Today’s Ethereum Price: $2,510

- Ethereum Network has steadily added nearly one million new addresses a week since May.

- The Genius Bill, which passed the Senate by 68-30 votes, is likely to serve as a catalyst.

- ETH can suffer from a strong failure if it cannot maintain the lower limit of key channels.

Ethereum (ETH) is trading around $2,500 in its early Asian session on Friday, despite a surge in new address growth over the past month. The development follows advances in digital asset regulation after the guidelines and establishment of national innovation as the US Stubcoin (genius) bill passed the Senate.

Ethereum’s new address surges amid advancements in stablecoin bill passages

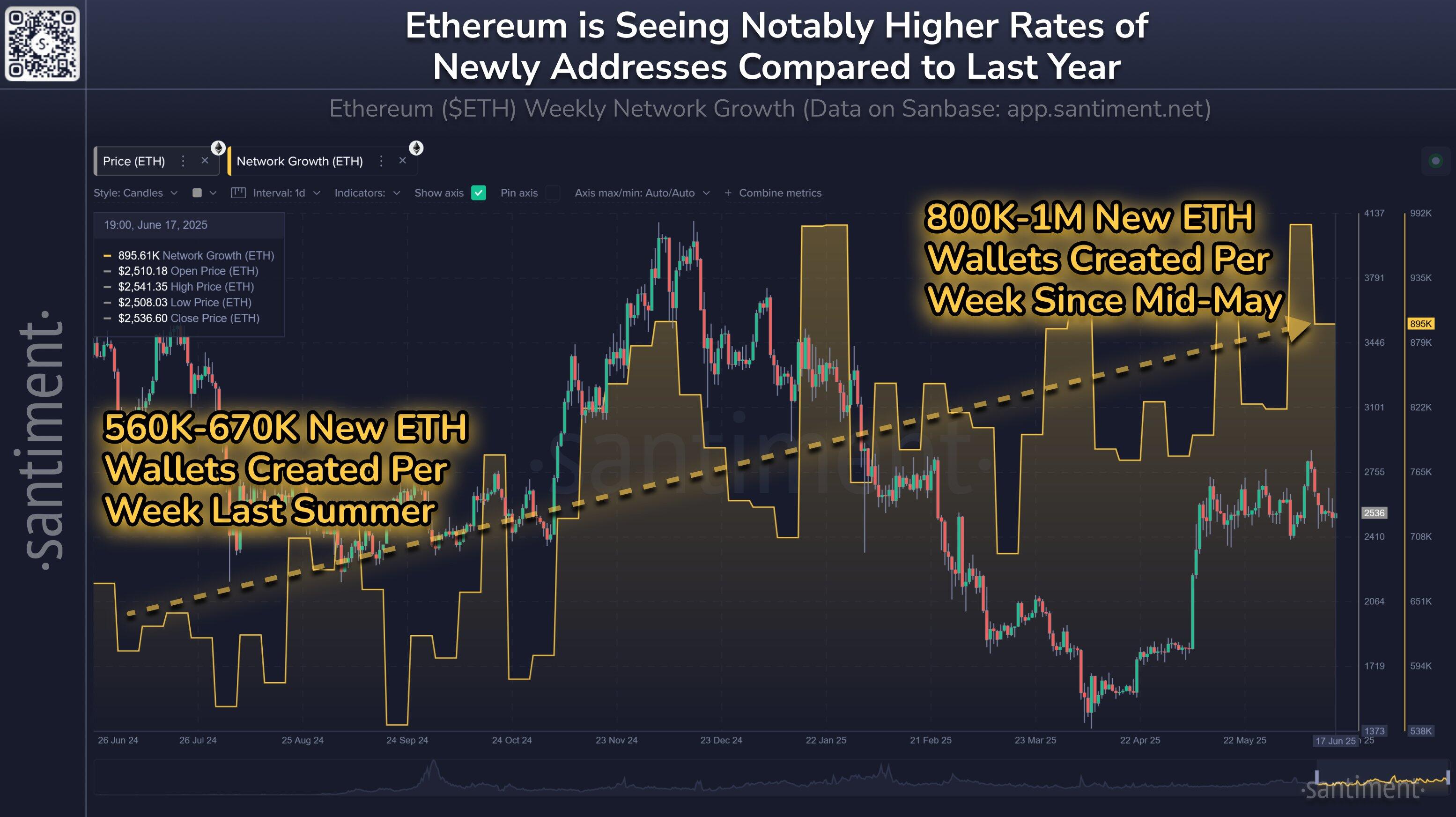

Santiment data shows that the number of new ETH addresses created in a week has increased over the past month, up about a third of the same period last year.

“The amount of new weekly ETH addresses created ranges from about 800k-1m per week compared to about a third less than this point last year,” Santiment analyst wrote in X-Post on Wednesday.

Address growth, particularly in the genius law, Stablecoin Bill, has passed the Senate with strong bipartisan support, following the positive developments surrounding the Ethereum ecosystem over the past month.

Growth of the ETH network. Source: Santiment

President Donald Trump has urged House Republicans to act “lightning” in moving forward to his desk the Senate-approved genius bill. He noted that lawmakers should pass the bill “as soon as possible” without further delays or adjustments.

“This is the best American sparkle, and we’re going to show the world how to win with digital assets like never before,” Trump said in a post on the truth about social media platforms on Wednesday.

The Senate passed the Genius Bill with a 68-30 vote on Tuesday, bringing the stablecoin Act closer to the finish line. House Republicans are expected to consider the law soon, with hopes among market participants that the bill will be passed before the August break. If passed, the Genius Bill would become the first crypto-related Congress to become law in the United States.

Most businesses and banks are already looking for it This effect There are notable examples such as Apple, Amazon, JP Morgan, and Morgan Stanley, who are exploring Stablecoin Solutions.

The Clarity Act, which aims to establish a broader regulatory framework for digital assets, has also contributed to growing interest in Ethereum. Bitcoin transaction. According to data from Defilama, Ethereum Layer 1’s Stablecoin’s market capitalization is over $126 billion, a steady increase over the past few weeks, showing a 50.2% advantage over other blockchains.

“This will start rebirth and turn blockchain into infrastructure, and become an infrastructure in which blockchain will become a global power-on, financial infrastructure and various other applications (social, logistics, supply chains, etc.) will be like the internet. fxStreet.

“ETH has long been performing because we were under regulatory purgatory. Now, it lifts everything up, so at some point in ‘Tech Play’ it’s very limited to value storage, global infrastructure like oil,” he added.

Ethereum price forecast: ETH must keep a lower bound on key channel to prevent strong failures

Ethereum According to Coinglas data, Futures has experienced a $16.59 million liquidation over the past 24 hours, with a long liquidation totaling $7.77 million and $8.82 million, respectively.

ETH continued to hold $2,450 in support at 38.2% as the 200-day Simple Moving Average (SMA) proved difficult to overcome Fibonacci Retracement. The levels are reinforced just above the lower bounds of the key channel due to the convergence of the SMA and exponential moving average (EMA) over 50 days.

ETH/USDT Daily Chart

As volume continues to decrease, ETH must maintain a lower boundary of key channels to prevent strong failures. Holding this level and maintaining movement above SMA for 200 days can potentially retest the channel’s upper limit resistance. However, failures below the lower boundary could send ETH to the $2,260-$2,110 range, and is enhanced by a 100-day SMA.

The relative strength index (RSI) and the stoch oscillator (Stoch) move sideways across neutral levels, showing slightly dominant bearish momentum.