Tokenized gold trading volume has exceeded $19 billion so far this year, surpassing many popular gold ETFs.

Tokenized assets are gradually proving to be a viable alternative to traditional investment instruments. According to a July 8 report by CEX.IO, tokenized gold gains traction compared to gold ETFs. The asset class attracted $19 billion in trading volume this year, surpassing several widely held gold ETFs.

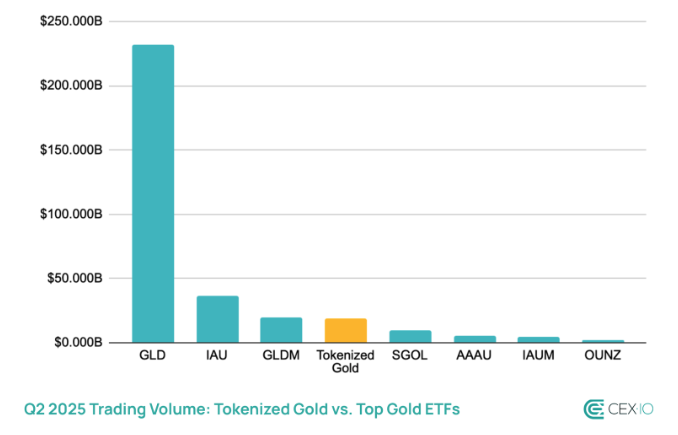

Popular Gold ETFs and Tokenized Gold Trading Volumes for the Second Quarter of 2025 | Source: CEX.IO

Tokenized Gold continues to trace major ETFs like SPDR Gold Shares (GLD) and Ishares Gold Trust (IAU), but surpasses many small counterparts. The asset classes show higher trading volumes than SGOL, AAAU, IAUM and OUNZ.

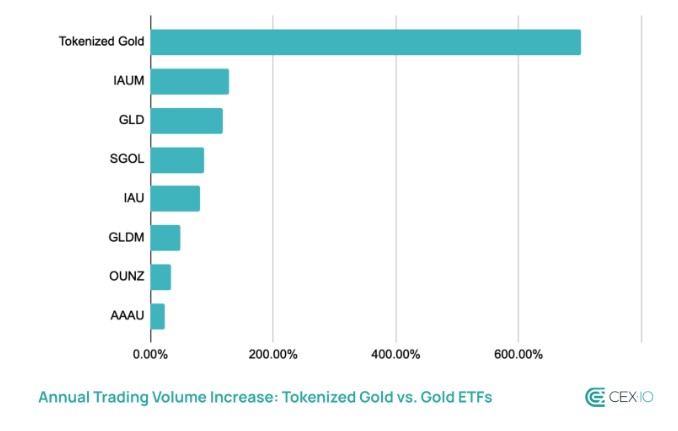

Furthermore, the increase in tokenized gold trading volume has significantly outpaced all gold ETFs so far this year. In the second quarter of 2025, asset class volume increased from $2.4 billion to $19.2 billion. This is an eight-fold increase.

This marks some of the broader trends as tokenized gold outperforms gold ETFs in four quarters volume growth. According to CEX.IO, this outperformance suggests that capital is shifting from gold ETFs to tokenized gold assets.

You might like it too: Canter Fitzgerald launches Bitcoin fund with gold price protection

Retail investors will supply fuel tokenized gold

According to a CEX.IO report, most of the new trading volume of tokenized gold is driven by investors from retail and crypto origins. Meanwhile, institutional investors continue to control traditional gold ETFs. In particular, the number of PAXG holders increased by 25%, while Xaut holders rose by 151%, highlighting a significant influx of new traders into the market.

Still, tokenized gold continues to track ETFs in terms of market capitalization. For example, GLD’s total market capitalization rose 36%, while 29% of tokenized gold rose just 29%. This indicates that tokenized gold is not yet widely recognized as a long-term repository of value. Rather, most traders use it as a utility asset within the Defi ecosystem.

read more: Do Americans want to throw away gold reserves for Bitcoin? New research raises eyebrows