Bitcoin mining networks could face difficult adjustments on the bottom for the first time in nearly four years. The difficulties could be reduced by 9% over the next five days. This will be the most sharpest since July 2021, when China’s mining ban caused a 50% collapse at the global hashrate.

Over the past two weeks, the total computing power to protect the Bitcoin blockchain has dropped by nearly 30%, according to data from Mempool.space.

GlassNode metrics show that the network hashrate is slightly below 700 exhaushes per second (EH/s) compared to the recent high of EH/s.

Today’s Bitcoin miners rely mostly on ASIC (application-specific integrated circuit) hardware. In the early years of network history, CPUs and GPUs were sufficient to mine coins. Profitability requires a custom built machine that consumes a significant power of over 7,000 watts and runs on a 220 volt system with high amperes.

Bitcoin Protocol re-adjusting the mining difficulty for every 2,016 blocks to maintain a block production rate of approximately 10 minutes. If there are few machines competing for block rewards, the network responds by reducing the difficulty of compensation. This time, the response is expected to be more pronounced.

Profitability Metrics Write Mining Stress

Data from encrypted contributor IT technology shows that Bitcoin miners are “very low wages.” Analysts say the market is floating in the stage of forced sales from the mining business.

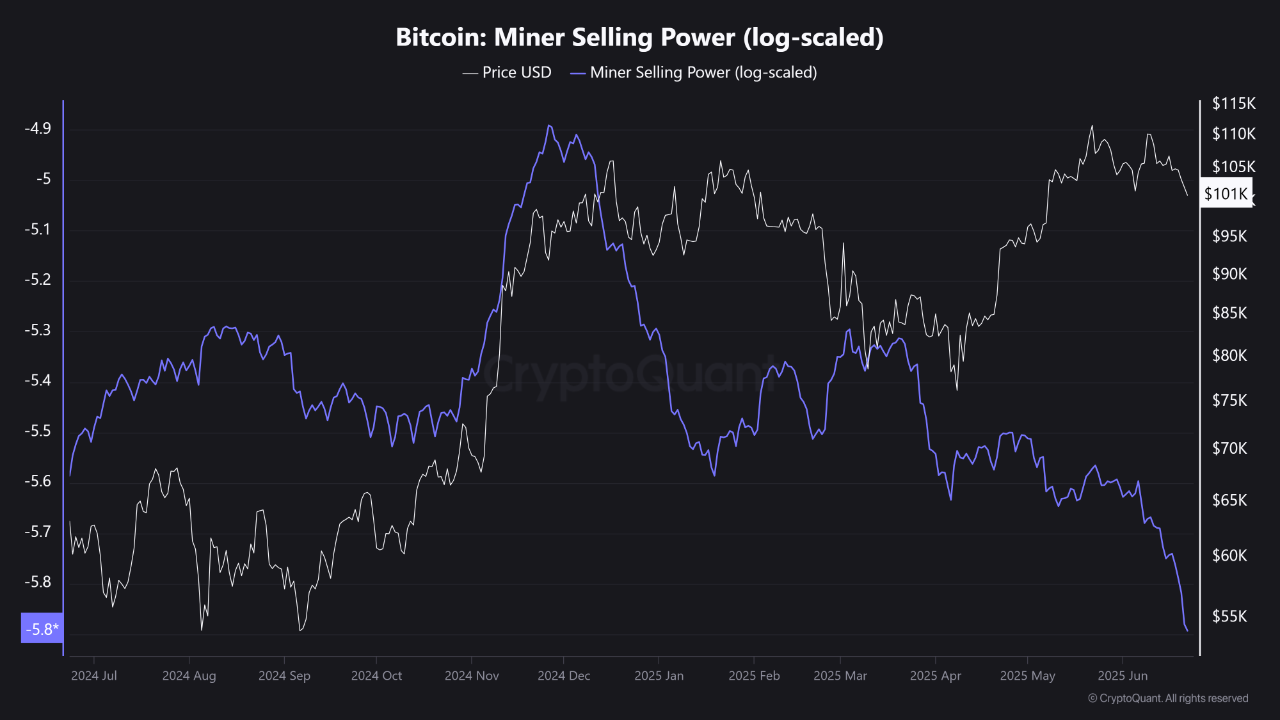

In recent weeks, sustainability metrics have fallen deep into negative territory, increasing sales power. In other words, miners have let go of their holdings and are leaving their mining.

Miners were heavily compensated during the period during which Bitcoin was traded between March and May in the range of $90,000-$105,000. However, since early June, profitability has been almost completely eroded.

Cryptoquant’s Bitcoin: Minor sales power (log-scaled) The chart reveals a recession in miners’ sales power. The metric explaining how much Bitcoin miners can offload to the market has reached a new low.

Bitcoin Minor Sales Power Chart. Source: Cryptoquant

As of June 24th, difficulty and hashrate values run at 390 Th/s and a single miner that consumes 7,215 watts of power produces just $11.76 per day at $0.05/kWh. Mining one Bitcoin under these conditions takes over 14 years to 5, 156 days.

Mining power slides as geopolitical differences bite

On June 22, the United States launched a targeted airstrike on Iran’s nuclear facilities. Although it has not been officially confirmed, it is believed that the power plant may have been affected.

Iran legalized Bitcoin mining in 2019, creating a considerable network using subsidies from fossil fuels and nuclear power plants. At its peak, Iran accounted for around 4.5% of the world’s Bitcoin hashrate. This figure is approaching 3.1%.

After the US strike, there have been several reports of power outages and digital network disruptions from both Iran and neighboring Israel. Outages could have affected mining facilities and damaged them due to power losses or forced them to be shut down.

Some analysts observed a sharp decline in Bitcoin hashrate earlier this week, with the network’s computational power down by 8% between Sunday and Thursday. The hashrate reportedly fell from 943.6 million thahash to 865.1 million th/s from 1 second (TH/s).

The market has previously backed up against the background of President Donald Trump’s announcement of the “complete ceasefire” agreement between Iran and Israel. Words from Trump helped restore investors’ trust, pushing Bitcoin back past the $106,000 level on Monday. At the time of this report, the largest coin by market capitalization has changed hands at around $105,300.