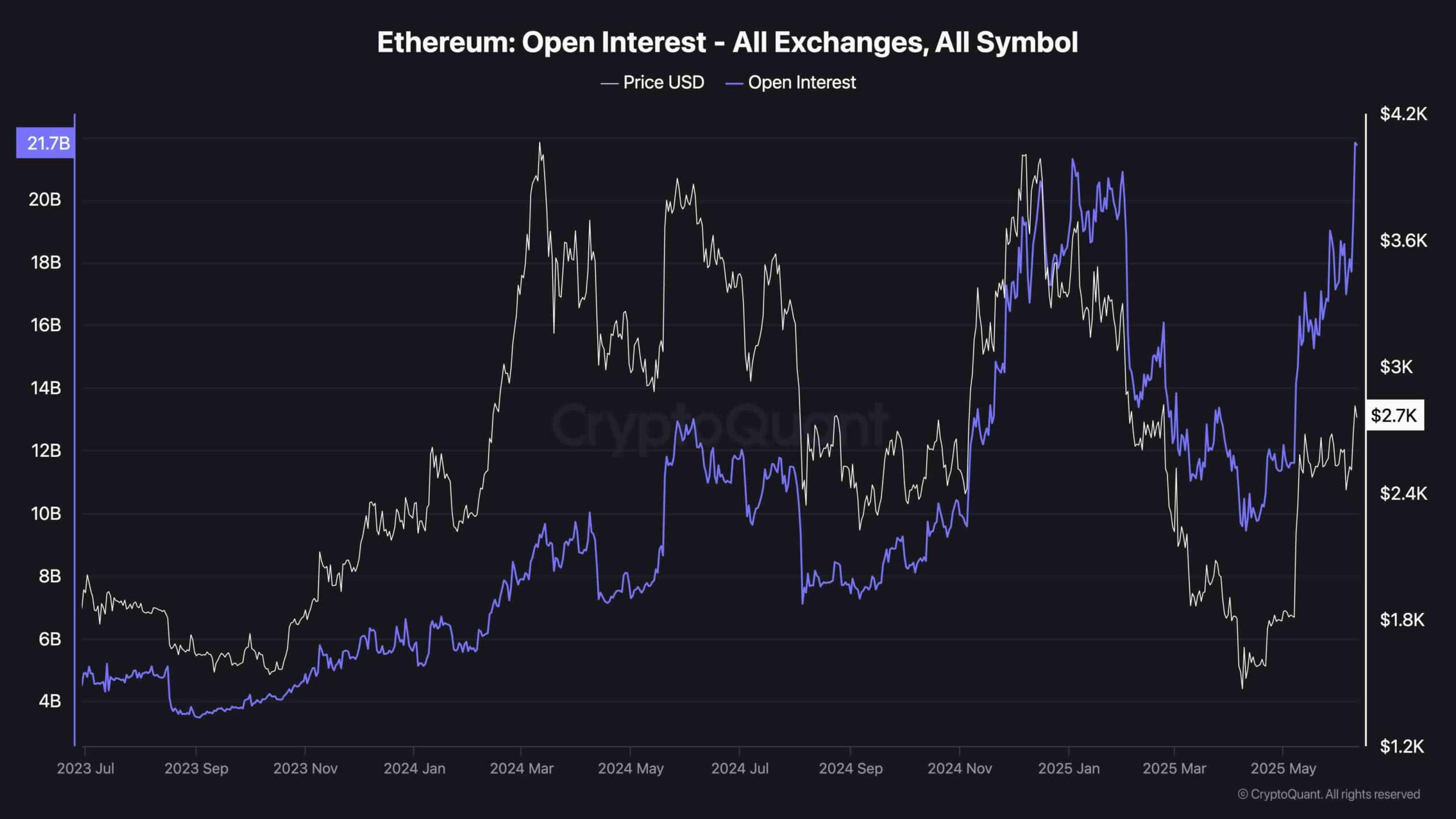

One of the most notable changes in recent years is Ethereum’s open interest (OI). As shown in the chart, the metric reached a new high of over $21.7 billion on all exchanges, despite the ETH prices still falling below the recent high.

This creates a clear divergence. The OI is actively climbing, but prices remain relatively calm. This type of divergence often precedes sharp volatility in the form of a liquidation flash or breakout aperture. Simply put, the market is largely located, but prices do not verify accumulation.

This scenario can lead to two outcomes: If ETH exceeds important resistance, heavy open interest can promote rapid short apertures and continuous rallies. On the back, if prices fail to regain $2,800 immediately and lose $2,500 in support, a long cascade of liquidation could begin, potentially wiping out the bullish leverage of recent years.

Traders need to be prepared for the expansion move quickly, as compression between OI and fixed rate increases and fixed rates is not sustainable. This is a volatility trap waiting for spring. Timing it right is important for short-term positioning.