Today’s Ethereum Price: $2,420

- The Ethereum spot and derivatives markets have experienced slow movements, indicating that investors have had less buying activity in the past few days.

- Ethereum has seen an increase in network usage despite the price remaining in range.

- ETH faced a denial at the $2,500 level after posting an inverted hammer.

Ethereum (ETH) fell 1% during early trading hours on Friday. This is because market activities remain cautious after low realised profits and losses, along with stable rights. Nevertheless, Ethereum’s network usage rebounded, with transactions rising from 123 million to 1.75 million on Wednesday, spurring an increase in active addresses.

Ethereum prices remain in scope as network activity grows

Ethereum’s derivatives and trading activities across the spot market have been fairly neutral over the past few days, revealing that careful sentiment remains primarily prioritized in the market.

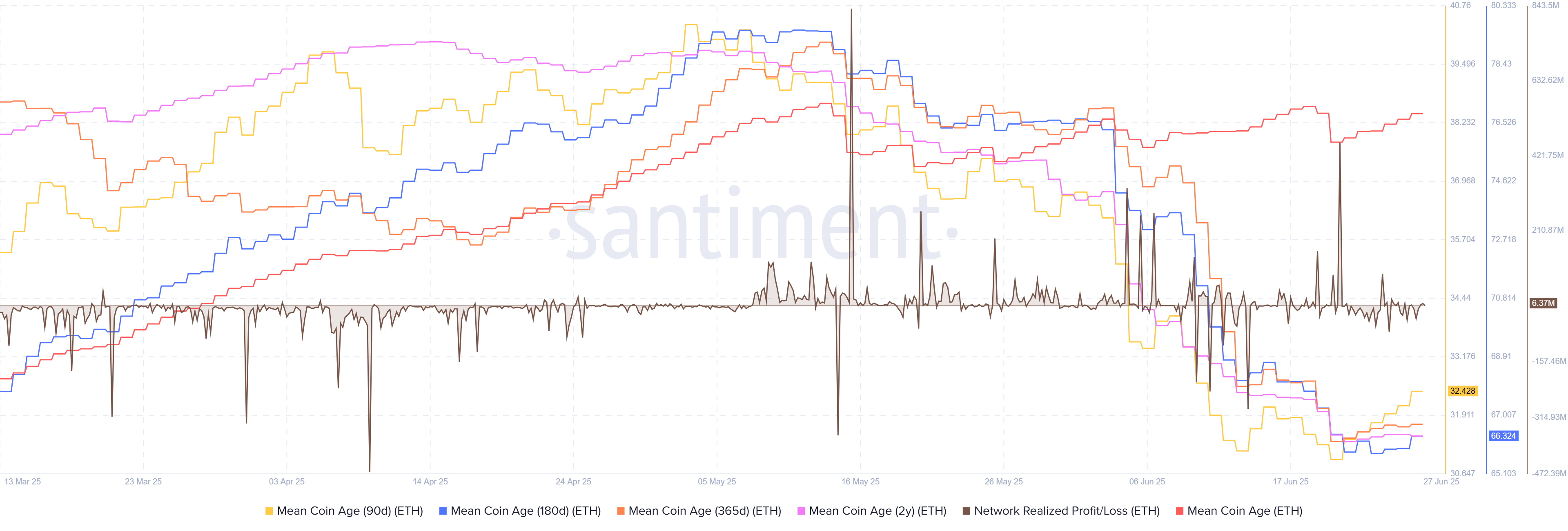

The network realized profit/loss and average coin age metrics. It shows investors have reduced trading activity, daily losses and profits fall below the $100 million mark, with distribution/accumulation remaining flat for the past few days.

ETH network achieved profit/loss and average coin age. Source: Santiment

According to data from Cryptoquant, whales with 10,000-100,000 ETH balances have also been stable since the beginning of the week, rising by just 7,000 ETH. This comes with a slightly upward-leaning replacement spare, indicating a slight increase in weekly sales pressure.

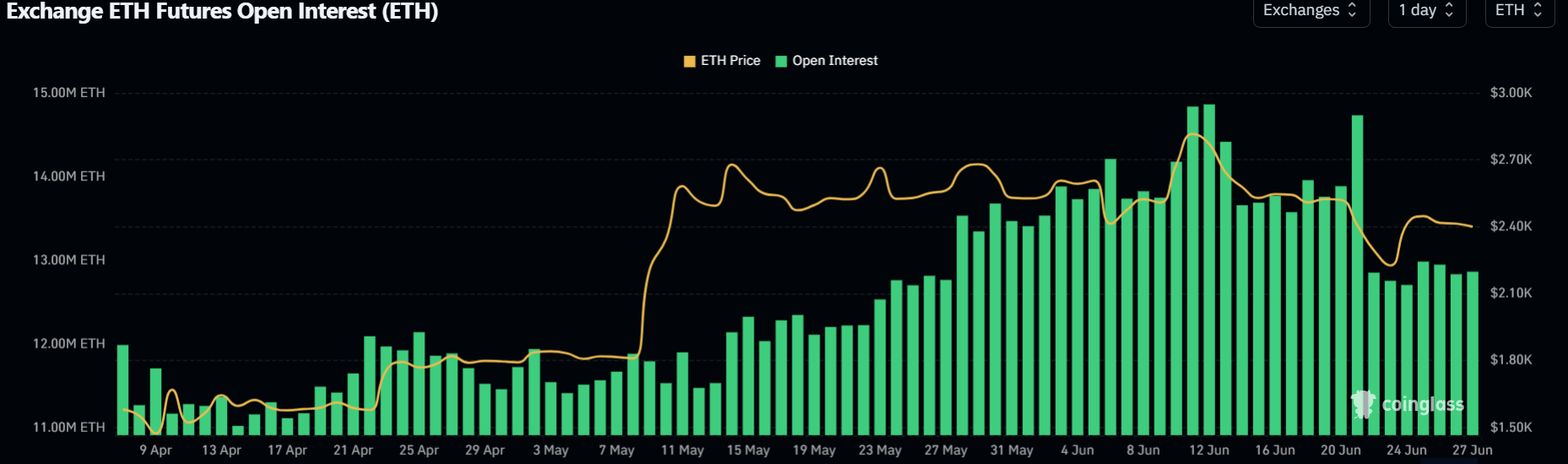

The derivatives market has painted a similar picture, with open interest (OI) not surpassing the 13 million ETH mark since falling on Saturday. Open profit refers to the total value of any outstanding or unresolved contracts in the derivatives market.

ETH open interest. Source: Coinglass

These metrics portray cautious market sentiment with slight bias towards the downside, but Ethereum’s network use and institutional sentiment leaning somewhat towards bullish trends.

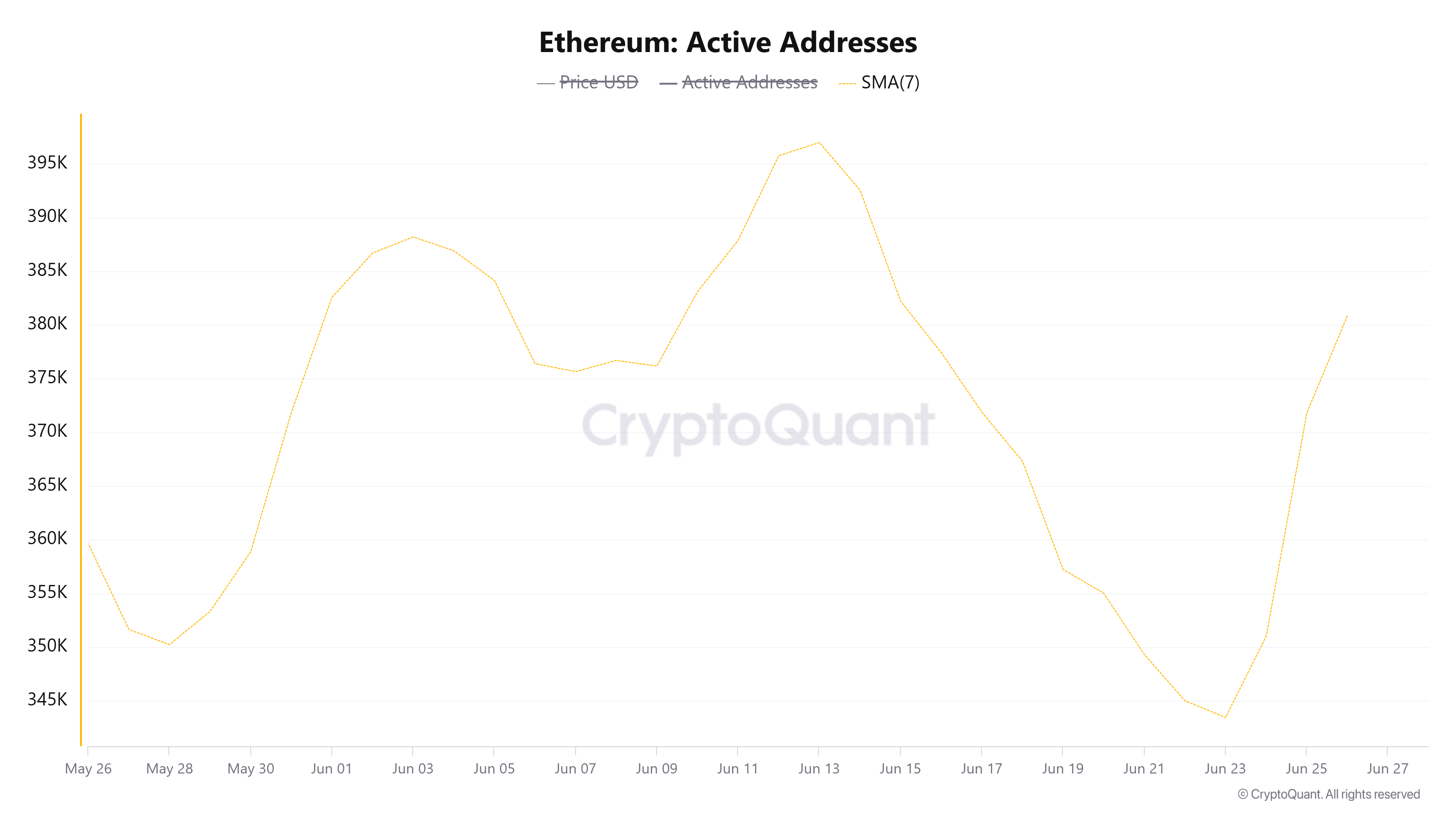

Ethereum’s active address is growing again, breaking the downtrend that began on June 13th despite the largely leveling prices.

ETH active address. Source: Cryptoquant

These addresses are also active when making transactions as Ethereum transactions increased from 123 million to 1.75 million between Sunday and Wednesday, indicating a growing interest in Ethereum ecosystems.

Such growth in network activity shows strength and often forms the basis for long-term recovery when macroeconomic factors are consistent. However, this appears to be unclear for now as market participants appear to follow the waiting approach due to the uncertainty surrounding President Trump’s 90-day tariff suspension, which is approaching the July 9 deadline. This leaves the bearish shadows hanging on much of the ETH and Crypto market.

https://x.com/kobeissiletter/status/1938291119483224102

Ethereum Price Prediction: Key Level $2,500 after posting ETH Test Inverted Hammer

Ethereum has experienced a $755 million futures liquidation in the last 24 hours, reaching $37.08 million and $38.03 million in long and short positions that were liquidated, respectively.

After temporarily collecting the $2,500 level for the first time in the past week, ETH saw rejections on the 100th Simple Moving Average (SMA) and posted an inverse hammer in the process. A bullish reversal is verified as ETH holds nearly $2,400 in support and breaks the $2,510 resistance.

ETH/USDT 12-Hour Chart

However, if you reduce below the support line of nearly $2,400, you can send ETH to test the upper line of downward channels. When ETH drops below the lower boundary of the triangle, which is symmetric with the channel’s upper bound, the bearish flag pattern is validated, allowing the price to fall below the key level of $2,110.

The relative strength index (RSI) tests neutral levels, and the stochastic oscillator exceeds its midline. Crossovers above the neutral level of RSI could strengthen bullish momentum.

Related News

- Ethereum price forecast: Bitcoin miner pivots to ETH Ministry of Finance strategy

- Ethereum price forecast: Powell’s hawkish tone as a ceasefire between Israel and Iran ignores Powell’s hawkish tone to burn bullish emotions

- Cryptocurrency can be used as a mortgage asset in 2025: This is why