In the stunning development, over $8.6 billion in 80,000 Bitcoin (BTC) has been moved to a new wallet that sets a wave of speculation across the crypto market. Contributing to this discourse, Conor Grogan, head of product at Coinbase, said this series of recent whale transactions could be a real crypto robbery.

Did the biggest bitcoin theft unfold silently?

In a July 4th X post, renowned analytics firm Arkham Intelligence Firm reports that a single entity has transferred 80,000 BTC to eight new wallets in equal parts. On-chain data reveals that these Bitcoin Holdings originally accumulated in previous wallets on April 2nd and May 4th, 2011, suggesting a complete dormant for over 14 years.

As with other major whale trading, these long-standing recent revitalization of BTC has warned market traders and investors alike, especially amidst the current struggle for BTC prices. However, the fact that these transfers do not include wallets associated with exchanges helped ease concerns about impending market divestitures.

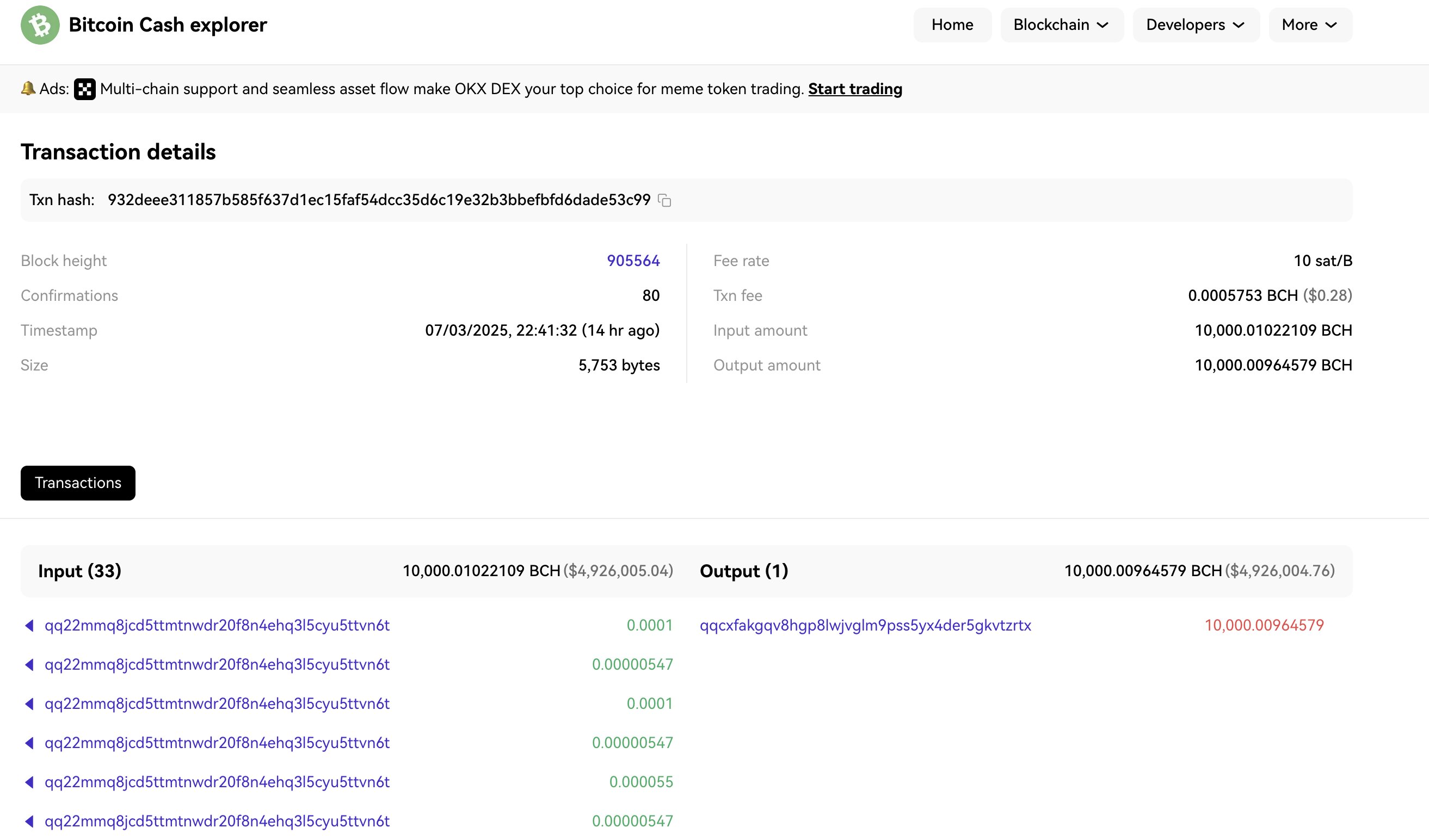

But Connor Grogan warns that these sudden Bitcoin transfers could be the biggest crypto robbers in history. In explaining this theory, Coinbase executives focus their attention on small amounts of Bitcoin Cash (BCH) transactions from one of their corresponding wallet clusters about 14 hours before the massive Bitcoin move.

Transactions, which are test-like outputs of 10,000 BCH worth around $4.9 million, were tracked on the Bitcoin Cash blockchain. Grogan suggests that the fact that other BCH wallets remain dormant as BCH transactions are usually tracked by the Whale Monitoring Service suggests that this particular BCH transfer could have been a hacker testing the private key.

Another concern highlighted by Coinbase executives is that the transfer appears to be a manual transaction rather than an automation or exchange-related, thereby increasing the suspicion of a compromised private key. Nevertheless, Grogan holds the position that this theory represents “extreme speculation.”

In particular, several crypto analysts and enthusiasts opposed Grogan’s story, describing the recent 8,000 BTC transfer as a “handshake transaction” rather than a hack. In particular, an analyst with X username Binji noted that the slow, intentional pace of transactions appears to be inconsistent with the behavior commonly observed in hacks, especially when performed by a single entity.

Bitcoin price overview

At the time of writing, Bitcoin is handed over at $108,150 after a 1.06% drop in the past day. However, major cryptocurrencies maintain positive performance in larger time frames, as evidenced by an increase of 0.98% and 2.78% on weekly and monthly charts, respectively.

Pexels featured images, TradingView charts

Editing process Bitconists focus on delivering thorough research, accurate and unbiased content. We support strict sourcing standards, and each page receives a hard-working review by a team of top technology experts and veteran editors. This process ensures the integrity, relevance and value of your readers’ content.