Next week, June 30th to July 6th, 2025, is set to bring significant volatility to the crypto market as several major projects are scheduled to release previously locked tokens.

More than $150.6 million of these insider tokens are scheduled to be unlocked, and sudden changes in supply could lead to significant turbulence.

Which major altcoins are unlocked?

This week’s headliners include SUI, ENA and OP, which unlocks $77.35 million on SUI alone, accounting for 0.86% of the circulation supply. As investors prepare for increased volatility, these token charts tell a compelling story of current sentiment, key levels, and what lies ahead.

🟣Weekly Insider Unlock: June 30th – July 6th, 2025

🔥150.6m+🔥

Insider Unlocks Highligns

.

(Cir. Supply%) pic.twitter.com/sjy4ztxroc-June 27, 2025

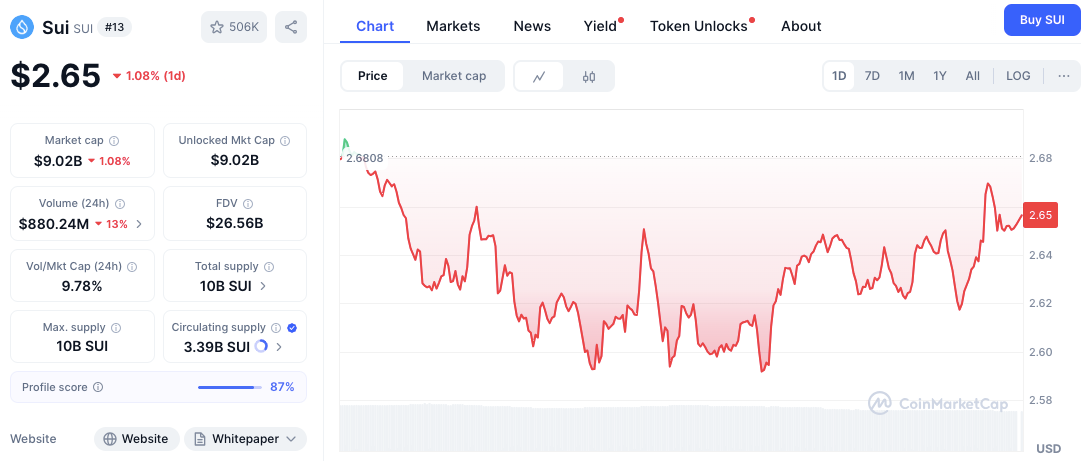

sui: Hold the line in bear pressure

SUI price transfer reveals careful trading behavior, with the token hovering at $2.65 after dropping from the daily high of $2.84. It attempted multiple daytime recovery but faced strong sales pressures above $2.70.

The notable level of support is around $2.56, which is slightly embarrassing to see the psychological threshold of $2.50. If this level breaks, it can cause more sudden falls.

Source: CoinMarketCap

Conversely, the $2.84 level shows great resistance. Any further breakouts could bring back bullish momentum. Currently, the SUI is integrated between $2.56 and $2.70. This is a very likely range of solutions to be resolved rapidly in the coming days, especially given the large lock.

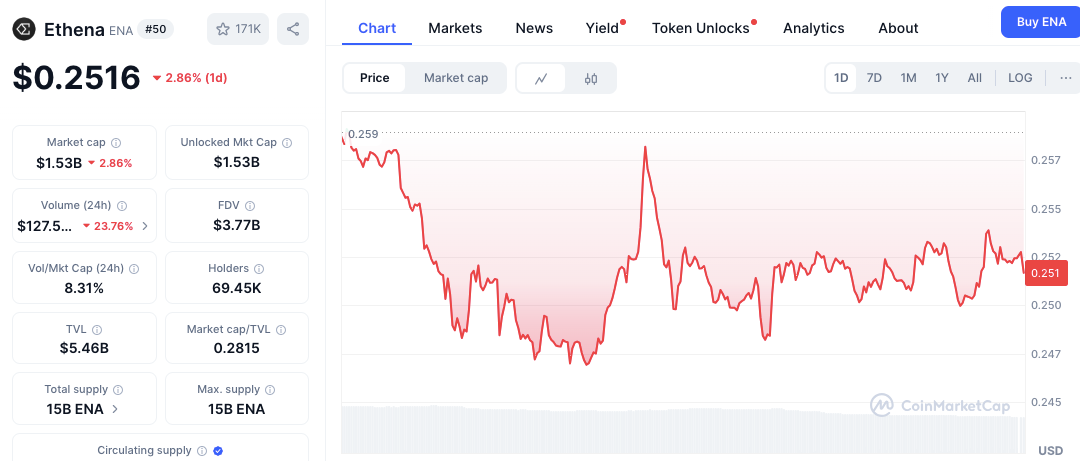

ENA and OP: Integration through uncertainty aspects

Ethena (ENA) experienced a 2.44% drop and closed at $0.2525. The $0.245 token’s intraday low served as a short-term anchor. It’s bouncing off, but it’s struggling to break past $0.257, and the consolidation is around $0.250.

Unlock size, $43.24 million (2.82% of supply), adds another pressure layer. The move below $0.245 marked the ENA retreat to $0.240.

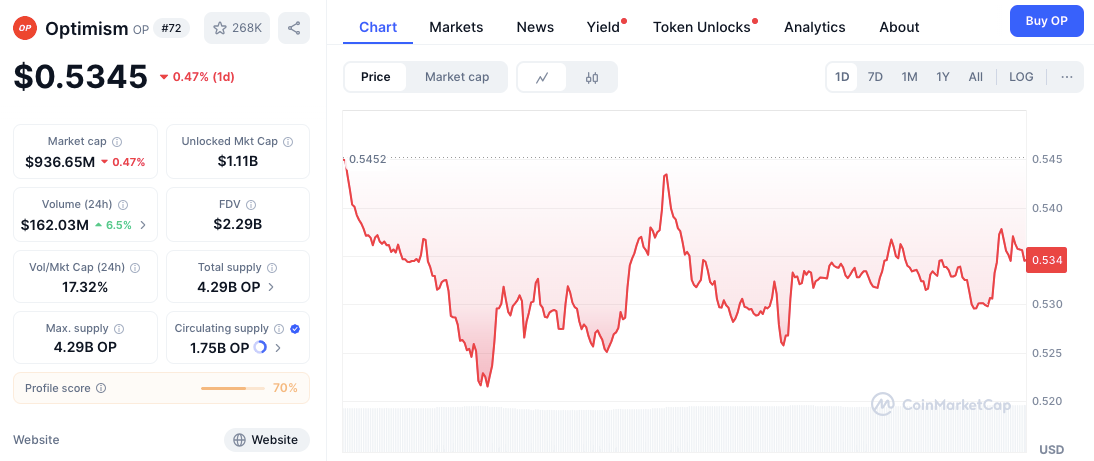

Optimism (OP), which is trading at $0.5345, has given a similar story. Despite the recovery at the end of the day, the OP was unable to recover its high of around $0.545.

Source: CoinMarketCap

Support is $0.520 and short-term resistance bands are $0.542-0.545. The above breaks could drive the rally to $0.550. However, given the $16.69 million unlock (1.79% of supply), traders may be looking at it with caution.

Smaller Caps: Kmno and Rez provide speculative movement

Source: CoinMarketCap

Kamino Finance (KMNO) and Renzo (Rez) will close the weekly unlock list with $4.74 million and $2.59 million, respectively. KMNO was faced with a rejection of nearly $0.059, marking its intraday low at $0.0555. The bearish trend continues, with resistance piling up at $0.058.

Source: CoinMarketCap

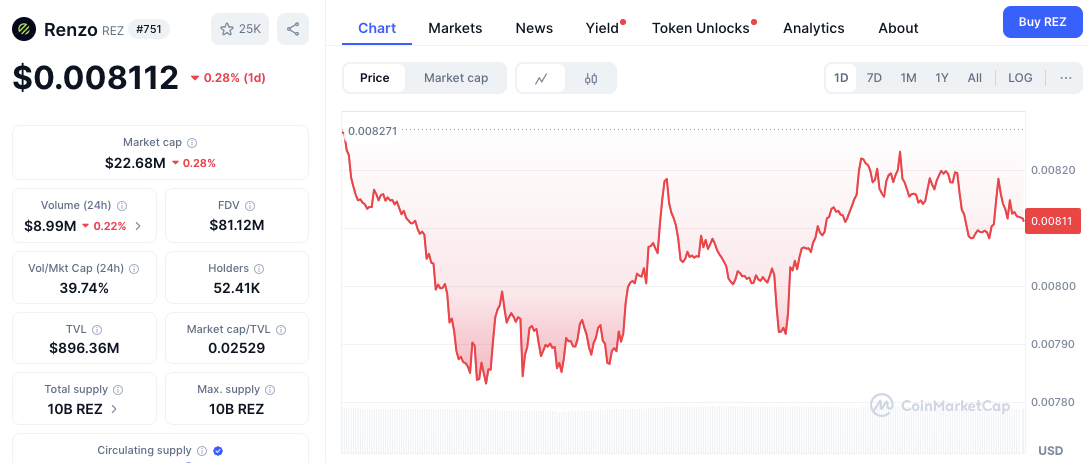

Meanwhile, Rez traded firmly at nearly $0.00811 after recovering from its lowest price of $0.00787. A large amount of lesbians compared to market capitalization could experience a sharper swing as 12.16% unlock hits the market.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.