Crypto-mining stocks record rapid divergence results over daily, weekly and yearly periods, with Bitmine emerging as a standout performer in the sector.

Crypto mining stock performance diverges significantly

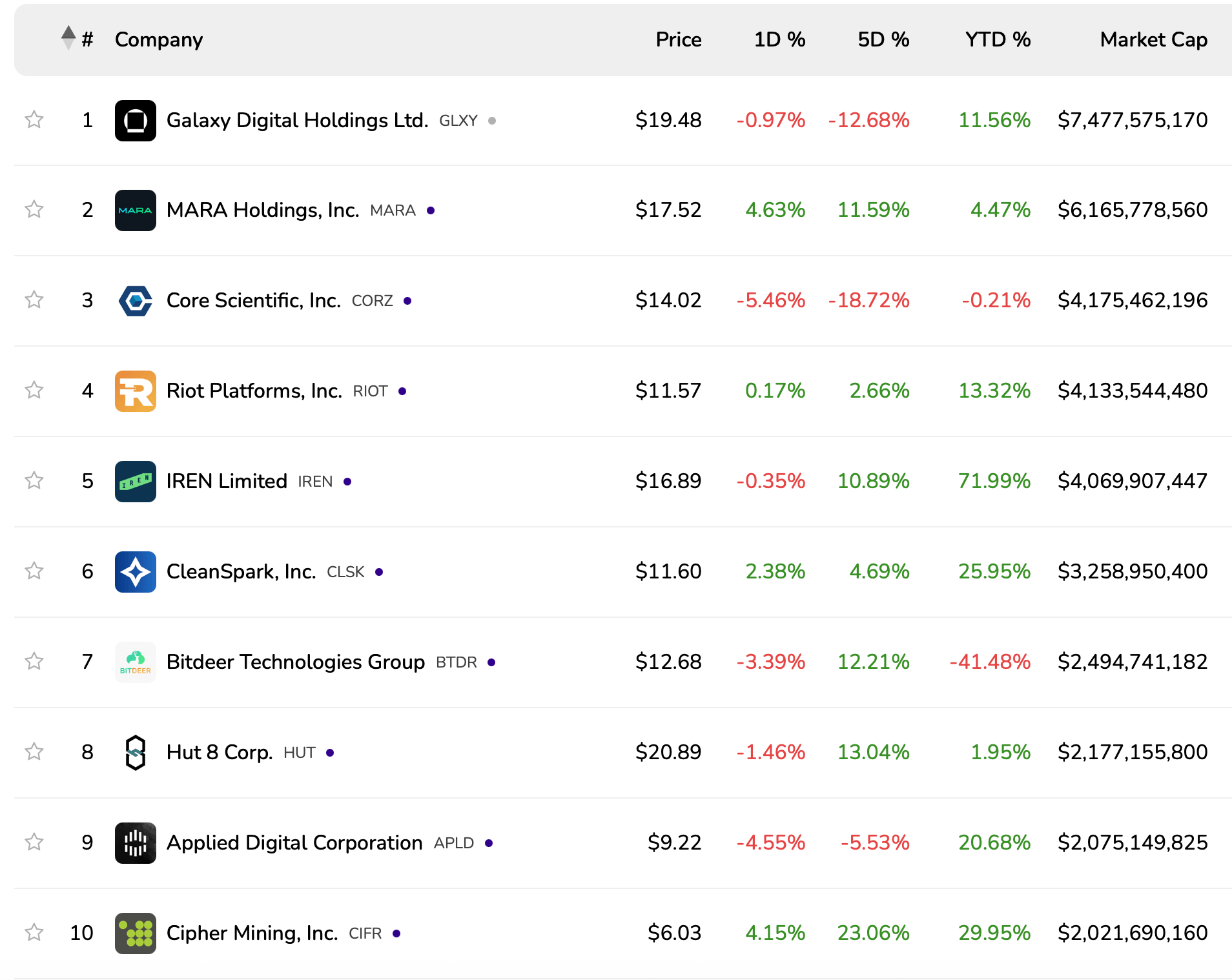

Crypto mining is not boring in 2025. As of statistics collected on July 8, 2025, Galaxy Digital Holdings Ltd. holds up to $7.488 billion in market capitalization despite a 0.97% decrease daily over the past five days and a 12.68% decrease. Meanwhile, Mara Holdings saw a profit of 4.63% every day and an increase of 11.59% each week. Meanwhile, Core Scientific, Inc. fell by 5.46% every day and 18.72% every week.

Top 10 Bitcoin miners by market capitalization using data collected by bitcoinminingStock.io.

The heavyweights in the sector are feeling the heat. The Riot Platform won 0.17% that day and 2.66% each week. Iren Limited recorded a profit of 71.99% since the start of the year. CleanSpark, Inc. rose 25.95% YTD, and BitDeer Technologies Group fell to 41.48% YTD. Cipher Mining, Inc. Advanced 29.95%YTD, and Bit Digital, Inc. rose 61.90% in a week.

However, some companies mine more than just coins. It seems to make money impressive for investors. Bitmine Immersion Technologies led all miners with a YTD increase of 1,329.48%. The US-based company trading under the NYSE American and symbol BMNR believes its growth is attributed to the use of immersion cooling technology, green mining practices and expansion into the low-cost energy domain.

Additionally, strategic pivots for Ethereum (ETH) and a $250 million salary increase have contributed to a recent surge in investor profits. The company operates sites in Texas, Kentucky, Trinidad and Tobago, and also offers mining as a service (MAAS). In contrast, Bitfufu, Bitfarms, and Hive Digital all posted all YTD reductions.

Northern Data AG fell 45.13%, Canaan, Inc. fell 65.10%, the sharpest drop of the top 20. On the Mining Front, Bitcoin Miners enjoy boost thanks to a higher hash pris (estimated revenue per petahash per second), up 11.67% compared to 30 days ago.