Ethereum (ETH) Price With it trading in a tough range of around $2,500, traders and investors wonder if the next move will go up or down? The possibilities can be revealed by analyzing daily charts, major resistance levels, and RSI signals ETH price target Potential breakout triggers.

Ethereum Price Forecast: Current Trends and Key Levels

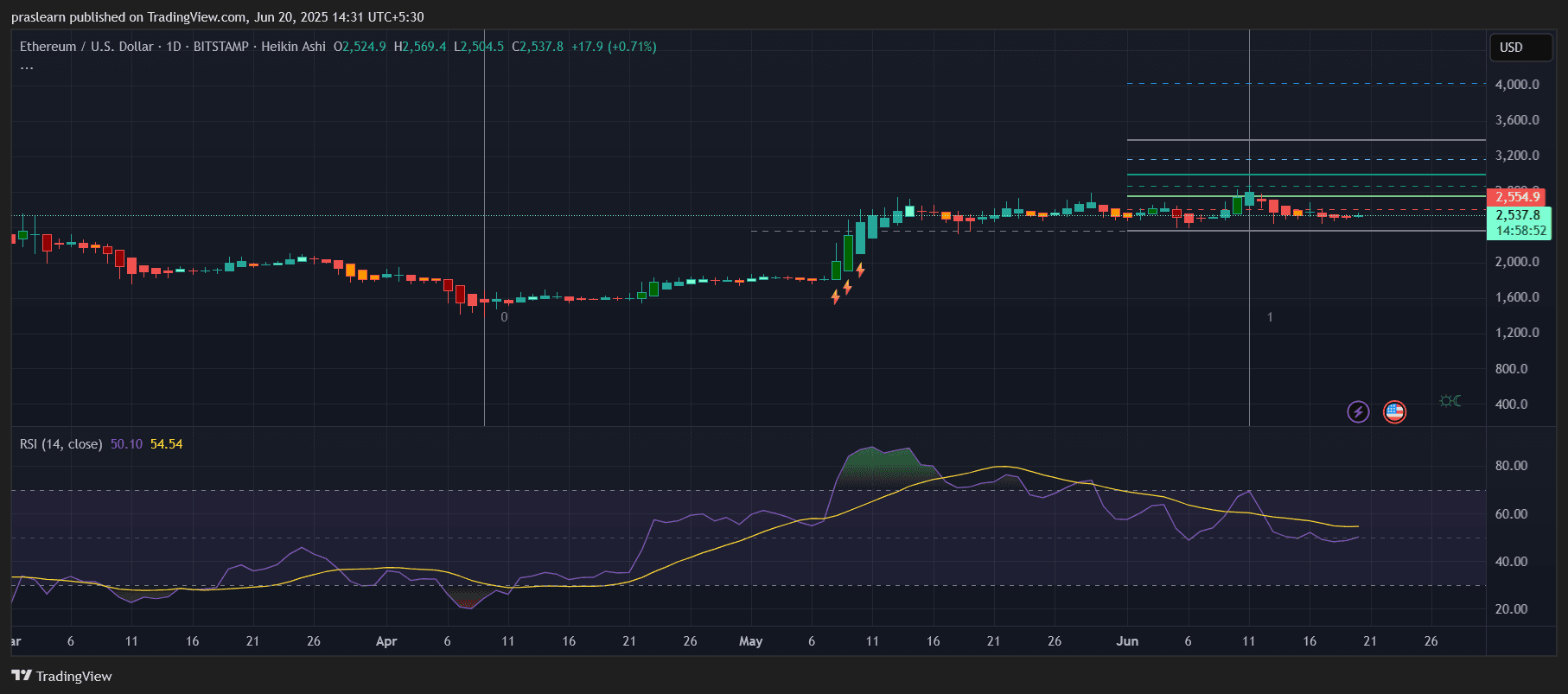

eth/usd daily charts – TradingView

As of June 20, 2025, Ethereum prices are traded at $2,537.80a little above 0.71% The day. It has been integrated for several weeks from a sharp meeting in early May.

- Main support: $2,420

- Immediate resistance: $2,554 (near today’s high)

- Main Resistance Zones: $2,800, $3,200, $3,600

- Psychological level: $3,000

This horizontal movement of Ethereum prices with small body candles in a narrow range is reflected Indecisive In the market, compression often precedes expansion. The hikin reed candle also shows a lack of strong directional bias.

The RSI is flat, but here’s why this is important

Relative Strength Index (RSI) Currently 54.54just above the neutral 50 mark. Although it is not an acquired territory, RSI has been on a downward trend since mid-May. This usually indicates a cooling period or integration before the next big move. If RSI rises above 60 and prices break $2,600 in volume, Ethereum prices could trigger a short-term rally towards $2,800.

Fibonacci forecasts show between $3,200 and $3,600

I’m using a recent swinglow $2,000 And the swing will be higher $2,950Applies Fibonacci expansion levels.

- 1.0 (100%) expansion: ~$2,950 (already tested and rejected)

- 1.618 extension: ~$3,600 – This is a strong long-term goal

- 0.618 Retracement Support: ~$2,420 – Current Floor

If the price of the ETH breaks above $2,950Movement towards $3,600 (1.618 FIB level) will be very realistic.

ETH Price Action: Accumulation before the explosion?

ETH price action has been formed Bullish integration patternfollowed by a strong impulse movement is a tight candle. This often serves as the basis for your next leg up. Current lateral movement reflects the accumulation stages that are historically seen before the failure.

Additionally, the volume remained low during the integration. This is another signal for the pending volatility spike.

Ethereum price forecast: What happens when ETH repeats its May rally?

In early May, ETH prices rose from $2,000 to nearly $3,000 – Increased by 50% In about 15 days.

If Ethereum prices move from the $2,500 base from its current base: $2,500 + (50% of $2,500) = $3,750. This matches well Fibonacci 1.618 Expansion It could serve as a zone and medium term top.

Could ETH reach $3,200-$3,600 over the next 30 days?

Unless the macroeconomic or crypto-specific sentiment changes dramatically, Ethereum prices retest $2,950 and appear poised to potentially spike $3,200 and $3,600. RSI, tough price action, and previous rally structures support this paper. However, if you can’t hold $2,420, your bullish setup will be disabled and you may send ETH back to it. Under $2,200.

Final thoughts

Ethereum prices are caught up in large moves, and the charts suggest that it could be a bullish breakout. Traders need to look closely $2,550~$2,600 range. The clean breaks mentioned above may provide a high-strength long setup, especially when confirmed with RSI momentum and volume. Leave a warning. ETH may not be able to settle for a long time.

$eth, $ethereum