Bulla has skyrocketed nearly 50% since Thursday, but many prominent community members believe Hasbulla is carrying out another lagpur scam. Despite what’s on trends, Bulla became one of the top Gaines in the BNB ecosystem this week.

Most blockchain analysts have written this meme coin down as a scam because of the influencer’s shady history. However, Binance Alphalists helped the tokens to gain legitimacy.

Hasbulla and Bulla explained

Russian crypto influencer Hasbulla has a long track record of launching meme coins, most of which ended with allegations of fraud.

Therefore, when he first began pre-selling new Bulla tokens, the community was extremely skeptical of rug pulls. Hasbulla’s Bulla Token has been traded for much of last month, but everything remains vague.

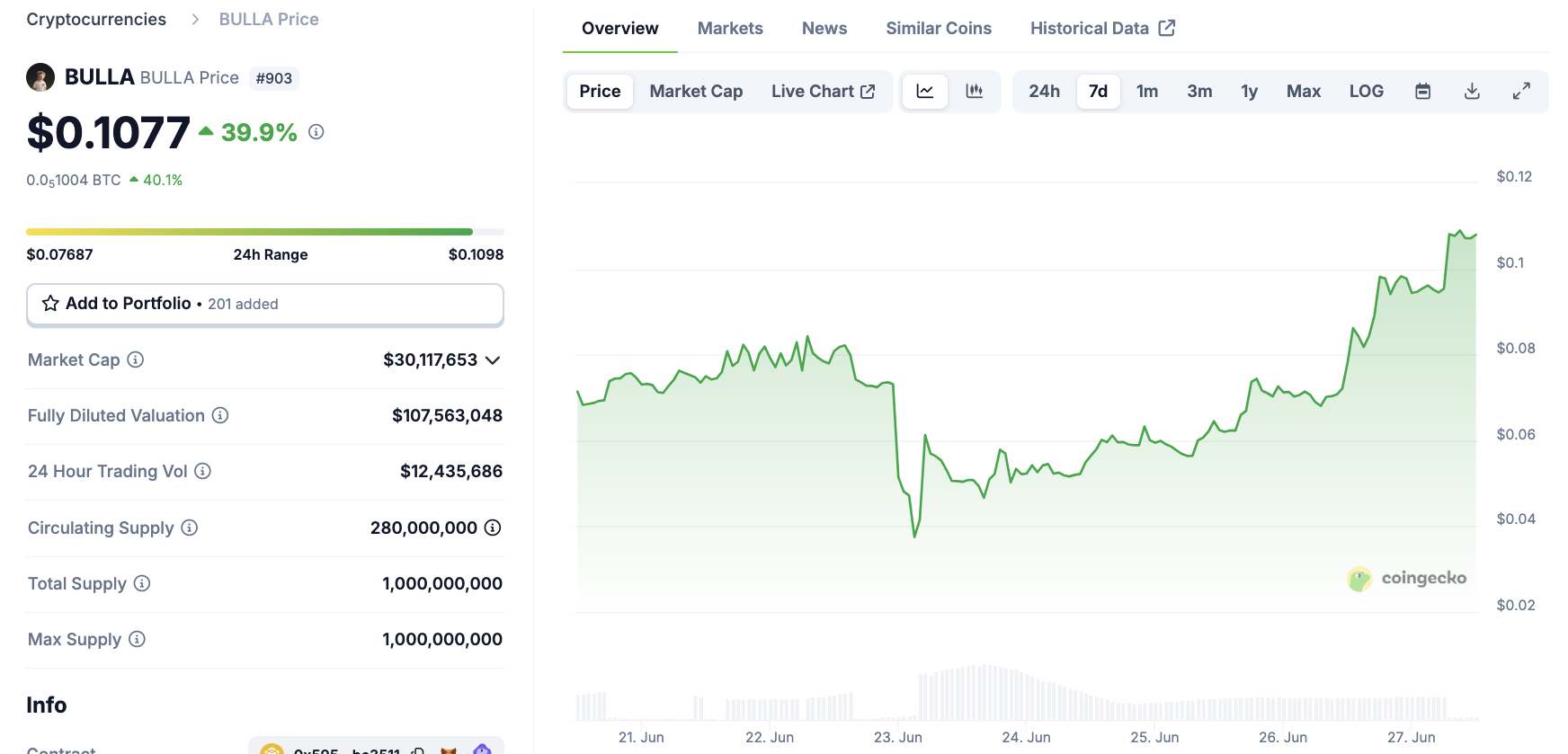

To be clear, the entire history of the assets has been interrupted by a massive fall. When Hasbulla launched Bulla on June 8th, it had a market capitalization of $100 million. Five days later, $70 million evaporated.

In most cases, Bulla showed a constant downward trend, but several events continued to back up.

On June 22nd, Binance Alpha announced that it features Hasbulla’s latest assets and is increasing its excellence. This included a huge airdrop that was particularly noteworthy of the exchange.

This quickly attracted intense criticism, and analysts were afraid of pulling the rug. Shortly afterwards, token prices fell 50%.

Still, this drop doesn’t seem to be perfectly in line with the lag pull theory. Rather, if there is a scam, it is not finished yet. Five days later, Bulla started trending again, with Hasbulla herself boasting about the success of the token.

Compared to Binance List Drop, Bulla recovered all these losses, posted new profits, jumped 40% today.

Bulla price performance. Source: Coingecko

So, what happened? The community is confident that Bulla is a scam, especially considering Hasbulla’s track record. Nevertheless, blockchain analysts have not proven this clearly.

For example, some skeptics theorized that it may have strengthened Bulla’s interests, as DWF Labs previously worked with Hasbulla.

Additionally, DWF Labs has been involved in several controversies and has become a simple scapegoat. However, for clarity, there are no concrete pieces of evidence.

Of course, Hasbulla’s own team could have pumped Bulla without external help. A more direct problem appears to be clear. Serious analysts don’t want to bother circulating harsh evidence of pumps and dumps.

Experts have been blaming Bulla even before its release, but Hasbulla’s supporters continue to buy it anyway. Several analysts have insisted on making them a scam.

This indifference and light empt attitude does not raise any prior warnings, but can occur even after interesting post-mortem.