Crypto Economy has fallen 1.08% in the last 24 hours, with a bearish atmosphere rippling through the space and Bitcoin touching a low of $102,220, bringing it back to $3.16 trillion. At the same time, tensions between Israel and Iran remained escalated as additional strikes were exchanged and marked the second week of ongoing conflict in the Middle East.

Edge Market: Trump Movement, BTC Skid, Lifting Liquidation

On Saturday, June 21, 2025, CNN reported a new strike in the ongoing clash between Israel and Iran. The outlet also said that US President Donald Trump is considering his next move, but many B-2 bombers have departed from Missouri Air Force Base.

CNN said the Israeli Defence Force (IDF) reported on Saturday that the Israeli Air Force had fired down three Iranian F-14 fighter jets. IDF spokesman Ephraim Defrin said the military also targeted radar detection systems and missile defense batteries in western Iran.

The publication further told reporters that Deflin told reporters that the action was part of a wider push to control the Iranian skies. US stocks concluded the week with a mixed bag of results as clouds of uncertainty hang overhead.

At Wall Street’s closure bell on Friday, the Nasdaq fell 0.51% to 19,447.41, the NYSE fell 0.16% to 19,868.36, and the S&P 500 eased 5,967.84 to 0.22%.

Meanwhile, the Dow Jones (DJIA) was tweaked up 0.08% to settle at 42,206.82. Gold has quietened despite its often rise amid geopolitical tensions. I slid 0.08% on my last day and just over 2% for a week.

Silver is also red, down 1.9% on Saturday and 0.82% over a week to $36.01 per ounce. The crypto market hasn’t escaped the darkness either. The space, valued at $3.16 trillion, is more than the full amount.

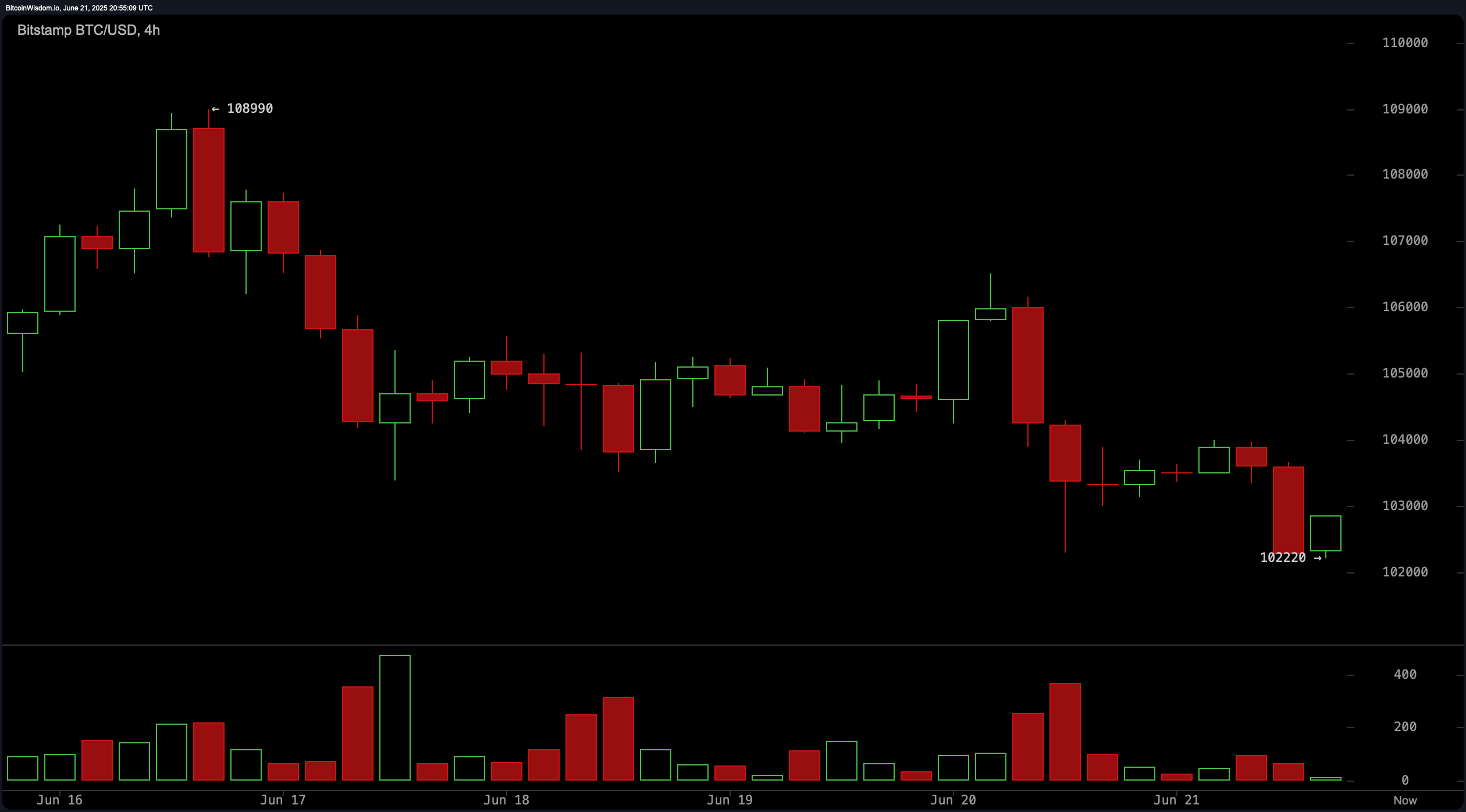

Bitcoin (BTC), the top digital asset by market capitalization, has slid to a Saturday low of $102,220, losing 1% in the last 24 hours. Over the course of the week, BTC has declined by 2%. Ethereum (ETH) took a more intense hit, falling 1.45% today and 4.5% on seven days of stretch.

BTC/USD chart via BitStamp on June 21, 2025. 4 hour chart.

Over the past 24 hours, approximately $190 million in crypto derivative positions have been wiped out. The advanced $4,257 million ETH Long achieved the same fate, but the Altcoins suffered a major sale during the same stretch.

A total of 92,899 traders have been liquidated, with the biggest single hit from HTX (an ETH-USDT position of $4.74 million). Meanwhile, after falling to $102,220 per unit, BTC is cruised at $102,635 per coin just before 5pm.

As global markets mix geopolitical tensions with investor jitter, traders appear to step carefully in all asset classes. Global conflict and the interaction of changing feelings led to codes, precious metals and stocks sailing through choppy waters.

As uncertainty persists, participants may be closely watching signals (political or financial) that could shape the direction for next week.