According to the latest on-chain data, Bitcoin Miners have refused to offload their BTC holdings despite their historically low profitability.

Since 2012, BTC trading fees have been at the lowest level.

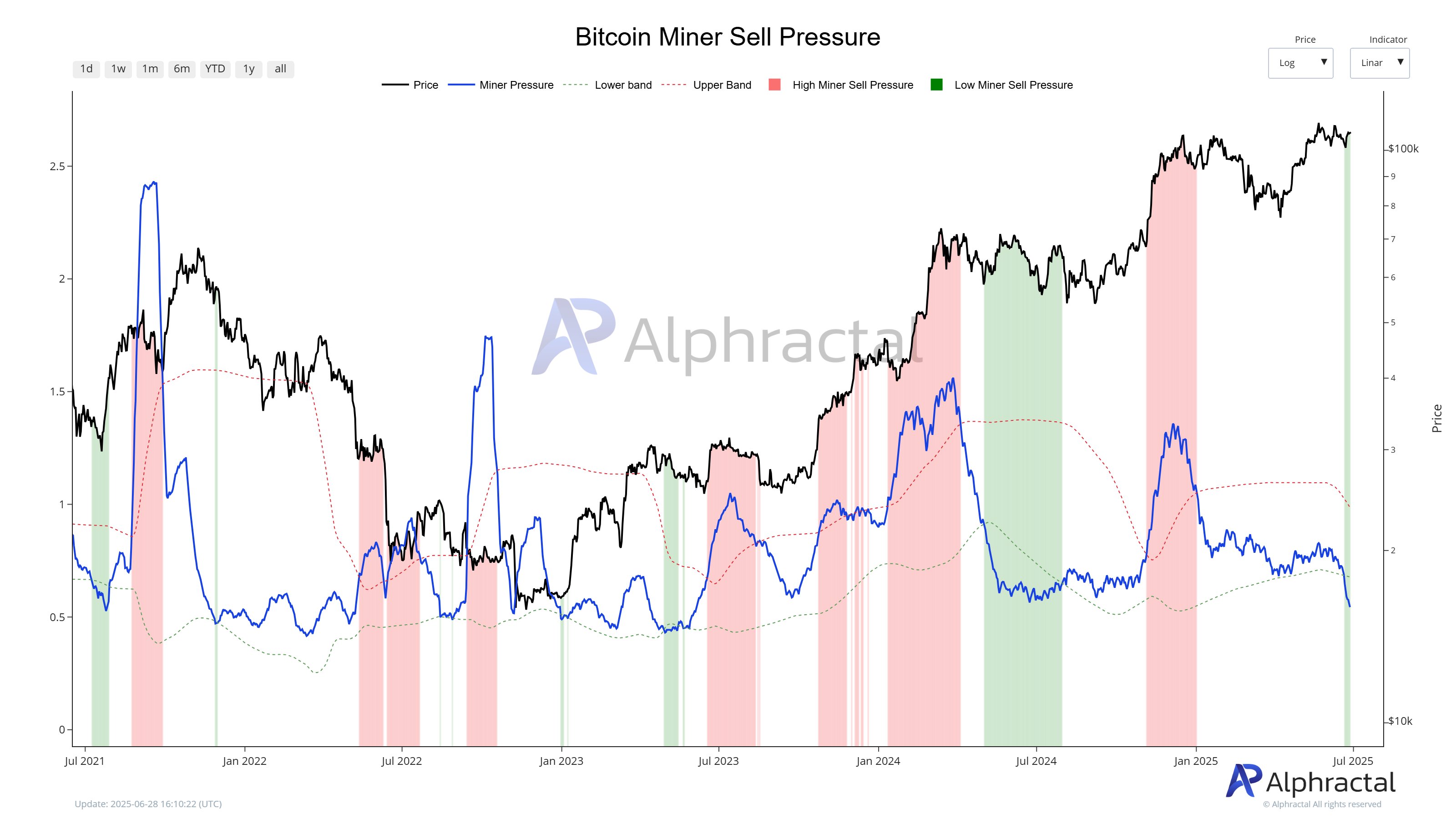

In a new post on X, blockchain analytics firm Alphractal revealed that Bitcoin Miner still holds reserves despite a decline in revenue. The on-chain data platform discussed the reasons behind this trend and the potential impact on the BTC mining industry.

First, Alfractal highlighted low on-chain activity in this cycle as one of the reasons behind the significant decline in miners’ revenues. As a result of a decline in activity, total transaction fees paid on the Bitcoin network have fallen to their lowest level since 2012.

The market information platform also said mining difficulty remains high despite recent declines in hashrates. There is usually a direct or positive correlation between hashrate and mining difficulty. However, according to Alphractal, this recent delay or dissociation further strains the profitability of the miners and delays network equilibrium.

Additionally, Alphractal revealed in X that Bitcoin hashrate volatility reached a new high. This essentially means that the network is witnessing the fluctuations or changes in the highest hashrate in history.

Blockchain analysis company added:

This can be caused by large mining operations that close ASIC machines, possibly due to lower revenues and low network demand.

Source: @Alphractal on X

Despite network revenue and high mining difficulties, pressure sales from miners remain at a low level. As the sales pressure metric for low miners showed, this indicates that miners are not actively offloading their holdings for profit.

Alphractal acknowledged that low sales pressure from miners is a positive sign, especially for Bitcoin prices. Blockchain companies have noted the possibility that some mining pools will reduce operations in response to reduced activity on the Bitcoin network. “BTC trades at over $107,000, so it may simply be witnessing miners redistribute the power of hash to adapt to current demand,” Alphractal added.

Typically, BTC miners tend to sell coins for commercial purposes during rapid price increases and high blockchain activities. However, Alphractal believes that both current absences suggest a period of adjustment rather than a yield among miners.

Bitcoin price at a glance

At the time of this writing, BTC is valued at around $107,375, continuing its lateral movement with just 0.3% increase over the last 24 hours.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

ISTOCK featured images, TradingView chart

Editing process Bitconists focus on delivering thorough research, accurate and unbiased content. We support strict sourcing standards, and each page receives a hard-working review by a team of top technology experts and veteran editors. This process ensures the integrity, relevance and value of your readers’ content.