Bitcoin (BTC) is knocking on a historic short-squeezed door.

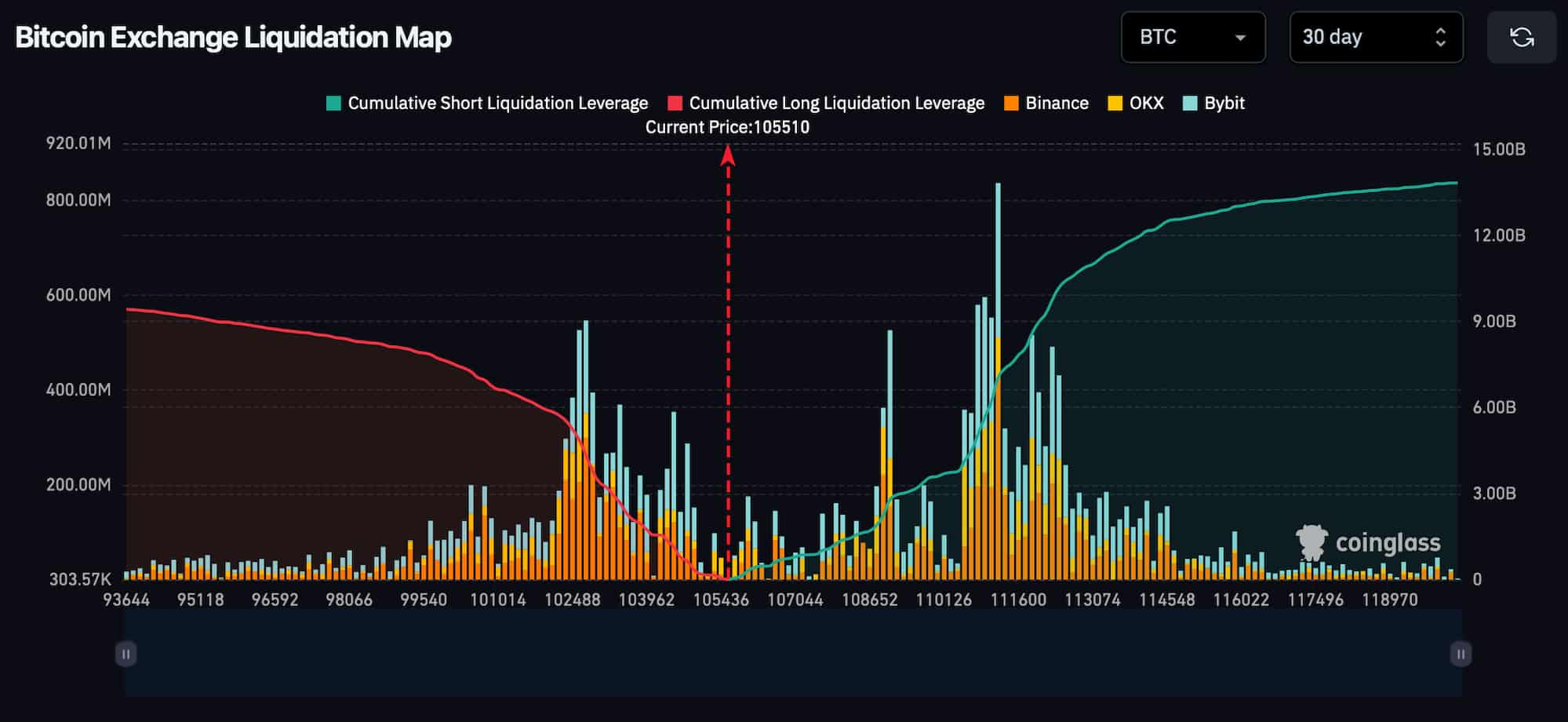

Digital asset transactions are over $105,500, with leveraged short positions worth $13 billion hanging in threads across major exchanges such as Binance, Bybit and OKX.

Liquidation Heatmap doesn’t lie. If Bitcoin surged beyond $118,000, we could witness one of the biggest mass liquidation in the history of the crypto.

Charts are decomposed when leveraged locations are most concentrated and, more importantly, when they are the most vulnerable. On the right, the rising green curve represents a short clearing leverage.

What makes this set up particularly dangerous for shorts is how the green line gets steeper than $110,000. That sharp upward curve means that the growing leverage is slightly above current market prices. As BTC starts inching towards these levels, a chain reaction is triggered, trapping the late seller and turning Bitcoin upwards.

Simply put, this shows how much a trader is betting on Bitcoin. As BTC climbs, these short positions begin to bleeding. And if it climbs quickly? They are automatically forced to close by replacement. The process is called liquidation.

The settlement does not happen quietly. Once the shorts are closed, traders will need to buy Bitcoin to resolve the loss. That sudden burst of purchase adds fuel to the fire, bringing the price even higher and forces more shorts to close. It’s a vicious cycle for bears. This cascade effect is known as a short aperture, and the chart is currently flashing textbook setups.

It’s not just theoretical. I’ve seen it before in my past cycles. Is the 2020 breakout worth over $20,000? A similar mechanism. A $30,000 rally in early 2021? Same story.

Overview of Bitcoin Short Liquidation Leverage

To a beginner, this chart may seem intimidating. But here’s a simple point. It shows where leveraged traders are likely to be wiped out. And what’s at risk now is the bets on Bitcoin.

The fact that a short $13 billion exposure is overhead is a strong bullish signal. Not because that money guarantees an upward movement, but because it reveals how unstable the current positioning is. If catalysts emerge, such as ETF influx, macro mitigation, or more institutional headlines such as BlackRock, this movement could be explosive rather than gradual.

Featured Images via ShutterStock