Ethereum (ETH) has recorded strong profits over the past two weeks, rising from $2,111 on June 12 to $2,515 on June 25, rekindling hopes for a sustained bullish rally that can push digital assets beyond the key $3,000 level.

Ethereum rally marked by dynamic shifts

According to a recent crypto quick take post by contributor Amr Taha, Ethereum’s latest rally was accompanied by a notable shift in market dynamics, including a rise in the flip-from-possible funding rate, potential short squeezes, and an influx into Binan script exchanges.

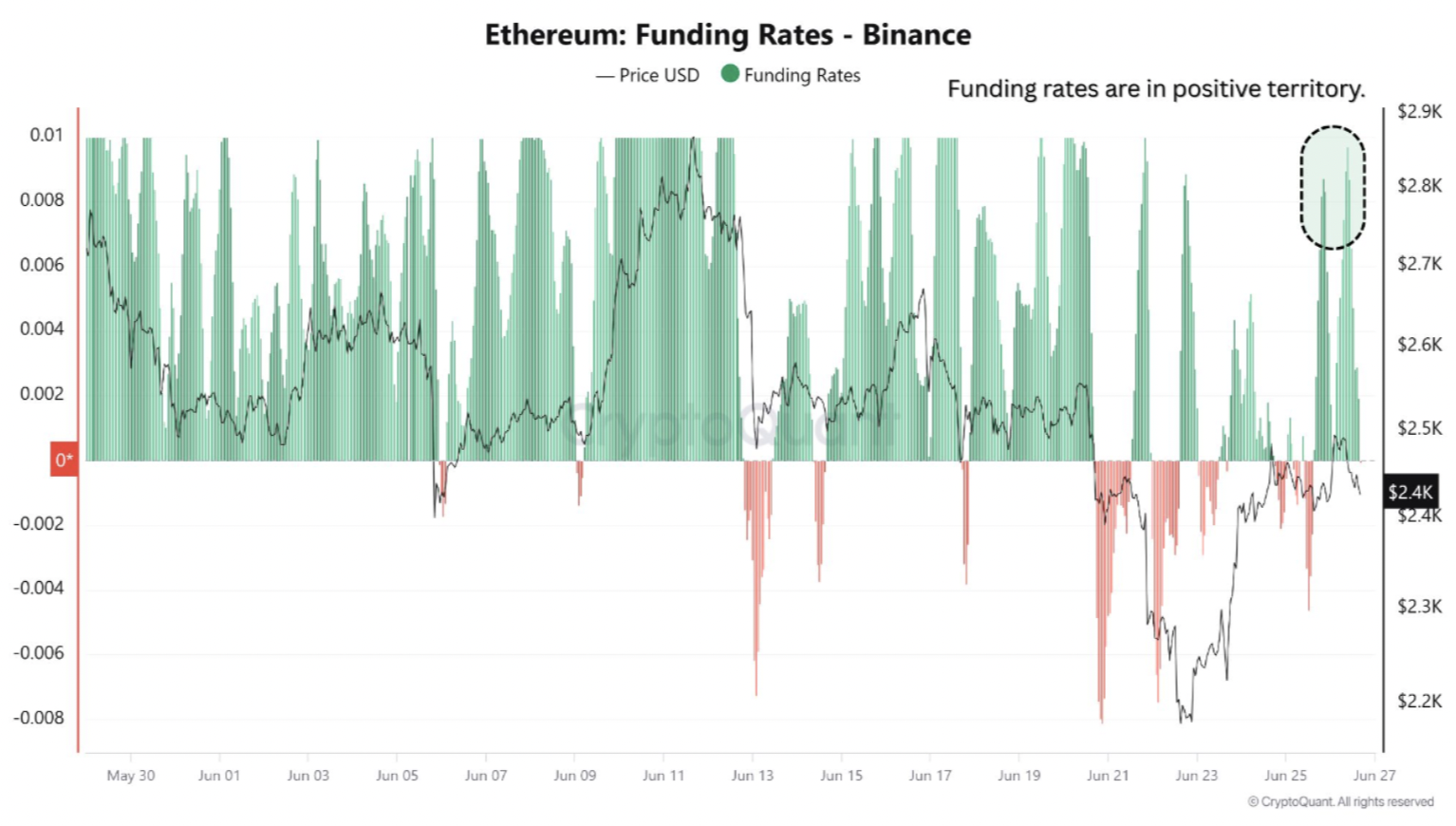

Recent data from Binance reveals a significant change in ETH funding rates from negative to positive. Positive funding rates usually indicate that traders are opening or holding long-leverage positions, reflecting further expectations of upwards.

However, rising funding rates can increase the risk of short-term price pullbacks when long positions occur. Overly expanded. data Coinglass highlights this risk, showing that 68.15% of the liquidation in the last 24 hours is a long position.

Taha also highlighted the role of shorter throttles in Ethereum’s recent price surge and the rise in funding rates. As ETH prices rose, they retested the previous Shorts Zone to around $2,500. He explained:

In that previous event, the short position was forced to close by launching aggressive market purchase orders to cover exposure, causing a cascade effect known as short apertures. This dynamic occurs when traders who bet on ETH (short pants) are forced to close their positions by actively buying back their assets to limit their losses.

Meanwhile, ETH influx into Binance is also rising sharply. Exchange data on the chain suggests that 177,000 ETHs have been deposited in Binance over three days. This is an extraordinarily large amount.

Such surges usually indicate an increase in sales pressure or large relocation by key holders. Most ETH transfers to exchanges often precede either potential sale or liquidity provisioning.

In conclusion, Taha said that while a short-term revision may be likely, the breakout of ETH above $2,500 highlights aggressive speculative activities that promote recent pricing measures. Traders are advised to closely monitor funding rates and exchange flows for signs of an imminent setback.

ETH Bull will be in charge

Recent technical analysis I’ll suggest ETH may be preparing for a breakout that exceeds the $2,800 resistance level. The assets are also recent Formation The golden cross on the daily charts burned speculation that the new all-time high (ATH) could be within reach.

However, ETH is not entirely clear. Recently, technical analyst Crypto Wave It was predicted That cryptocurrency could revisit low levels in the range of $1,700 to $1,950. At press time, ETH will trade at $2,429, a 0.4% decrease over the past 24 hours.

Featured images from Unsplash, Cryptoquant and TradingView.com charts