Ethereum (ETH) faces relatively low prices and increased usage. The network has transactions that are close to the level of the network, whereas over 30% of the supply is locked.

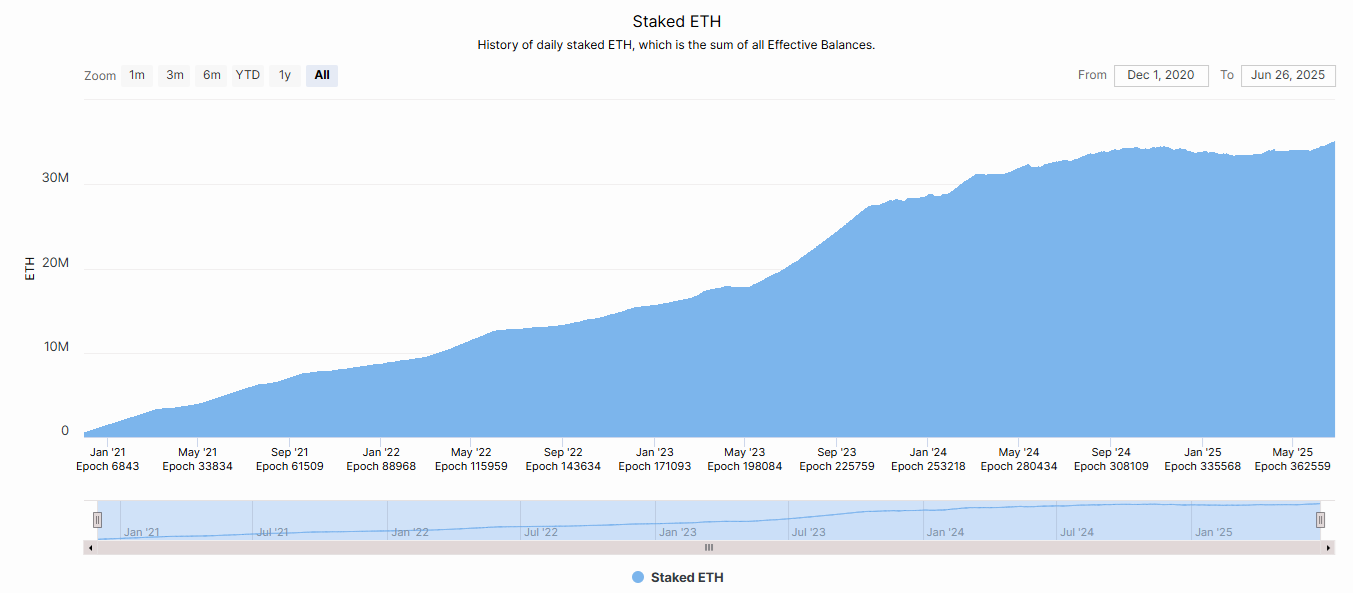

Ethereum (ETH) continues to build supply crunches based on increased whale holdings and staking. Currently, about 30% of the supply is staked, and it has been inflowing very actively over the past few months. Over 35m of ETH has soaked into the beacon chain, making it the best ever. The staking trend may continue as ETFs are also allowed to include staking for passive income.

ETH staking was featured again in the second quarter, leading to record values with ETH above 35m or about 30% of available supply locked. |Source: Beacon Chain

After several spills from staking contracts during market panic in March and April, Ethereum staking has returned to peak levels that have not been seen since September 2024. ETH staking has become one of the most reliable markers that can be trusted in the long term for network value.

Following the Pectra upgrade, staking has also accelerated as large whales could deposit more ETH at once to build stocks. As a result, the total bets at Ethereum are the highest ever.

The Ethereum network will be taken over $6.1 billion Loans, liquid staking, DEX liquidity pools and more are locked to Defi protocols. ETH is valuable as collateral, and whales are not in a hurry to sell.

More ETH is wrapped in multiple protocols and is out of the open market. Whales also show increased activity on average and added on average 800k ETH Only 16k of new ETH will be produced every week per day of the previous week. The whales have shown unprecedented levels of accumulation, boosting the much-anticipated price breakout story.

Eth Exchange reserves are still lacking at around 19M tokens. ETFs are also actively purchasing, and BlackRock has recently absorbed the piles sold by Grayscale. ETH has become attractive to corporate buyers as a collateral asset.

The Ethereum Network is also waiting for something new Upgradeit could speed up transactions further. Despite its relatively high prices compared to other networks, Ethereum remains Defi’s important platform. Based on smart contract activity, the main use case for the network is ETH forwarding, with USDT and USDC still being some of the busiest smart contracts.

ETH is undervalued for volatile trading

The current situation at ETH is to raise expectations for a catch-up rally. Trades under $2,500 are considered undervalued despite the peak chain activity. Transactions continue to rise in Ethereum throughout 2025, reaching a higher baseline with occasional days of unusual record activity.

Nevertheless, prices in the ETH market remained near low and crashed after each breakout. In June, ETH failed to retrieve the $3,000 level. Tokens fell about 5% in June, but the second quarter could end with significant net profits. Expanded ETH 31.8% The second quarter is driven primarily by peak gain in May.

Multiple bulls in ETH are not sufficient to cause more definitive gatherings. There are still hopes for a breakout in June that could boost ETH by $10,000. Even without a meeting, Ethereum showed it was not a dead chain. Recently, the network has drawn over $334 million every day Internet inflow When we return from the bridge to the liquidity hub with the greatest value.