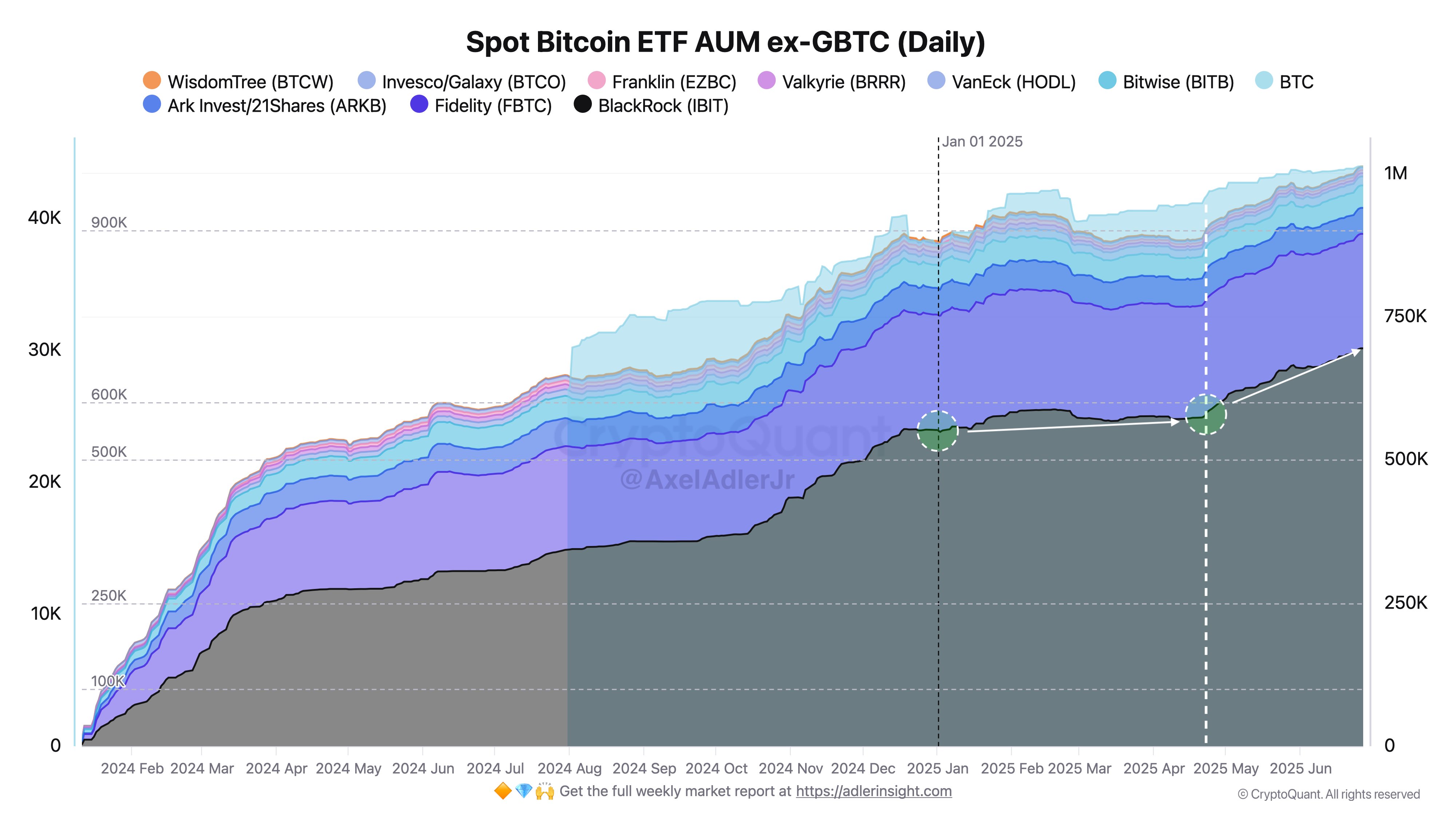

The US Bitcoin Spot ETF is one of the key bullish drivers in the current market cycle, and is telling the influx of institutional investors into the BTC ecosystem. In 18 months, these ETFs acquired 6.25% of Bitcoin’s market capitalization, solidifying their position as a major force in the market.

Interestingly, renowned market analyst Axel Adler Jr. points to recent positive trends within the Bitcoin ETF space, suggesting further upside potential and bullish prospects over the coming months.

Bitcoin Spot ETF with 1.2 million BTC by September – Analyst

In a June 28th X post, market analyst Axel Adler Jr. highlighted the persuasive trends in the accumulation patterns of US Bitcoin spot ETFs over the past three months.

A well-known analyst explains that the net worth of these ETFs, except for Grayscale GBTC, has increased significantly from 932,000 BTC in April 2025 to 1,056,000 BTC today. The development represents a net profit of 124,000 BTC over 87 days, averages an impressive inflow of 1,430 BTC per day.

As an uncontroversial market leader, BlackRock IBIT makes up a large part of this growth, attracting 1,360 BTC per day to sediments for the majority of this growth. In contrast, the remaining 11 ETFs offer a total of 6,000 BTC (70 BTC per day), indicating a clear focus of investor interest in BlackRock’s products.

According to Adler Jr., if institutional investors maintain their current accumulation pace of 1,430 BTC per day, these Bitcoin ETFs would reach 1,840,000 BTC AUM by September, accounting for 9.25% of the circular BTC Token. Among that total, BlackRock IBIT is expected to hold an estimated 817,000 BTC.

Combined with GBTC’s current AUM of $197.9 billion, Adler Jr.’s forecast means that the US Bitcoin Spot ETF will significantly value its net worth of over $1.975.4 billion.

Bitcoin price overview

At the time of writing, Bitcoin is trading at $107,339, reflecting mild price growth of 0.28% over the past 24 hours. Meanwhile, daily trading volume of assets fell 33.88%, worth $30 billion.

In the larger time frame, the best cryptocurrencies maintain positive performance with an increase of 5.61% and 1.06% on weekly and monthly charts, respectively, indicating a potential bullish momentum shift after weeks of range-binding movement.

Since establishing a new all-time high of $111,970 in late May, Bitcoin has struggled to explore new pricing territory and instead settled into a downward channel from $100,000 to $110,000.

Libertex featured images, TradingView charts

Editing process Bitconists focus on delivering thorough research, accurate and unbiased content. We support strict sourcing standards, and each page receives a hard-working review by a team of top technology experts and veteran editors. This process ensures the integrity, relevance and value of your readers’ content.