It also withstands momentum signals. The relative strength index (RSI) sits at 69 near an excess level, but refers to continuing interest from the Bulls. The recent bullish cross on the moving average supports the possibility of being more upside down in the near future. These signs reflect strength rather than fatigue at this stage.

- The miner slowly transfers the coin into exchanges, suggesting nerves with more negative side movements.

- Prices still hold within bullish chart setups, but the lift requires a clean break of over $105,000.

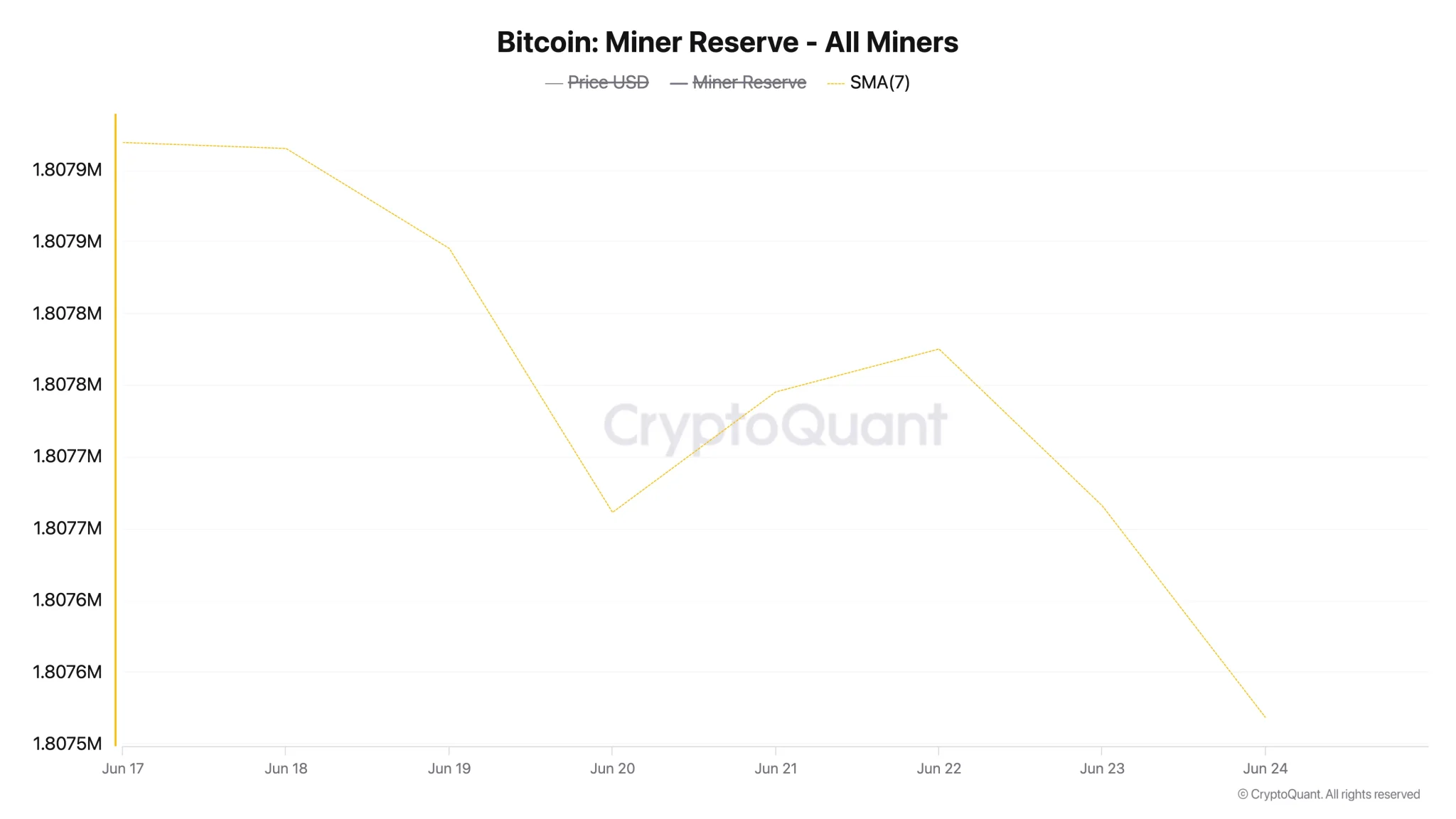

Bitcoin miners appear to show restraint, trimming exposure and bracing perhaps due to wider market weakness. Minor reserves tracking the amounts held by Bitcoin Miners have dropped just 0.022% over the past week on a seven-day average. Although small, this change suggests that some miners are leaning towards sales.

This shift refers to the decline in reliability, especially after Bitcoin fell below the $100,000 level during the last two trading sessions. That price acts as a psychological line for many, and drops through it can indicate an increased uncertainty across the market.

Source: Cryptoquant

Adding weight to this emotion is a sharp 55% spike in the miner’s position index (MPI) within three days. This metric compares the amount that Bitcoin miners send in exchanges against the average of one year. In general, an increase in MPI means miners are moving more holdings for exchange. Usually, they are indications that they are going to sell.

Market tensions grow as Bitcoin miners leave

Recent trends in MPI suggest an increase in sales activity, suggesting miners are confident in Bitcoin’s short-term performance. The shift in coins from wallets to exchanges shows the belief that prices will either go down even further or that they will not be able to gain upward traction for now.

However, some analysts retain a different view. Cryptoooelites expresses and says solid optimism,

If you think that the rally hasn’t come for Bitcoin, you probably don’t know anything.

Another market watcher, Analyst Jere, believes Bitcoin remains in a bullish pennant pattern. He said that the first breakouts from this type of setup are often deceptive. He said that once prices regain strength and exceed $110,000, they break by saying, “This will fly much higher.”

#bitcoin is back in bullish pennant!

Usually, using these patterns, the first breakout is fake. If prices turn back, a true breakout is right around the corner.

Above $110K, this is much higher.

Check out 👀pic.twitter.com/tislkcur8i

-Jelle (@cryptojellenl) June 24, 2025

Cup and Handle Targets $144K – Near Key Breakout

Bitcoin currently shows cup and handle patterns on its daily chart. This is a setup that traders often relate to upward movements. The price is traded within the handle section, with resistance sitting at $105,000. This level also coincides with a simple 50-day moving average. Nearby above it paves the way to $109,000, representing the patterned neckline.

Breaking $109,000 with a strong volume could pave the way for a retest of its May 23rd high of $112,000. If Bitcoin was closed on it, traders began monitoring all targets in the Cup Pattern at $144,000. This is about 37% above the current price.

Source: TradingView