Bitcoin’s upward momentum has weakened as it approaches the $111K resistance zone and increases the risk of another rejection.

But bullish sentiment remains unchanged, with market participants expecting a breakout, while a new influx of demand is essential for a sustained move beyond the record high.

Bitcoin Price Analysis: Technology

By Shayan

Daily Charts

After weeks of consolidation, BTC continues to face challenges in surpassing its main $111K resistance level, the highest resistance level in history, today. Despite multiple attempts, sales pressure and intensification of profit acquisition at this level repeatedly halted bullish momentum, resulting in sideways price action.

Recently, cryptocurrency has fallen below the $100,000 support zone, causing liquidity sweeps and collecting fuel to gain potential new legs.

However, the subsequent rebounds stagnate around the $107,000 mark, indicating weakness in bullishness. As demand returns and pressure increases, breakouts above the 111k ATH could be achieved. Otherwise, another rejection is likely, pushing the price back to important $10,000 support in future sessions.

4-hour chart

In the lower time frame, Bitcoin is forming a bullish flag just below its highest ever height. This is usually a pattern that indicates a continuation of existing uptrends.

After seizing liquidity under the boundary under the flag of nearly $10,000, Bitcoin gathered towards the cap at $107,000. Despite this upward movement, prices have entered a low volatility stage, indicating that momentum is losing as we approach resistance.

If a breakout occurs early next week, it looks like it will be the highest ever height. Conversely, if you can’t hold it beyond the current level, another drop will be triggered, and the price will return to the bottom of the flag. Until then, price action remained limited as both the bull and the bear were waiting to see the next direction move.

Bitcoin on Chain Analysis

By Shayan

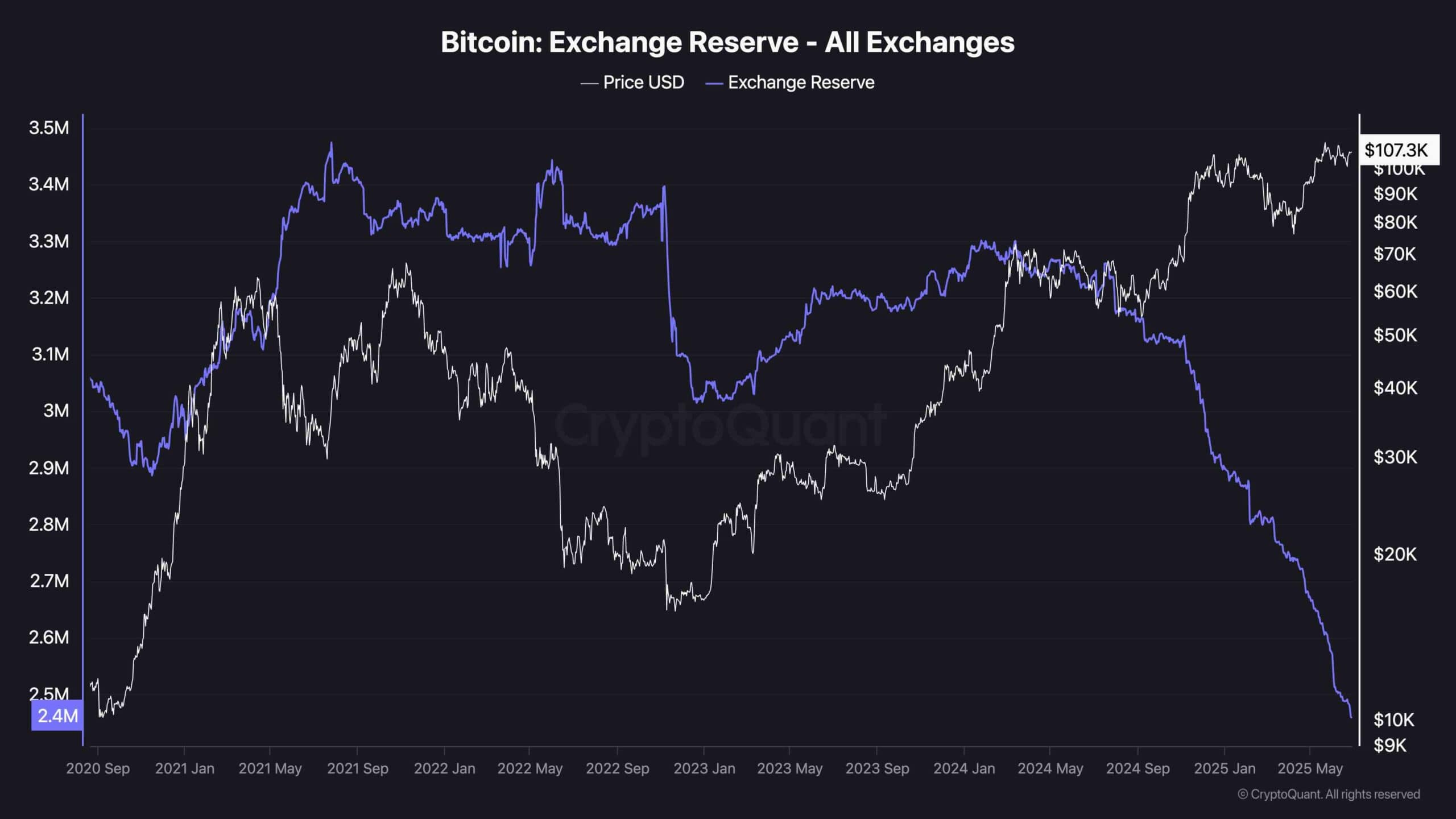

Cryptoquant’s on-chain data reveals a sharp decline in Bitcoin Reserves, currently held at the lowest level in years, at the lowest level.

This continuous outflow highlights the growing preference for independence and accumulation among investors. This is a pattern typically associated with lower sell-side pressures and long-term bullish outlook. A low supply of BTC readily available in exchanges creates a potential supply-side shock phase during periods of renewed demand.

That said, although declining reserves have historically been correlated with major bull runs, they should not be considered an immediate catalyst for short-term price increases.

Market conditions and liquidity dynamics still play a key role, and price adjustments are still possible unless demand does not correspond to its rise. In summary, Exchange Reserve trends highlight strong basic support for Bitcoin, but short-term price actions can be affected by broader macros or technical headwinds.