DDC Enterprise is also known as DaydayCook, a published consumer brand focusing on wellness-driven dietary solutions. I said On Tuesday, we will secure a total revenue of up to $528 million to expand Bitcoin Holdings.

Capital is raised through a combination of stock investments, convertible memos, and stock credit lines.

The company’s fundraising packages registered with the NYSE include $26 million in equity investments from investors such as Animoca Brands, Kenetic Capital, QCP Capital, Jack Liu and Matthew Li, co-founder of Origin Protocol.

The second component is a $300 million convertible security note facility, both of which are $2 million private equity arrangements led by institutional investment firm Anson Funds.

DDC Enterprise has secured a $200 million share credit line with the Anson fund to buy Bitcoin. DDC plans to use virtually all of the proceeds from these funding to acquire Bitcoin.

“Today is a critical moment for DDC Enterprises and shareholders. This capital commitment of up to $528 million, backed by respected institutions from both traditional financial and digital asset frontiers, represents a strong mission to implement ambitious Bitcoin accumulation strategies around the world.

The multi-brand Asian cuisine company first bought Bitcoin late last month and acquired 21 BTC. Since then, the Bitcoin Treasury has grown to 138 BTC, and is now worth around $14 million based on market price.

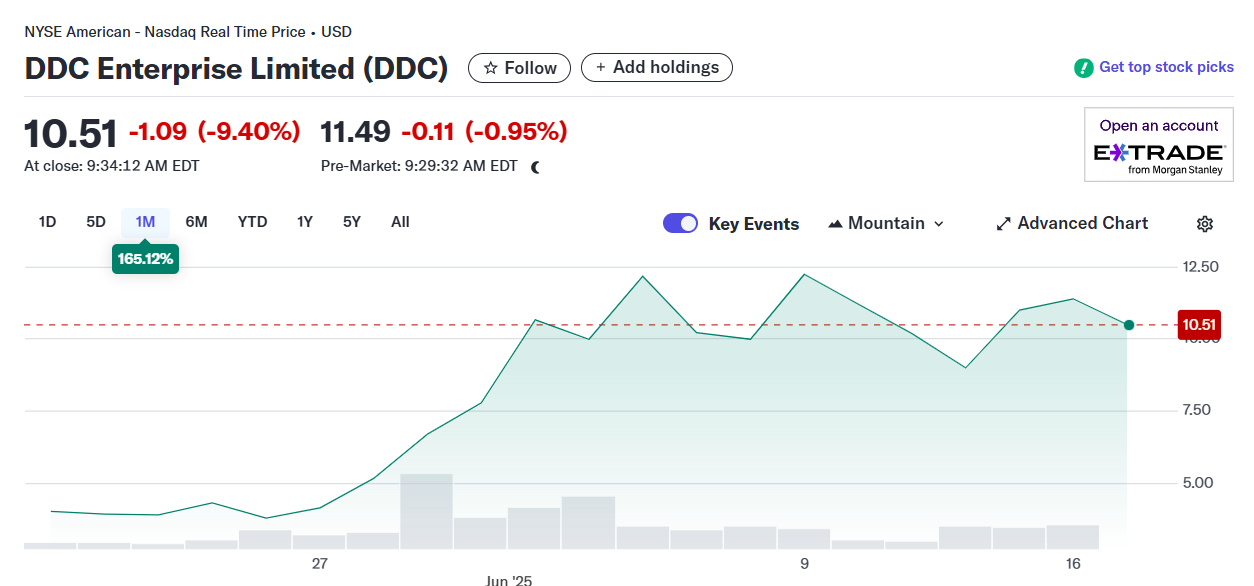

According to Yahoo Finance, DDC Enterprise stocks have skyrocketed about 165% over the past 30 days data. However, since New York’s debut, stock prices have fallen by about 95% from the initial trading level.