- According to Bloomberg ETF analysts James Seifert and Eric Balknath, the XRP Spot ETF is currently 95% likely to be approved by the SEC.

- Asset managers such as Franklin Templeton, Bitwise and Proshares have already submitted applications for XRP ETFs.

Imagine that if the US had no president like Donald Trump who supports cryptocurrency, progress in space would likely be much slower. For example, take Ripple (XRP). It faces a significant portion of the legal battle and delays to make an approved investment product approved.

But things are beginning to look up. There is now a 95% chance that the Ripple Spot Exchange Fund (ETF) will acquire Greenlight from the Securities and Exchange Commission (SEC), according to Bloomberg ETF analysts James Seifert and Eric Bulknass.

XRP supporters are optimistic, pointing to growing interest from agencies and a growing regulatory environment as key reasons for the potential for the XRP ETF to be ultimately approved. Legally, things are moving, but not without some bumps.

Recently, both the SEC and Ripple Labs filed a joint request in Manhattan federal court to revert to previous rulings that categorized Ripple’s major XRP sales as a securities violation.

As mentioned in a previous post, they also suggested cutting the fine of $125 million, suggesting that $50 million will be sent to the SEC and the remaining $75 million will be returned to Ripple. However, Judge Annalisa Torres denied the motion, saying it didn’t show the “exceptional circumstances” necessary to overturn the ruling.

The SEC has not officially stated whether it will continue to pursue its own appeal, but Ripple has already agreed to drop the crossing. In addition to speculation, the closing door SEC meeting scheduled for July 3 has sparked hope that the incident could ultimately end.

The road to XRP breakout

XRP became legally clear in 2023, but many agencies remain cautious about diving in. There is speculation that even giants like BlackRock may be waiting for a ripple-based case to close out completely before moving on with their own XRP ETF filing.

In the meantime, some companies have already made progress. Bitise Asset Management began things with filing in October 2024, followed by the Canary capital, 21shares, Wisdomtree, Proshares and Coinshares, all showing strong institutional interest. And it’s not just about the ETF issuer involved.

Recent reports featured XRP entering what many people call the “institutional age.” It has won over $1 billion in Treasury allocations from companies such as Chinese AI company Webus, Vivopower’s $121 million commitment and Florida-based Pharmaceutical Distributor Wellgistics. This could run above $5 and, if conditions are aligned, fueling towards the $10 mark.

In addition to the bullish case, Grayscale’s Digital Large Cap Fund (GDLC) includes XRP along with Bitcoin (BTC), Ethereum (ETH), Cardano (ADA) and Solana (SOL), and has received SEC approval for converting it to spot ETFs. XRP does not yet have a dedicated ETF approval, but this indirect inclusion indicates progress.

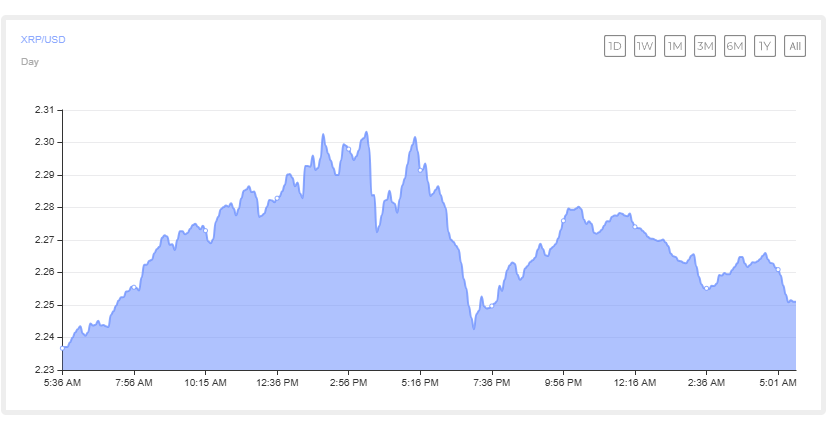

Still, short-term pricing measures remain unstable. Over the past 24 hours, XRP has declined 0.71%, trading at $2.18, up 1.4% over the last 30 days and 348% over the past year. If current sales pressure continues, XRP could fall below $2.13, potentially sliding to $5 on the horizon.